To market watchers, it is fairly clear that the fate of the current stock market trend is tied to today's House vote on the Republican's healthcare bill designed to "repeal and replace" Obamacare. And while the wranglings in D.C. are often quite complex, the bottom line for the stock market here is pretty straightforward.

To be sure, there are never any guarantees in this game and Ms. Market does tend to make a fool of anyone thinking they've got the game figured out. However, logic would appear to dictate here that if the vote on the GOP healthcare plan passes today, traders can go back to focusing on the benefits that tax reform and stimulus spending will bring to the economic outlook - and in turn, the expectation for improving earnings.

As such, one could argue that the worst of the current pullback, which at Tuesday's closing bell stood at -2.2% on the S&P 500, had likely been seen and that a "sigh of relief" rebound would likely be the next step. And depending on the appetite for risk still out there, it wouldn't be surprising to see the major indices step lively back toward the recent highs in relatively short order.

But... If the vote on the bill is delayed, or worse, fails, then we should probably expect to see traders voice their displeasure by pressing the sell button early and often. Thus, the expectation would be for the current "garden variety" pullback to immediately and violently morph into something more meaningful. And while I'm just spitballin' here, a move down toward (or through) the S&P 2275 zone would be a logical response.

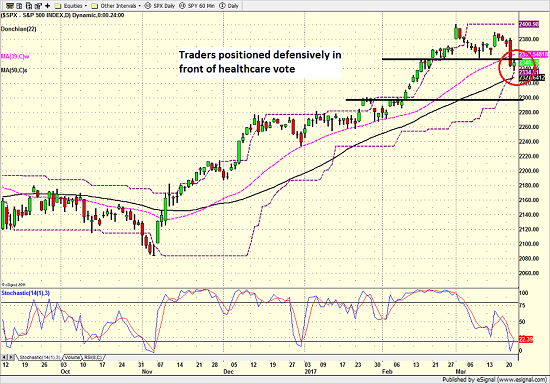

One thing I've learned by playing this game for more than 30 years now is that traders like to position themselves at "inflection points" in front of potentially big, bad events. Therefore, it isn't surprising to see the S&P 500 sitting just below what had been near-term support over the past month.

S&P 500 - Daily

View Larger Image

For those thinking that the "break" of support in the 2350 zone is a harbinger of bad things to come from a technical perspective, please keep in mind "lines in the sand" don't mean what they used to in today's market. I'll even go so far as to say that technical analysis of key levels is not nearly as useful as it once was. Remember, humans are not looking at charts when they make trades today. No, it is computer algorithms running at nearly the speed of light that are pulling the trigger on trades today. Therefore, moves such as Tuesday's decline often "overshoot" and wind up violating levels that humans deem important.

It is for this reason that more and more I view the short-term machinations in the market as "noise" and try my darndest to stay in tune with what is really driving the action. And for me, it is the vote on healthcare today that is the likely driver to pay attention to.

So, now we wait...

Thought For The Day:

If you are wondering how someone really feels about you, remember that actions speak much louder than words.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies (Specifically Healthcare in the Short-Term)

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies (Think ECB pulling back on QE)

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member