Good Monday morning and welcome back. The "Trump Rally" continued last week as investors scrambled to get in position for reflation, higher rates, reduced regulation, and an aggressive fiscal stimulus plan. The assumption is that things will get done in Washington in the coming year since the GOP is now firmly in control. We shall see. However, in light of the fact that the stock market tends to be a discounting mechanism for future expectations, the traditional year-end rally in stocks appears to be off to a good start.

But enough of my subjective analysis of the action on Wall Street. Let's now move on to our major stock market indicators in order to get a disciplined, unemotional take of what "is" happening in the market.

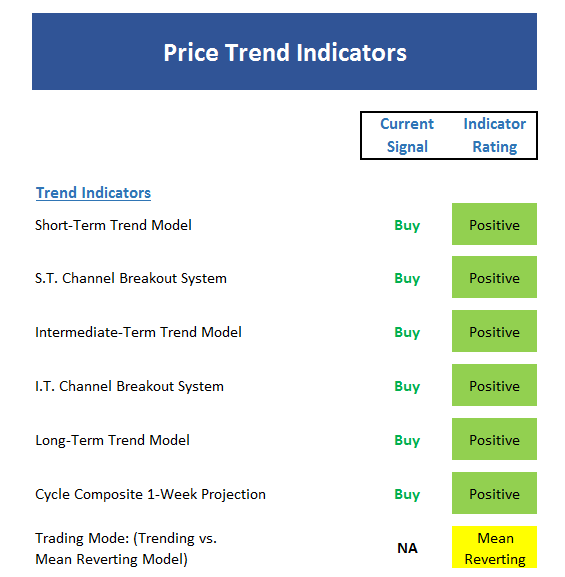

The State of the Trend

We start with a look at the "state of the trend" from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- The S&P 500 has traded above its 5-day moving average for 10 consecutive days - a positive sign

- The indicators board is one model short of a clean sweep as the Trading Mode models continue to suggest stocks are in a mean reverting environment

- The S&P and NASDAQ are actually the weakest charts at the present time as all the other major indices moved to fresh new all-time highs last week

- The S&P is bumping into short- and intermediate-term resistance

- The cycle composite suggests weakness early in the week and then a rebound to higher prices moving forward

- The long-term trend remains positive

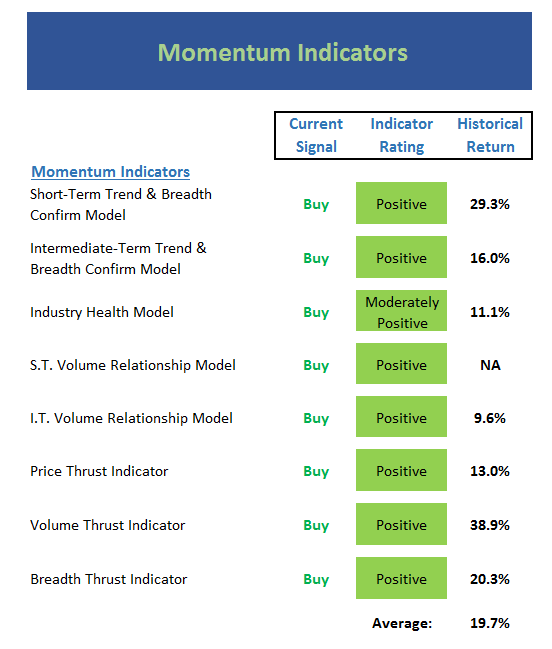

The State of Internal Momentum

Now we turn to the momentum indicators...

Executive Summary:

- That's a lot of green on the Momentum board

- This board suggests the bulls are clearly in control at the present time

- The Industry Health model upticked to moderately positive last week - I'd feel better if this model could move into an outright positive mode

- While the Thrust Indicators are positive, we did not see any fresh buy signals from this group

- The average return of the board is nearly double historical levels

- However, a bright green Momentum board has been a sign of an overbought condition over the past couple of years.

- So, the question, of course, is if the board can stay green - which would be an indication that the current move is just beginning

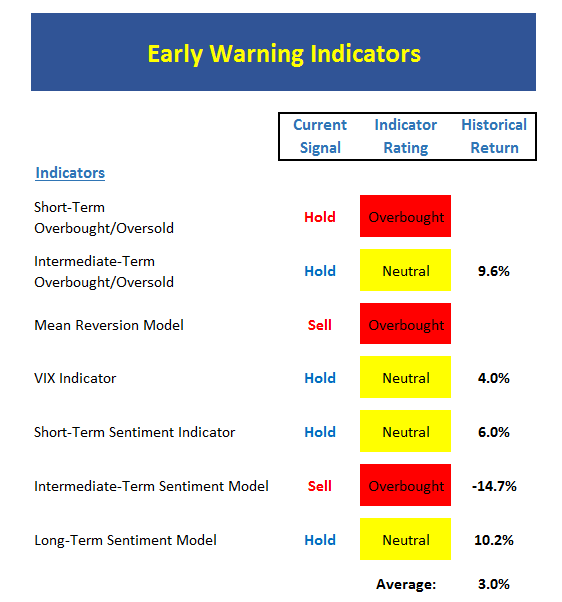

The State of the "Trade"

