Good Monday morning and welcome back to the land of blinking screens. With the Fed meeting on tap this week and traders possibly on hold until then, let's start the week with a review of our major stock market indicators. The goal of this exercise is to set aside our subjective views of what we think might be happening in the markets and focus on a disciplined, unemotional review of what actually "is" happening in the market.

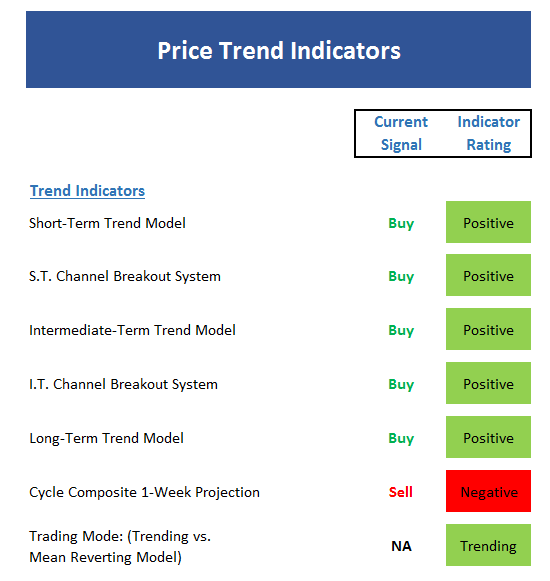

The State of the Trend

We start with a look at the "state of the trend" from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- It is said that the most bullish thing a market can do is make new highs. 'Nuf said.

- The Trend board is universally bullish except for the Cycle projection, which suggests a modest pullback this week

- It is worth noting that the Nasdaq 100 continues to lag the rest of the major indices due to the rotation game that is seeing money move out of the "FANG's"

- The Trading Mode indicator has flipped to positive, albeit begrudgingly so

- The degree to which price is above its long-term moving average is becoming extreme

- The short-term Channel Breakout sell signal currently stands back at 2187

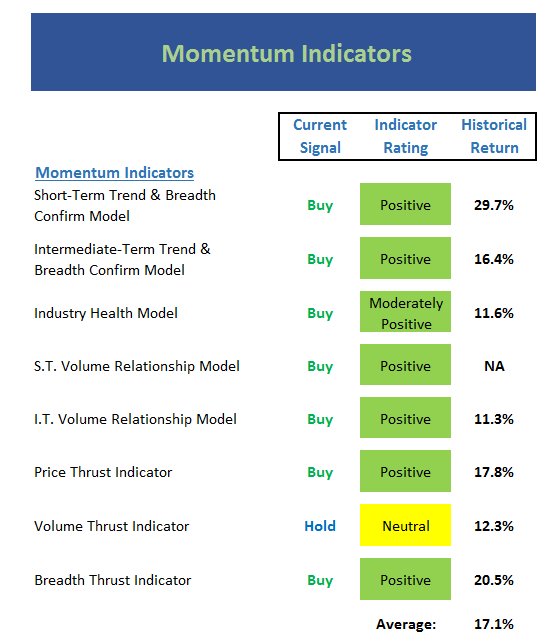

The State of Internal Momentum

Now we turn to the momentum indicators...

Executive Summary:

- The Momentum board also sports a bright shade of green to start the week

- In its current mode, the Short-Term Trend & Breadth confirm model has seen annualized gains of nearly 30% per year. However, when viewed since 2008, the annualized return for the indicator is -11.3%.

- The Industry Health model is getting close to the outright positive zone. A move into the green would be a positive confirmation of the current run for the roses.

- Volume Relationship indicators are in great shape

- The only thing that isn't green is the Volume Thrust indicator. But while neutral, the indicator sports an annualized return of 12.3%, which is above the historical norm.

- The Breadth Thrust indicator moved up to positive last week

- The average annualized return for the market with the board in its current state is 17.1%

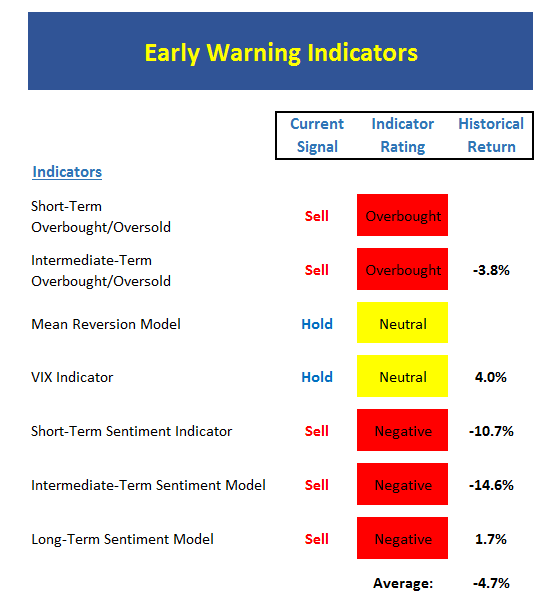

The State of the "Trade"

Next up is the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

Executive Summary:

- The message from the Early Warning board remains clear: Stocks are overbought and could pull back for any reason, at any time.

