Although the S&P 500 remains 8.4% higher than the post-BREXIT panic low seen on June 27, there can be little arguing the fact that the rally has stalled out over the last week or so. After blasting 8.2% in just 12 trading session, both the Dow and S&P have moved mostly sideways since July 26.

The reasons for the pause are certainly understandable. There is the fact that the indices have become overbought from both a short- and intermediate-term time frame. There is the fact the Japanese appear to be backing off the coordinated the degree of stimulus markets had been hoping for. There is the fact that the latest data on the British economy isn't pretty. There is the fact that oil is moving the wrong direction again (the USO ETF has lost -18.5% since June 8). There is the earnings season. And then there is this week's meetings of the FOMC to consider.

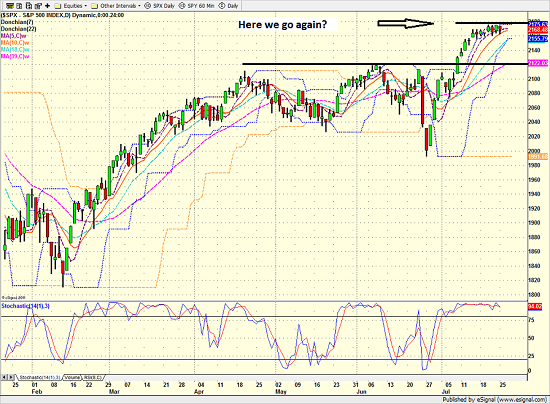

When taken collectively, these issues are clearly enough for traders to press pause - at least for a while. As the chart below shows, it appears that a new ceiling might be developing from a short-term perspective.

S&P 500 - Daily

View Larger Image

However, none of the above appears to be a reason for energetic selling at this time as the Dow closed Monday just 102 - or 0.55% - off the most recent all-time high.

So, should we be worried? Is it time for traders to start using their trading range strategies again? Will the bears quickly resume control and turn the breakout into the latest fake-out?

Cutting to the chase, I don't think so.

Focus on the Big Picture

Last week, I had the honor of speaking to a group of CEOs in Beaver Creek, CO. The topic of my talk was ...