Well that was fun. Don't look now fans, but after Friday's joyride to the upside, the S&P 500 is up nearly 8% from its Christmas Eve low and is now down only -13.3% from the most recent high water mark. My guess is everybody is feeling a little bit better about the stock market right about now.

The financial media initially credited Friday's jobs report for the stock market's impressive rally. To be sure, both the blowout new jobs number and the uptick in wages were positives from a state-of-the-economy standpoint. And yes, stocks did rally at the open after the report. However, looking at the timing of the day's news and how the indices moved during the session, it is clear that the jobs report was not the true driver of the bulls' big bounce on Friday.

No, it looks like we have Mr. Jerome Powell and his merry band of central bankers to thank for that.

Lest we forget, stock futures were higher well before the eye-popping Nonfarm Payroll data was released Friday morning. Prior to the open, traders reacted favorably to the news that the Chinese had cut their RRR and that a meeting between the U.S. and China to talk trade had been confirmed.

Following the release of the NFP report, futures actually sold off a bit as it appeared that the numbers might be "too good" - meaning that the report could give the Fed cover to stick to their guns on plans to hike rates at least a couple more times in 2019 and to keep the $50 billion per month balance sheet reduction plan (aka QT or the "run off") on "autopilot."

But stocks opened higher and after some initial waffling, continued to advance. As such, it appeared that after some review, the combination of good news out of China and the jobs report was being viewed as a positive.

The Real Story

But make no mistake about it; the real story behind Friday's romp was the about-face from Jay Powell's Fed on the path of rates and the so-called "run off" of the Fed's balance sheet. And this dear readers, could be a game changer.

If you will recall, one of the primary drivers of the pre-Christmas market plunge was Chairman Powell's confirmation that the sale of $50 billion of bonds per month from the Fed's balance sheet was on autopilot. In fact, on December 19th, in reference to the Fed's balance sheet reduction, Powell told reporters at his press conference, "I don't see us changing that."

In response, traders voted with their feet and proceeded to take the Dow down another 2,000 points in the ensuing four trading sessions, ushering in what appeared to be a slow-motion crash. While we can never know for sure why Ms. Market does what she does, one of the primary reasons for the precipitous drop appeared to be the sudden realization that selling $600 billion in bonds during 2019 was the equivalent of (depending on your math) 4-7 additional rate hikes - and that these hikes weren't open to discussion.

The problem here is the Fed has a very long history of "overshooting" during rate hike campaigns and dragging the economy into recession in the process. (If memory serves, the Fed wound up pushing the economy into recession in 10 of the last 13 rate hike campaigns.) While on the surface, it appeared that Powell & Co. had no intention of making a policy mistake (aka doing something stupid), the insistence that the "accidental" rate hikes from the balance sheet reduction plan were on autopilot certainly appeared to be contradictory.

Credit guru Larry McDonald didn't mince words as he voiced his opinion on the subject by writing, "Spending nearly $1T on deficit overloading tax cuts, then lighting it on fire with 8 rate hikes (nine since December 2015) and an experimental $430B of Fed balance sheet reduction, will go down as one of the most destructive policy mistakes in the history of the Republic."

Although several Fed members had tried to walk back the apparent firm stance on both the path of rates and the balance sheet run off, it took the words coming from the man himself to assuage traders' fears over a self-inflicted economic wound.

The Magic Words

On Friday, Powell said the magic words addressing the market's two big fears. First, he said, "With the muted inflation readings that we've seen coming in, we will be patient as we watch to see how the economy evolves."

This is big. In Fedspeak, these words meant that the Fed's projected rate hikes aren't preset and that based on the "data," the next hike was likely on hold. This fits with the "soft" U.S. economic data that has been coming in of late as well as market expectations for rate hikes.

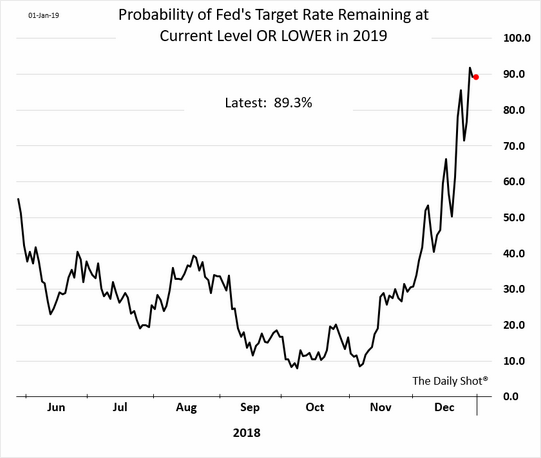

On that note, below is a chart showing the probability of the Fed NOT hiking rates in 2019.

View Chart Online

Image Source: The Daily Shot

As you can see, there has been a rather dramatic shift in "Fed Expectations" since early November, when lots of economic data started coming in punk.

