Good Monday morning and welcome back. It's a new week, so let's start things off with an objective review of my key market models/indicators and see where we stand. To review, the primary goal of this exercise is to try and remove any subjective notions about what "should" be happening in the market in an attempt to stay in line with what "is" happening in the markets. So, let's get started.

NEW THIS WEEK:

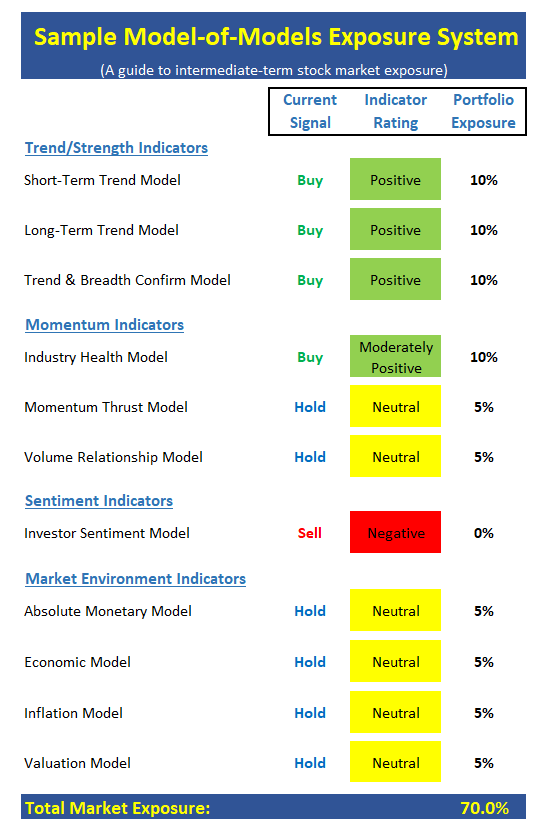

Over time, we have received numerous requests for suggestions on how readers might utilize the indicators/models shown in this report, this week we introduce a "model of models" approach to determining longer-term exposure to market risk. Please note that this is merely an example of how these indicators can be used and is not a recommendation or the positioning of any specific investing strategy. The idea is to illustrate how a disciplined approach may help one stay in tune with the "message" of the models/indicators.

In addition, we've included a brief summary of the indicators/models used in the report.

It is our sincere hope that you find the upgrades to our weekly summary of interest.

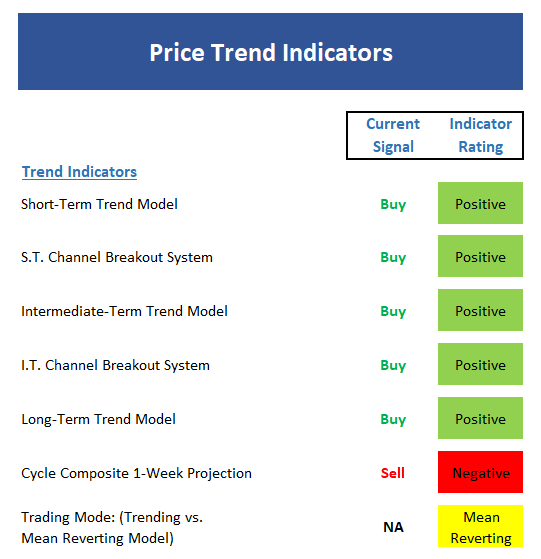

The State of the Trend

We start our review each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- Last week's rally and fresh all-time highs has turned the short-term Trend Model positive.

- Both the short- and intermediate-term Channel Breakout System remain on their 8/22 Buy Signals.

- The new all-time closing high keeps the intermediate-term Trend Model positive.

- The long-term Trend Model continues positive as well...

- The market action continues to run counter to the Cycle Composite projection, which remains negative next week.

- The Trading Mode models remain unimpressed by the new highs so far and call this a mean-reverting environment.

- The bottom line is the most bullish thing a marke can do is make new highs, so...

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model flipped back to positive last week.

- Our intermediate-term Trend and Breadth Confirm Model is also positive - a good thing.

- The Industry Health Model moved up to the moderately positive zone. And with the global version positive, the bulls hold the edge here.

- The negative reading of the short-term Volume Relationship remains a warning sign. But, in and of itself, is not a reason to be negative. This is simply a yellow flag.

- The intermediate-term Volume Relationship is improving but is not yet outright positive.

- The Price Thrust Indicator moved back to positive last week - another plus for the bulls.

- The Volume Thrust Indicator remains neutral. However, note that stock market returns have been above trend when in this mode.

- The Breadth Thrust Indicator is also positive.

- The bottom line is momentum, while not wildly robust here, is positive and moving in the right direction.

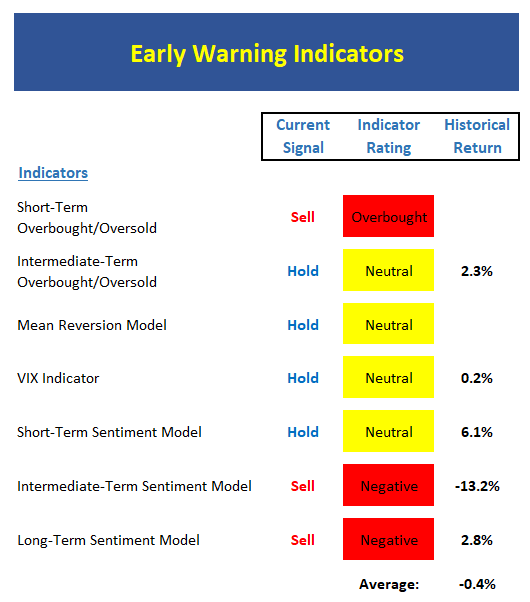

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are now very overbought. This alone is not a reason to sell, but it is a warning flag.

