It was a late night celebrating the cessation of 47 years of personal frustration with the Cubbies (I watched every game as a kid in 1969, still have the mug with the names Ron Santo, Don Kessinger, Glenn Beckert, Billy Williams, Jim Hickman, Randy Hundley, and of course, Ernie Banks emblazoned on it, and still to this day feel the pain of that season - as well as every season since then until now) so I'll keep this brief and to the point this morning.

Given that (a) there are still a minimum of three trading days until the results election will be known and (b) the election and the associated risks of a surprise outcome seem to be a focal point here, there doesn't seem to be any reason for traders to make any big moves at this time.

However, it does look like Wall Street is celebrating the Cubbies by not declining in the early going this morning.

But as we've seen for more than a month now, most intraday rallies have been met with selling. As such, the bulls will need to do more than stop the bleeding in order to get anybody's attention here.

From a chart perspective, things definitely are not looking good at the present time.

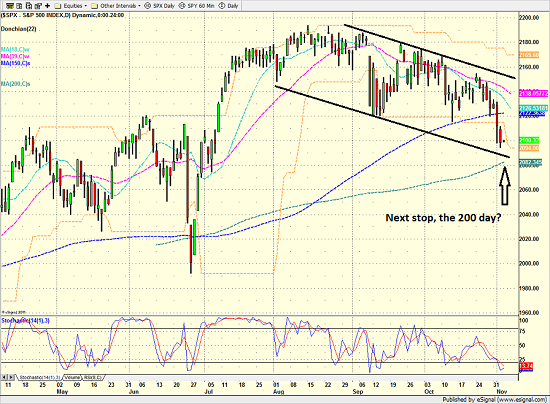

S&P 500 - Daily

View Larger Image

We've got a downwardly sloping channel going on the chart and a clear break of the important support zone at 2120 on the S&P 500. And it appears that the next stop might be the 200-day which currently resides at 2080ish.

The good news is that stocks are now oversold from both a short- and intermediate-term basis, sentiment is now downright ugly, and the seasonal tendencies have become a tailwind for the bulls going forward.

So, assuming there is no BREXIT-like ...