It is safe to say that the prognosticators got this one wrong - really wrong. And even the fast money traders who anticipated a market crisis Tuesday night by pushing Dow futures down some 800 points as it appeared Trump was heading to victory, got it wrong. Again, really wrong.

Some folks I talked to yesterday said that the markets got it wrong too. But the key thing to remember here is markets are never wrong, people are.

And even if markets are indeed wrong, they don't stay wrong for long. The election is a perfect example. Analysts anticipated disaster if Hillary Clinton lost the election. A Trump win created uncertainty and fear, we were told. And sure enough, an hour before the open Wednesday morning, stock futures were pointing to a decline of more than 200 points on the DJIA.

But a funny thing happened on the way to what was expected to be the largest fear-induced dance to the downside since 9/11 - the fear trade was replaced by the "Trump Trade" and the big, bad dive just didn't happen.

Yep, that's right; traders took a breath and began to program their computers to act on what they expect to happen next. Instead of the worst decline in years, the computers started buying biotech, pharma, and healthcare stocks. They snapped up anything related to infrastructure and transportation. And don't look now, but suddenly the banks are back in vogue and being bought with both hands.

The moves were impressive. With the GOP in control of the House, Senate, and the Presidency, traders realized that things could change and new initiatives could actually get approved - something that hasn't happened in Washington, D.C. for a very long time.

And while the talking heads on TV spent most of the day talking about the big moves in the stocks expected to benefit from a brave new world in politics, an even bigger move was happening over in the bond market.

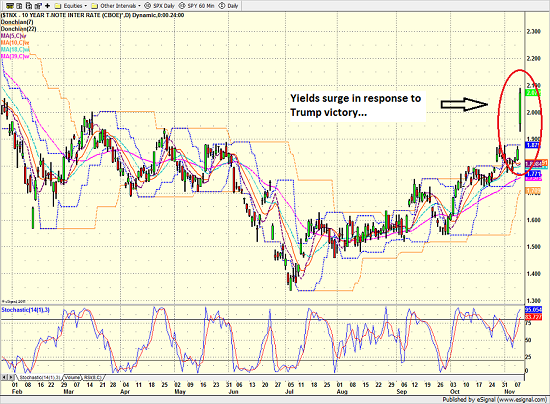

Yield of US 10-Year - Daily

View Larger Image

The yield on the 10-Year Treasury Note surged 21 bps yesterday, finishing the day at 2.07%. This was the first time yields had traded over 2% since January. And in percentage terms, the pop in yields came in at 11.3%.

Looking at a longer-term chart of yields helps put the move in perspective as the current spike appears to be significant.

Yield of US 10-Year - Weekly

View Larger Image

Point number one is that a Trump win, when coupled with a GOP controlled Congress, means that tax cuts are coming. It means that deregulation is coming. It means that fiscal stimulus on infrastructure (roads, bridges, airports, etc.) is coming. It means that free trade may be reduced, which, in turn, means that some more inflation is coming. And most importantly, it means that a corresponding uptick in economic growth is also on its way.

From a macro point of view, stronger growth means more tightening from the Fed. All of the above spells higher interest rates. And this is why traders and their computers were falling all over themselves selling bonds yesterday.

However, take another look at the daily chart of the 10-year. You should note that yields have been rising since July. This is due to what is being called a "Tightening Tantrum" in the bond market.

You see, not only has it become clear to bond traders that the Fed is going to try and return rates to more normalized levels (albeit at a snail's pace), but that other central bankers around the world may soon begin to "taper" their QE programs.

The key here is to recognize that expectations for global economic growth are increasing. And as James Carville became famous for saying back when Bill Clinton was running on change back in the 90's, "It's the economy, stupid."

So, when you couple more spending in the U.S. - spending that is likely to be funded by deficit spending (which means more bond supply) - with less buying by central banks around the world, the result is simple. Bonds get sold and yields rise.

The question, of course, is how far will yields run during the "Trump Trade" (which enters day 2 on this fine Thursday morning). Personally, I think the bond market may be getting ahead of itself during this "price discovery" phase. In short, I'm thinking that the recent move from 1.37% to 2.07% is close to being sufficient given the current situation. But, we shall see.

So, if you are thinking that the "Trump Trade" only extends to stocks, you may want to think again. And remember, a rise in rates that occurs "for the right reasons" is a good thing - to a point. As such, the action in the bond market remains something to watch.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Election

2. The State of Global Central Bank Policies

3. The State of Global Economies

Thought For The Day:

There is no better way to clarify one's thinking than to try and explain it to someone else. -Margaret Thatcher

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member