Don't you just love this game? Or, after the action of the last couple of days, perhaps I should put that another way... Doesn't this game drive you absolutely batty at times?

You see, no sooner had I tapped out a missive esplainin' that the state of the dollar and/or interest rates were the focal points, the game changed - on a dime.

Early in the week, the market was clearly being driven by worries about the surge in the greenback. The fear was that the rising dollar would negatively impact earnings, the economy, inflation, and the fancy trades made by the big boys around the globe. But yesterday, the focus shifted as stocks, the dollar, and interest rates all fell hard at the open.

Weren't We Watching the Dollar?

The fact that the stock market was down again at the open on Thursday wasn't terribly surprising. There were important technical levels in play that just begged to be tested. However, the severity of the decline did get my attention as the Dow wound up diving 184 points within the first half hour or so and appeared to cut through those technical levels like a hot knife through butter. But what really caused me to do a double-take was that stocks, interest rates AND the dollar were all moving down at the same time. Wait, what?

It's The Economy, Stupid

Perhaps it was the early call that distracted me or the fact that I've been uber-busy trying to get our quarterly numbers in order. But somehow, the headline that China's trade data had stunk up the joint escaped my early morning reading yesterday.

So, after perusing a few headlines, the issue became clear. The dollar was out and global growth concerns were in.

Just like that, the weak China numbers, which were not good at all, told traders that China's economy was on the ropes and heading in the wrong direction. Then when you tossed in the fears over what the BREXIT might do to the UK economy and the reality that the European economy continues to flounder, well, there it was - a new reason to wring your hands and to hit the sell button early and often.

But Today Is a New Day

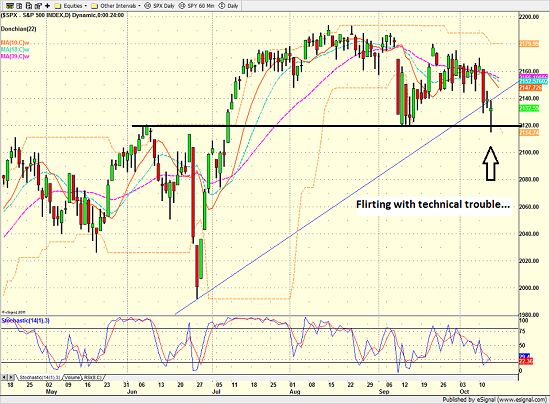

The good news is that the debacle at the open dissipated as the day wore on. And while stocks definitely flirted with some very important technical areas between S&P 2120 and 2130, the bears failed to push the ball across the goal line yesterday.

S&P 500 - Daily

View Larger Image

The even better news is that the current stock market has a serious case of A.D.D. and the focal point appears to once again be shifting.

In addition to some better news on the Chinese economy (China's inflation data was higher than expected, which, strangely in this day and age, is a good thing), the new, bright and shiny object that has caught the market's collective eye this morning is the earnings from JPMorgan Chase (NYSE: JPM). And I'm required to note that JPM is a stock we own in a few portfolios.

Now the world's biggest bank (as measured by market cap) JPMorgan Chase reported earnings of $1.58 per share, which was well ahead of the consensus estimate of $1.39 and revenues of $25.51 billion, which also beat the $24 billion estimate. In addition, analysts seemed to like the fact that growth was broad-based across business segments.

Although Wells Fargo (NYSE: WFC) and Citi (NYSE: C) are still to report this morning, and Janet Yellen will step to a microphone this afternoon, traders appear to be in a good mood in the early going. The question, of course, is if the focus will shift to something else as the day wears on!

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Earnings Season

2. The State of Global Economies

3. The State of Global Central Bank Policies

4. The State of U.S. Dollar

5. The State of German/European Banks

Thought For The Day:

"No one has the right to feel hopeless, there's just too much work to do." Dorothy Day

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member