- The Mean Reversion model flipped back to neutral after a brief sell signal proved false

- The shorter-term VIX system (not shown) issued a sell signal late last week

- The primary VIX indicator, which is intermediate-term based, is fast approaching a sell signal

- All sentiment models are now at extreme levels

- However, it is important to remember that when a market gets overbought and stays overbought, it is a sign of strength.

- In the early stages of a strong trend, the early warning indicators can issue multiple false signals.

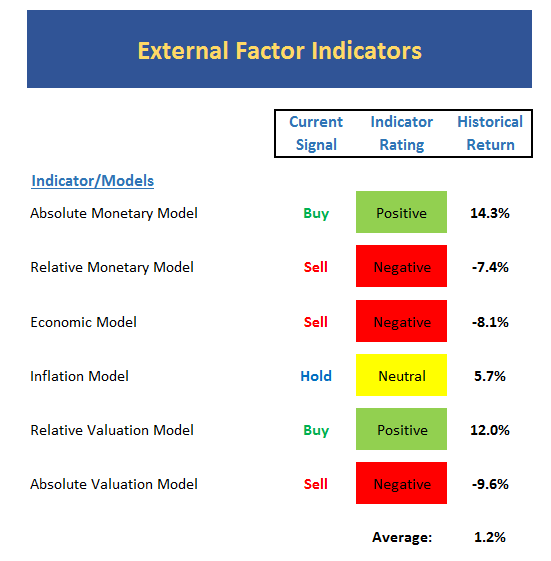

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

Executive Summary:

- The net of the two monetary models, means the monetary picture is neutral

- With bond yields continuing to rise, a tailwind that has helped the bulls for years is no longer blowing.

- While the mode of the Inflation model has not changed, it is worth noting that the trend of the model itself continues to slowly increase.

- The combination of the fall swoon in stock prices and the improvement in earnings caused some valuation components to actually improve recently.

- A quick glance at this board suggests that this is not a low risk environment.

- The historical average with the board in its current state is barely positive and this is worrisome.

The State of the Big-Picture Market Models

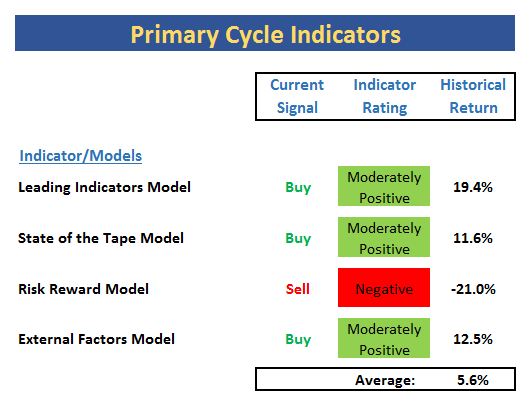

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- The Primary Cycle board is in pretty good shape.

- The Leading Indicators, External Factors, and State of the Tape models all remain moderately positive

- The Risk/Reward model remains negative this week

- Historically rising rates has been problematic for stocks

- There is a "yea, but" associated with the Risk/Reward reading as the monetary components are the reason the model has moved into the red zone. But the argument can be made that rising rates are actually positive at this time.

- If rates continue to rise, they will "bite" at some point.

The Takeaway...

Traders are continuing to embrace the so-called "Trump Trade" in a big way. The expectations are for the new administration to be pro-business with a healthy dose of tax code relief and fiscal stimulus on the side. And how far this theme can take the market is anybody's guess. However, stocks are now overbought, positive sentiment is reaching extreme levels, and interest rates are continuing to rise. As such, a pullback of some sort would be logical at some point. But with the number of trading days left in the year rapidly dwindling, we shouldn't ignore the prospect for some last-minute window dressing, which could certainly keep prices elevated into New Year's eve.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the "Trump Trade"

2. The State of Global Central Bank Policies

3. The State of Global Economies

Thought For The Day:

Keep in mind that not every person's opinion is worthy of your attention and/or consideration...

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio Management? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member