Long time readers know that when markets do something unexpected - such as breaking a 3-day losing streak with a surge of 184 Dow points - I need to know why. And while I haven't forgotten that I'm in the middle of a series on "how to outperform" when designing portfolios (with the next segment slated to cover the three primary ways one can add alpha), I believe yesterday's sudden and rather surprising rebound in the stock market deserves our attention on this fine Tuesday morning.

Given (a) the happenings in North Korea over the weekend, (b) the fact that the market's 3-day decline left the S&P in a precarious position from a technical perspective, and (c) there is a clear downtrend on the charts, one might have expected Monday's action to represent an important test of the key line in the sand. But instead, stocks rallied out of the gate and then proceeded to spike higher into the close yesterday. Interesting.

A Myriad of Reasons...

The popular press provided a myriad of explanations for the action. There was talk of traders breathing a collective sigh of relief over North Korea and Afghanistan. There was VP Pence talking tough. There were the China GDP numbers. There was a host of weaker than expected economic data (more on why that was seen as a plus in a moment). And, of course, there was a discussion of the earnings parade. However, none of the above appeared to provide a reason for the spike that began around 3:00pm yesterday afternoon.

Sure, the fact that Pence made it into the DMZ between North and South Korea unharmed was a plus. And most felt the VP's announcement that "the era of strategic patience" with North Korea is over, was the right thing to say. (Note that Pence added this morning that all options, including unilateral military action, is on the table here.) Oh, and word that China will apparently commit to helping dismantle North Korea's nuclear program was certainly encouraging.

Next up was the economic data. In China, GDP was reported at an annualized rate of 6.9%, which, for a change, was above analyst expectations. So, given the global nature of economics today, it isn't much of a stretch to see how this was a positive.

Here at home though, the data went the other way. The Empire State Manufacturing data slid. The NAHB Homebuilder Sentiment survey declined (albeit from lofty levels). The Consumer Price Index fell 0.3%. And Retail Sales, seen as the mother's milk to economic growth at this time, disappointed.

But, the soft data was taken by traders as a positive as it meant the odds of a June rate hike slipped a bit yesterday. Recall that there remains some fear that the Fed could become overzealous and threaten the recovery. Thus, the thinking is the weaker data could become a reason for Yellen to exhibit some caution in the near term.

It can be argued that all of the above were positive inputs. However, it appears the REAL reason for yesterday's triple-digit gain has more to do with what has been driving stocks since the election - policy expectations.

The Real Reason...

While this is merely one man's opinion, I will suggest that the real driving force behind Monday's little joyride to the upside was a comment from Steven Mnuchin. In an interview with the Financial Times, the Secretary of State said that Republicans could get tax reform done this year - and here's the important part - WITHOUT a so-called "border adjustment tax." And we're back.

So, with stocks stuck in a pullback that began on March 1st, sentiment no longer exuberant, and an oversold condition intact, it wasn't surprising to see traders and their computers react to the idea that tax reform might be doable after all. The response appeared to be, "Buy 'em!" (Or perhaps more appropriately, "Cover those shorts, now!")

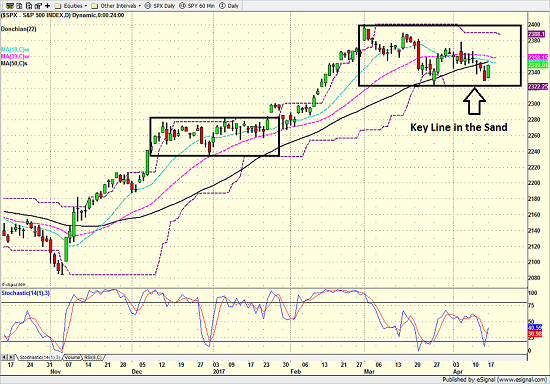

Looking at the price action on the charts, Mnuchin's comments appeared to arrive just in time.

S&P 500 - Daily

View Larger Image

Although the S&P appears to be trending lower here, it can also be argued that we're seeing yet another period of sideways consolidation - something akin to what was seen from early December to late January.

However, a meaningful break below 2320 that managed to stick around for more than a day or two, might change my view. In short, a "lower low" on the charts would be hard to argue against. (P.S. the bears tell us there already is "lower low" on a closing chart basis.) But so far at least, the line in the sand remains intact, which according to the bulls, is a good thing. Stay tuned.

Thought For The Day:

Nothing in life brings more joy than serving a cause greater than yourself. -John McCain

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Geopolitical Issues

2. The State of Earning Season

3. The State of Trump Administration Policies

4. The State of the U.S. Economy

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member