To be sure, it has been a long slog in the stock market for the past three months. In essence, stocks rallied hard on expectations of further monetary stimulus from the folks at the Bank of England, the European Central Bank, and the Bank of Japan after the BREXIT vote. However, after the three-week long, post-BREXIT blast, the major indices have gone nowhere.

Obviously, we can't know exactly why this is happening. Some will argue that it's the election. Some suggest it's just the traditional seasonal swoon. Others contend that fears over the German banks are to blame. Another camp, which includes some big-names in the business say valuations are keeping a lid on stock prices. Still others pound the table that the Fed is the problem. And finally there is the dynamic duo of the economic outlook and corporate earnings.

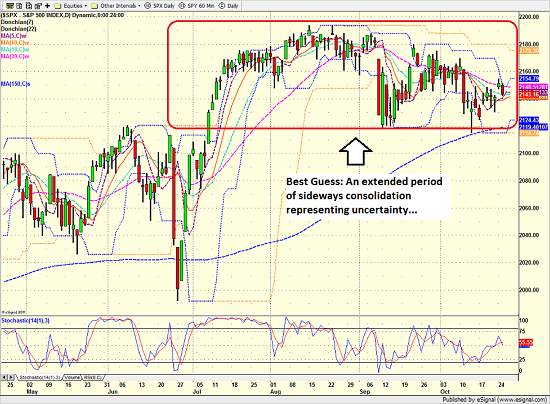

Cutting to the chase, my best guess is that we're seeing an extended period of sideways consolidation that is being driven by uncertainty. Uncertainty over, well, fill in the blank with your favorite worry here.

The bottom line is that investors simply don't have a reason to take a stand here. As such, money that needs to be invested is put to work, and then the fast-money types take profits early and often whenever stocks rally for a few days. With the end result being an up and down, back and forth market that winds up frustrating both teams.

S&P 500 - Daily

View Larger Image

The good news is that while stocks have been technically in a downtrend since mid-August, the indices really have not declined much. For example, as of yesterday's close, the S&P 500 is off just 2.15% from the recent high. The point being that while the action certainly hasn't been fun to watch and it's been tough to make any money, I've can't really call this market negative either. No, from my seat, things have just been sloppy.

When does it end, you ask? Clearly nobody knows for sure. However, from a technical standpoint, the key lines in the sand are 2120 on the downside ant 2160 on the upside. And until one of the teams is able to make a run for the border, the sloppiness is likely to continues.

Turning to this morning, sloppy is clearly in play as Apple's (NASDAQ: AAPL) earnings underwhelmed, a new poll shows Trump leading in Florida, there has been talk of the Fed moving up their schedule if the new President gets aggressive with fiscal policy, and there is fresh bad news on the BREXIT front. So, despite the fact that Coca-Cola (NYSE: KO) and Boeing (NYSE: BA) beat estimates and are up nicely in the early going, it looks like we'll see a weak opening on Wall Street.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Earnings Season

2. The State of Global Economies

3. The State of Global Central Bank Policies

4. The State of U.S. Dollar

Thought For The Day:

The naked truth is always better than the best-dressed lie. -Ann Landers

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member