- From an intermediate-term view, stocks are not yet overbought, but are getting close.

- After a timely buy signal, the Mean Reversion Model has moved back to neutral and is actually close to a short-term sell/short signal.

- The VIX Indicator also gave a timely buy signal recently is now very close to a sell signal.

- After a timely buy signal, the short-term market sentiment has moved to neutral.

- The intermediate-term Sentiment Model slipped back into the negative zone.

- Longer-term Sentiment readings are also negative.

- The key takeaway here is the "mean reversion/trading winds" are no longer at the bulls' back.

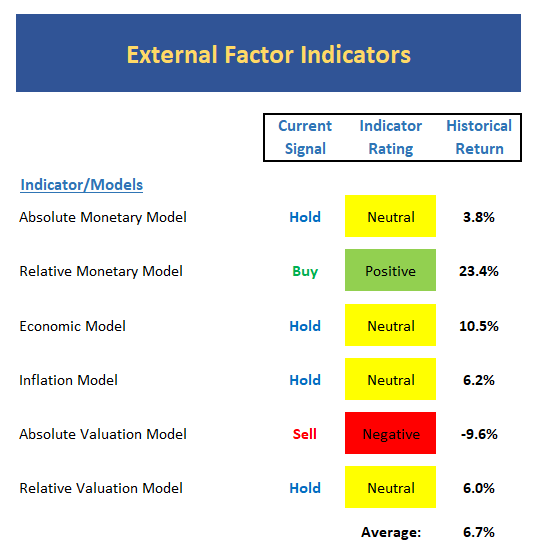

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Absolute Monetary conditions continue to dip and our 14-indicator model is now falling in the neutral zone.

- The Relative Monetary Model remains in good shape.

- Our Economic Model (designed to call the stock market) continues to falter and is now at the low end of neutral - something to watch.

- The Inflation Model remains solidly neutral. Our inflation models continue to suggest the Fed's inflation target is unlikely to be sustained.

- The Absolute Valuation Model is still the same - very negative.

- With rates near 2017 lows, our Relative Valuation Model continues to improve and is very close to turning positive.

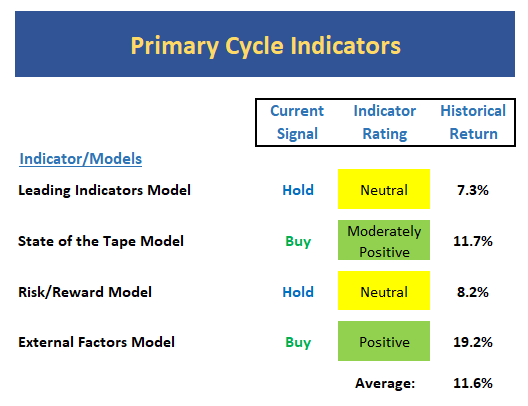

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, which was our best performing timing model during the last cycle,

- The Tape is in decent shape - just not strong.

- The Risk/Reward model is back to neutral.

- The External Factors model continues to improve (likely thanks to the move in rates), which is a good thing from a longer-term perspective.

My Takeaway...

The readings from the primary cycle board really tell the story here. From a big-picture standpoint, things are in "pretty good" shape, which tells us to continue to give the bulls the benefit of any doubt. However, the facts that (a) the early warning board is waving its flag, (b) momentum is anything but robust, and (c) valuations remain extreme, tells us that risk factors are NOT low at this stage of the game. My take on this is that if the bears were to find a raison d'etre, the ensuing decline could be sharper/more severe than normal. Yet at the same time, stocks have been able to handle just about anything thrown at them this year and so far at least there has been no reason for traders to hit the sell button. So, until/unless there is a reason to worry, the dips are likely to be bought and volatility is likely to remain low.

Sample Risk Exposure System

Below is an EXAMPLE of how some of above indicators might be used in order to determine exposure to market risk. The approach used here is a "Model of Models" comprised of 10 independent Models. Each model included gives separate buy and sell signals, which affects a percentage of the model's overall exposure to the market.

Trend models control a total 40% of our exposure. The 3 Momentum Models and 3 Environment Models each control 10% of the portfolio's exposure to market risk. The model's "Exposure to Market Risk" reading (at the bottom of the Model) acts as an EXAMPLE of a longer-term guide to exposure to market risk.

View Sample Exposure Model Online

The model above is for illustrative and informational purposes only and does not in any way represent any investment recommendation. The model is merely a sample of how indicators can be grouped to create a guide to market exposure based on the inputs from multiple indicators/models.

Thought For The Day:

Beware the barrenness of a busy life - Socrates

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Geopolitics

2. The State of the Economic/Earnings Growth (Fast enough to justify valuations?)

3. The State of the Trump Administration

4. The State of Fed Policy

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Industry Health Model Explained: Designed to provide a reading on the technical health of the overall market, Big Mo Tape takes the technical temperature of more than 100 industry sectors each week. Looking back to early 1980, when the model is rated as "positive," the S&P has averaged returns in excess of 23% per year. When the model carries a "neutral" reading, the S&P has returned over 11% per year. But when the model is rated "negative," stocks fall by more than -13% a year on average.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -8.5% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and wnen below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicators looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a intrmediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliche, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is actually extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member