Therefore, the fact that Powell recognized the shifting sands and was willing to publicly admit flexibility on the path of rates was important.

About That "Autopilot" Thing...

However, from my seat, the idea of the Fed pulling back on the two projected rate hikes wasn't the main course here. No, it was the 4-7 "accidental" hikes associated with the balance sheet reduction plan (aka QT) that worried me more.

So next, and in my opinion, more importantly, Powell said, "We wouldn't hesitate" to change balance sheet policy if needed.

There it was; the official proclamation that the Fed wasn't going to do something stupid and "accidentally" push the economy into recession. Phew!

Couple this with the words from Cleveland Fed President Loretta Mester earlier on the day (Mester said there was no urgency to raise rates now, that she's open to seeing where the economy goes on rate moves, and that the Fed always left open the option on balance sheet reduction) and it appeared that the Fed had officially done an about-face and given the market what it wanted.

The bottom line here is simple, investors are no longer at odds with the Fed as Jay Powell's gaggle of central bankers appear to be on the same page with the message from both the stock and bond markets - that growth is slowing and there is no inflation in sight.

Now The Big Question Is...

Now that the Fed is out of the way, so to speak, the next issue investors have to deal with is the Trade War with China. And since the economic data for both countries is going the wrong direction, it makes sense that both sides would want to get a deal done - perhaps sooner rather than later.

The good news is we won't have to wait long on this subject as official talks begin today. Here's hoping that this episode of "Deal Or No Deal" is a winner.

Now let's turn to the weekly review of my favorite indicators and market models...

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

View My Favorite Market Models Online

The Bottom Line:

- Once again there important changes on the Primary Cycle board this week, this time to the upside. First, the Risk/Reward Model upticked to neutral from negative. Ditto for my "Desert Island" Model and the Environment model. Granted, the advances seen in the three models were far from robust. For example, the Environment Model reading is literally on the line between neutral and negative. But the bottom line here is that the board is far less negative than it has been recently.

This week's mean percentage score of my 6 favorite models improved to 40.3 from 36.5 (2 weeks ago: 41.9%, 3 weeks ago: 47.8%, 4 weeks ago: 53.6%) while the median rose to 50% from 44.0% (2 weeks ago: 44.2%, 3 weeks ago: 45%, 4 weeks ago: 55%).

The State of the Trend

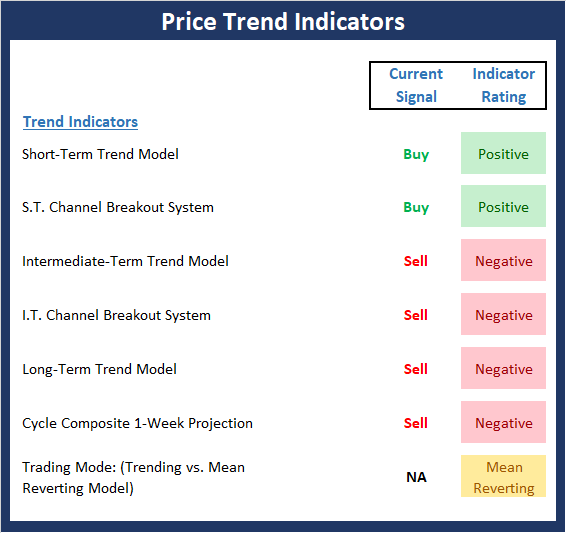

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

The Bottom Line:

- Friday's joyride to the upside has the makings of a "rally continuation" move. The rally produced buy signals from our short-term trend and channel breakout trading systems. At this stage, the move should be viewed within the context of a dead cat bounce. However, should we see further improvement accompanied by overwhelmingly strong breadth, we may be able to argue that the bottom is in.

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

The Bottom Line:

- Although the near-term trend has improved, the momentum board is unimpressed so far. The reason for the lack of green on the board here is that the majority of the indicators are intermediate-term oriented. And given that the rally is only 7 days old, the indicators have not improved enough to move out of negative territory.

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

The Bottom Line:

- The positive readings from the short-term overbought/sold and VIX indicators have been worked off and are now neutral. However, the good news is the intermediate-term indicators as well as the sentiment readings all continue to favor the bulls.

The State of the Macro Picture

Now let's move on to the market's "environmental factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View Environment Indicator Board Online

The Bottom Line:

- There are some modest shifts happening within the External Factors board. First, the monetary composite continues to improve as one can argue that there has been yet another false start to the big, bad, bond bear. Second, while both the economic and earnings models remain positive, the model readings have been slipping of late. And finally, although the valuation composite still sports a sell signal and a negative rating, valuation metrics are improving.

Thought For The Day:

Love me when I least deserve it, because that's when I really need it. - Swedish Proverb

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

<hr>Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -12.29% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

<hr>Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19