Eight days ago, the stock market looked to be in trouble. The S&P 500 had closed at a "lower low" on the daily chart, the weekly chart was in a downtrend, and the bears were busy telling anyone that would listen it was their time to shine. Pundits were busy pointing out the downside potential and talking about the correlations between 2017 and 1987, 2007, etc. And with the VIX spiking to the highest level of the year, it appeared that some fear had indeed returned to the corner of Broad and Wall.

But then the political landscape abruptly shifted. Donald Trump began insisting on unveiling his tax plan ASAP. And the French Presidential election, which, we were told by our friends who see the market's glass as at least half empty, was going to be a game changer - and not in a good way. Then the polls opened in France.

To the delight of the markets, both of France's establishment parties were swiftly booted to the curb and a pro-growth, pro-EU political outsider took the lead. In short, the next European crisis appeared to be over before it began and analysts everywhere started to look at the bright side of the macro picture.

Just like that, Ms. Market's mood turned from dour to optimistic. Suddenly, the hope trade was back as traders realized that a tax deal might get done sooner rather than later and the European economy might actually be improving.

Speaking of hope, this is exactly what traders appeared to be pricing into the stock market this week. With some big details, such as a 15% tax rate on corporations, being leaked early and often, the thinking was that the Trump tax plan was going to be a winner. After all, with the White House touting their plan as the biggest tax cut in history, it had to be good, right?

However, once Messrs. Mnuchin and Cohn started unveiling the plan to the public, the stock market took a dive. Take a look at the chart below, which is a 1-minute chart of the S&P 500 yesterday afternoon.

S&P 500 1-Minute

View Larger Image

This chart suggests that although traders knew that the plan was likely going to be light on details, the announcement itself underwhelmed. Apparently, Wall Street was disappointed that there was no mention of the actual rate tied to the repatriation of trillions of dollars corporate America holds overseas. As such, traders and their computers voiced their displeasure by hitting the sell button repeatedly into the close yesterday afternoon.

However, from a daily chart perspective, the situation, while not overtly positive, was not nearly as negative, as the S&P turned from positive to negative after the announcement.

S&P 500 - Daily

View Larger Image

So, while the mood in the market appears to have improved, the overall situation remains the same on the charts. In short, the major indices, save the NASDAQ, are still stuck in a sideways trading range.

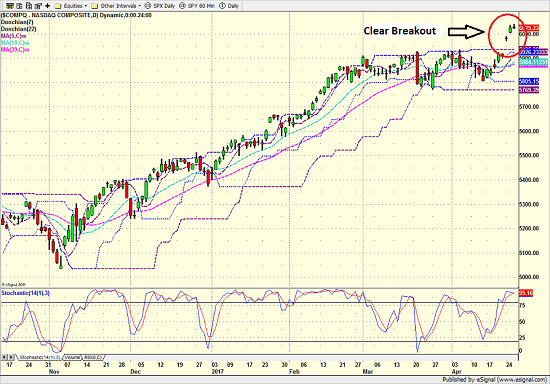

The good news is that the chart of the NASDAQ, which houses most of this bull market's leadership, is marching to its own, more positive beat. As the chart below illustrates, the NASDAQ has broken out of the recent range and appears to have embarked on a new leg higher.

NASDAQ Composite - Daily

View Larger Image

The question here is which message from the charts should we listen to? In my experience, it generally pays to follow the leaders in the stock market game. Thus, unless something comes out of the woodwork to spook traders and cause them to worry about valuations, I'd be willing to bet that the rest of the major indices will wind up following the NASDAQ's lead at some point in the near future.

However, we must recognize that the details of the tax plan need to match expectations - and soon. Oh, and there can't be any surprises across the pond on May 7 either. Otherwise, disappointment could easily set in.

Thought For The Day:

Resolve never to quit, never to give up, no matter what the situation. -Jack Nicklaus

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of World Politics

3. The State of the U.S. Economy

4. The State of Earning Season

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member