Good Monday morning and welcome back. Hopefully, your computer doesn't make you WannaCry this morning as the global cyber attack has apparently infected more than 200,000 computers so far. Oil, North Korea, and European politics are also in focus this morning. A barrel of West Texas Intermediate crude was trading up more than a dollar in early trade Monday as the Saudi's and Russia publicly announced they favor extending production cuts into the first quarter of 2018. In the latest round of provocations, North Korea launched a new ballistic missile that can purportedly carry a nuclear warhead. And in Europe, Emmanuel Macron was sworn in as France's next President and Angela Merkel's party received a boost over the weekend, creating hope for stability in the region. On the markets front, stability seems to be the key word to start the day as there are no new political surprises out of Washington.

Since it's Monday, let's move on to an objective review the key market models and indicators. The primary goal of this exercise is to remove any subjective notions about the markets and ensure that we stay in line with what "is" happening in the market. So, let's get started...

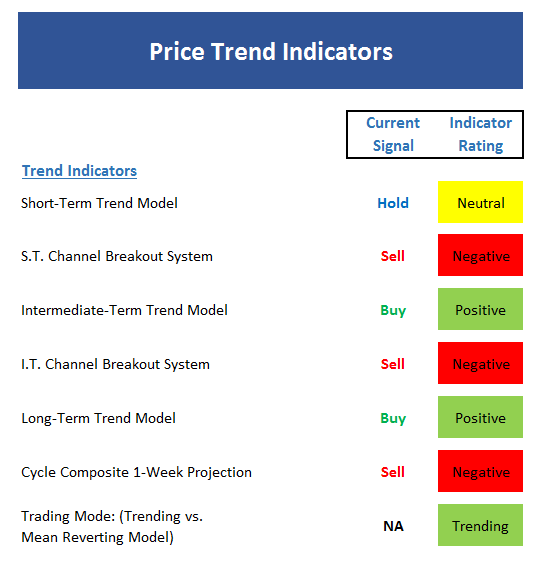

The State of the Trend

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- While the overall trend of the stock market is up, the short-term Trend Model has sagged a bit due to the sideways action seen over the last three weeks.

- The short-term Channel Breakout System remains on a sell signal at this time. A close above 2404 would trigger a new buy signal.

- The intermediate-term trend of the market remains ...