Those expecting to see the stock market indices crumble in response to the GOP's failure to get their healthcare bill passed are probably disappointed with the action seen over the last two days. Remember, just about everybody in the game has been calling for a meaningful decline in stock prices due to (a) the market "getting ahead of itself," (b) sentiment becoming overly optimistic, (c) lofty valuations, (d) the potential for the Fed to change their plans, yada, yada, yada. As such, the GOP fiasco appeared to be the perfect catalyst for the fast-money types to locate the sell button again.

While stocks did initially decline Monday morning on worries that the Republicans were too busy playing politics to get anything done, the market quickly rebounded and then managed to put in a nifty move higher on Tuesday.

The question I asked in yesterday morning's meandering market missive was, what is the market narrative now that the healthcare effort has failed and stocks are in a downtrend?

Although things change quickly in this business, it appears that the word of the day, as far as stocks are concerned, is confidence. Confidence in the economy. Confidence in the Fed. And confidence that losing a battle, albeit an important one from an optics standpoint, does not mean that the GOP will lose the war.

Investors got word yesterday morning that Consumer Confidence had surged 9.5 points in March to the highest reading since December 2000. This turned out to be the latest in a string of positive surprises from the economic data as the consensus among economists surveyed had been for a decline of 1 point. And according to Ned Davis Research Group, "such a high level of confidence has historically been associated with above-trend economic growth."

In addition, Fed Vice Chair Stanley Fisher also provided the bulls with a confidence boost early Tuesday morning by suggesting that two more rate hikes in 2017 sounded about right. Recall that there has been some concern that the better-than expected economic data, when combined with the uptick seen in inflation, might cause the Fed to get antsy and sneak in an additional rate hike this year.

As for the Trump policies and the concern about the GOP's ability to get something done on tax reform and economic stimulus, apparently the market remains upbeat on the likelihood of a positive outcome. Sure, the Republican's shot themselves in the foot with the healthcare thing. But the reality is that tax cuts, reduced regulation and infrastructure spending are the issues this President really cares about. So, the thinking is that the Republicans will learn from this experience and get their act together when the really important stuff (important to the market, that is) comes into play.

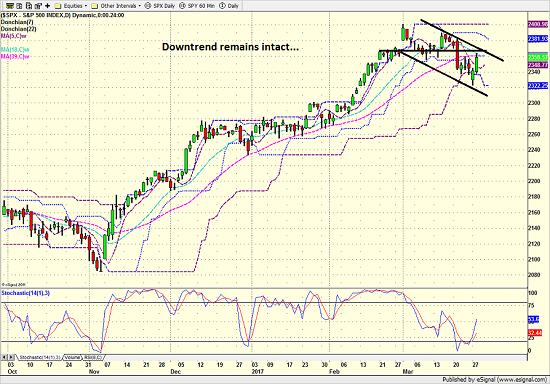

The bad news for those in the bull camp is that although the action has been pretty decent so far this week, the S&P 500 remains in a downward sloping channel and below important technical levels.

S&P 500 - Daily

View Larger Image

So, as I opined yesterday, the near-term action will continue to take on added significance here. In short, my view is that a solid move above 2360-65 (that sticks) would suggest the recent sloppy phase may have ended while a break below Monday's low will put the bears in control of the game.

Publishing Note: I am traveling the rest of the week for some R&R and will not publish morning reports.

Thought For The Day:

Intuition is given only to him who has undergone long preparation to receive it. -Louis Pasteur

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Trump Administration Policies

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member