Next up is the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

Executive Summary:

- Sure enough, all the green on the trend and momentum boards produces warning flags from the Early Warning board

- Stocks are clearly overbought from a short-term perspective

- However, the market is not yet overbought from an intermediate-term view. This suggests the bulls have some additional room to roam.

- Our Mean Reversion Model flashed a sell signal last week - the second such signal in the last 2 years

- It is positive that the Sentiment indicators are not all red at this time

- The bottom line is the Early Warning board suggests that some sort of pause or pullback would not be surprising at this time

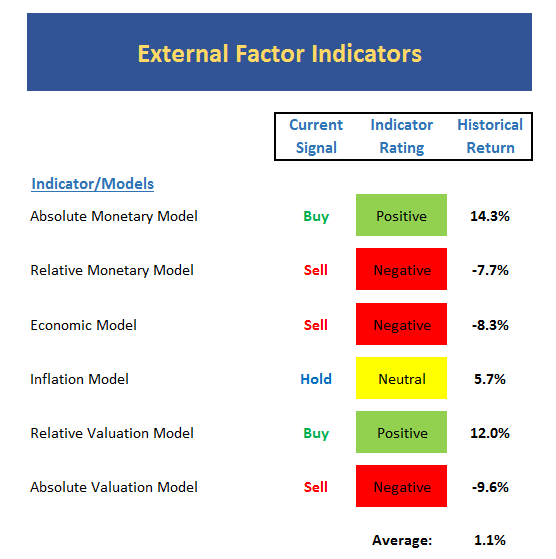

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

Executive Summary:

- If you find yourself worried about the market, this board should provide you with some supporting evidence

- The Relative Monetary model flipped to negative last week and gave first sell since 2012

- The Economic model remains negative

- One of the component models of the Inflation model is now in the "strong inflationary expectations" mode

- The average return is only modestly positive

- However, the "yea, but" here is that the rate spike is likely in the late innings, the economy is improving, and inflation has been the goal of the Fed for some time now. Thus, I'm not getting overly nervous about all the red on this board at this time.

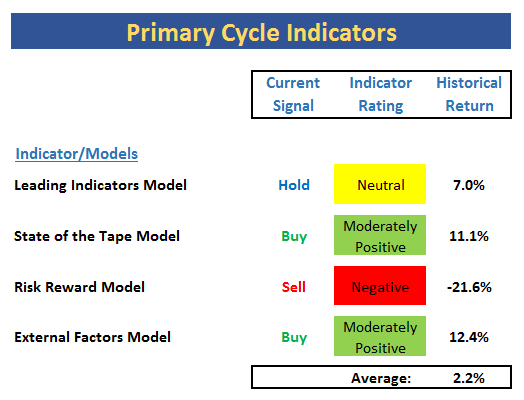

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- This board presents another reason for those seeing the market's glass as half-empty to fret

- The Leading Indicators models moved to the lower reaches of neutral last week but rebounded a bit by Friday

- The State of the Tape model upticked to moderately positive

- The External Factors model is also moderately positive

- However, the big news is the Risk/Reward model gave an out-and-out sell signal last week

- The return of the market when the Risk/Reward model is negative drags down the average return to just 2.2% per year

- I have to rate the board as neutral to moderately positive at this time

The Takeaway...

It is clear that the two month "sloppy period" seen from mid-August until the election took its toll on some of our big-picture market models. However, the spirited "Trump Trade" rally has caused the shorter-term trend and momentum indicators to turn green. Then when you add in an overbought condition, you wind up with a mixed, or neutral picture. The good news is the "troops" are leading the "generals" here as the S&P has lagged the small- and mid-cap indices. It is also positive that the seasonal winds become tailwinds now for the bulls. So, if big-cap tech and the rest of the S&P can follow the lead of the broader indices and move to new highs, I could upgrade the outlook on the market. But until that happens, we will be watching the resistance zones.

Publishing Note: I am going to take a break from the keyboard the rest of this week and enjoy some quality time with the family over the holiday. Here's wishing everyone safe travels and a Happy Thanksgiving!

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the "Trump Trade"

2. The State of Global Central Bank Policies

3. The State of Interest Rates

4. The State of Global Economies

Thought For The Day:

Live for today for tomorrow never comes. -English Proverb

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member