The traditional fall swoon appears to have taken hold of the stock market over the past week as "what if" fears regarding the outcome of the Presidential election are beginning to run rampant. Although reports indicate that Hillary Clinton's path to 270 electoral votes is not in jeopardy, the reopening of the email issue that has plagued the former Secretary of State's bid for the White House has once again become a bit of a wild card.

In short, the markets are not prepared for a Trump victory. And frankly, there has been no need for such preparation since Clinton's lead in the battle ground states appeared insurmountable lately. But with the polls tightening since the FBI's announcement on Friday, there appears to a certain faction of traders that are putting on some "black swan" insurance - just in case.

What we're talking about is preparation for the unexpected. The surprise BREXIT vote is Exhibit A in the reason why such precautions are being put in place. Lest we forget, the vote on whether or not to leave the EU wasn't supposed to be close. Nearly every poll showed the British staying the course. But then - SURPRISE! - the vote went the other way and markets freaked out. Well, for two days, anyway.

So, when the VIX began to spike yesterday and folks on TV started getting excited about the surge of "fear" in the markets, well, one thing led to another and early gains were quickly replaced by a pretty decent dance to the downside.

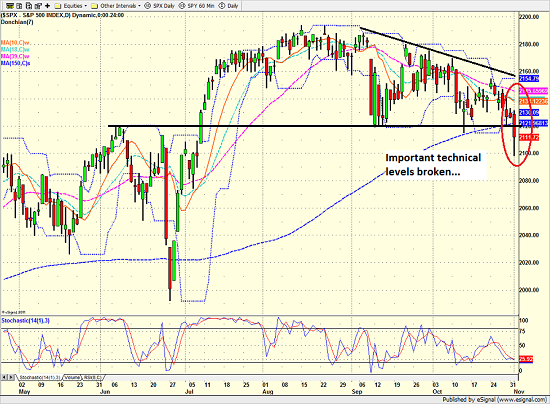

The fact that the S&P 500 also broke down through important support as well as its 150-day moving average on the charts probably contributed to the selling since algos had almost certainly been programmed to issue sell signals on such an event. And before lunch was over, the Dow found itself down 200 points.

S&P 500 - Daily

View Larger Image

Looking at the situation from an objective point of view, I'm of the mind that this appears to be the latest case of the market being overrun by algorithmic selling. After all, nothing really changed from a fundamental standpoint yesterday. There were no new headlines to speak of and thus, there was really nothing new for traders to act on.

Apparently part of the "fear" that was in the market yesterday was attributed to the concern that the next president will embark on an aggressive fiscal stimulus campaign, which could (key word) lead to inflation, which, in turn could cause the Fed to act rashly, yada, yada, yada.

However, from a near-term perspective, it is important to note that this particular worry is not new and has been with us for a while now. So, perhaps it was the better-than expected PMI numbers in China overnight that helped spark concern about global inflation. Or maybe the fact that the Fed began a two-day deliberation yesterday was a source of discomfort.

In any event, I'm not sure there was anything going on yesterday other than a spike in the VIX and the corresponding computer-programmed response. However, today is another day and it will be interesting to see if yesterday's themes are still with us.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Election

2. The State of the Earnings Season

3. The State of Global Economies

4. The State of Global Central Bank Policies

Thought For The Day:

Trust everyone, but cut the cards. -Ronald Reagan

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member