Prior to last week, the market narrative was based on hope. Hope that corporate tax cuts would bring cash and jobs back home and make America great again. Hope that tax reform would help the middle class. Hope that reducing regulations would help banks and other industries flourish. Hope that infrastructure stimulus would underpin economic growth. And hope that all of the above would create earnings reports that would exceed already lofty expectations.

Then on Monday morning, the word was that the narrative had suddenly changed and could be summed up in one sentence: The abject collapse of the GOP healthcare bill has raised doubts about Trump's ability to deliver on the administration's key goals - namely tax reform and economic stimulus.

As expected, stocks followed Asia's lead Monday morning and opened lower - much lower - on the theme of disappointment/uncertainty regarding the outlook for policy implementation.

But a funny thing happened to the anticipated panic on Wall Street - it just didn't happen. Sure, stocks dove in the early going. But then the market spent the rest of the day recovering. The S&P 500 actually turned green in the last hour before dipping into the close and the NASDAQ finished with a gain of 11 points. Hmmm...

So the question I have is, what is the market's primary "narrative" now? Buy the dip because Trump has moved on to the important stuff? (Important to the markets, that is.) Or is this the start of the correction - aka the "Trump Slump" - that everybody under the sun has been calling for?

The correction theme certainly makes sense. Stocks ARE overvalued. Sentiment IS overly optimistic. The indices ARE overbought from a longer-term perspective as the Trump Bump has run a long way in a short period of time. And speaking of Trump, there IS some question about the administration's goals actually coming to fruition.

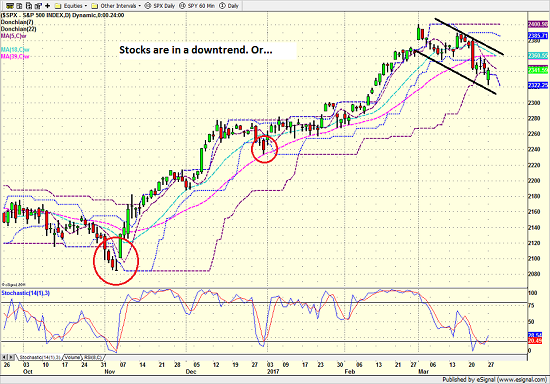

One glance at the chart below appears to further support the idea that a corrective phase has taken hold. The S&P clearly broke important near-term support and despite yesterday's comeback, a downtrend is clearly in place.

S&P 500 - Daily

View Larger Image

The bears tell us that it will be a downhill slide from here and that a test of the 2250-2300 zone is inevitable. And if that support is broken, well, who knows, things could get u-g-l-y...

However, there is also another scenario to consider. Take another look at the chart above. Note the areas I've circled in red. These represent the "scary periods" that occurred after or during a consolidation phase. And if you will recall, these scary periods were supposed to portend bad things to come.

My point is that while that surely looks like a downtrend on the chart of the S&P 500, we could also be seeing another "scary period" play out here.

As such, the near-term price action is likely to be telling. A break of yesterday's low will certainly embolden the bears while it can be argued that a meaningful move back above 2350 suggests that what we're seeing currently is merely a "sloppy phase."

Frankly, I have no idea which way this will go (I never do). But I can say that our indicators have been telling us that some caution has been warranted for some time now. So, I'll be watching the 2320 and 2350 zones for clues as to what might come next in Ms. Market's game.

Thought For The Day:

Every failure carries within itself the seed for an equivalent advantage. -Andrew Carnegie

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member