Stocks got smacked around pretty good on Tuesday as a triple whammy of negative news caused traders and their computers to suddenly rethink their outlook.

Cutting to the chase, it was a combination of lousy earnings guidance, surprisingly hawkish Fedspeak, and a fresh worry on the political front that appeared to be the culprit for the pain in the markets.

First up was the earnings report from Alcoa (AA), which followed up on the negative outlook from Honeywell (HON). Both companies are viewed as bellwethers for the industrial sector and in short, neither had upbeat things to say about the future. As a result, Alcoa's stock dove -11.4% while HON is now off -8.5% from last Thursday's close. So, it will suffice to say that there is some concern about the outlook here.

However, a crummy earnings report from Alcoa really doesn't move the market to any great degree these days. No, from my perch, it was the next two issues that were the real drivers to yesterday's dance to the downside.

When Doves Turn

While just about everybody in the game expects the Fed to hike rates in December, on Tuesday, even a noted dove chimed in that it was probably time for the Fed to get moving. Charles Evans, who is President of the Chicago Federal Reserve, said Tuesday that he's fine with a December rate hike. And for watchers of the Fed, this was a clear sign that a rate hike is in the cards at the December FOMC meeting. The problem is apparently the market has not fully priced in such an expectation. But yesterday's downdraft will certainly go a long way towards this end.

When What-If Suddenly Looks Possible

And then there is the election. While there can be no denying that this is one of the strangest elections ever seen, from Wall Street's perspective, there really hasn't been much to worry about. Remember, the stock market really never cares who wins an election. No, it is political uncertainty and/or the risk of one party having too much control that gives the market the willies.

The key here is the GOP finds itself in a state of disarray and prominent Republicans are now calling for Donald Trump to step down -- for the good of the party. This means that those trying to either keep their jobs or get elected are worried about the collateral damage being caused by Trump. In turn, there is suddenly a fear that the Republicans could lose their grip on the House of Representatives. And given the assumption that the Dems will win the White House, the market is suddenly worried that one party will be able to rule the roost in D.C.

The Result...

The end result of yesterday's triple whammy was a dive in stock prices, a surge in the dollar, and a worrisome rise in interest rates.

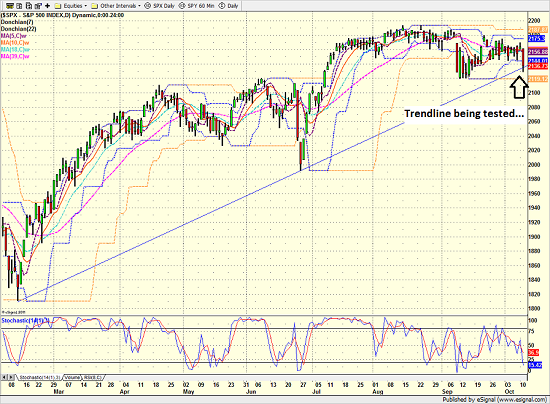

S&P 500 - Daily

View Larger Image

Although the negative seasonal period is coming to a close, it wasn't positive to see the S&P test the trendline of the current bull phase in meaningful way. And while NO line on a chart is a back-breaker these days, we will continue to watch 2130 to 2120 zone. As I've been saying, a breach of the 2120 line could be problematic for the bulls in the near-term.

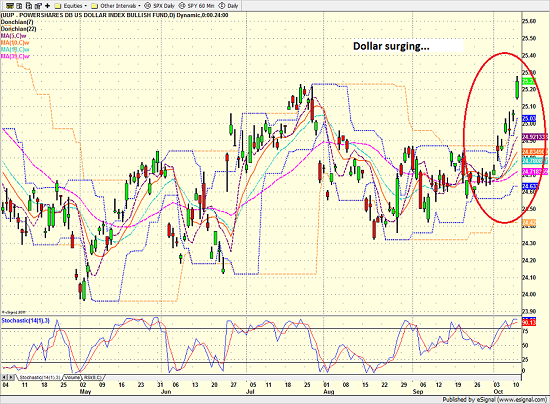

Next up is the surge in the dollar.

Powershares US Dollar ETF (UUP) - Daily

View Larger Image

In short, a move like this causes all kinds of problems for traders on many fronts. And the greenback's break above the July high is causing some consternation.

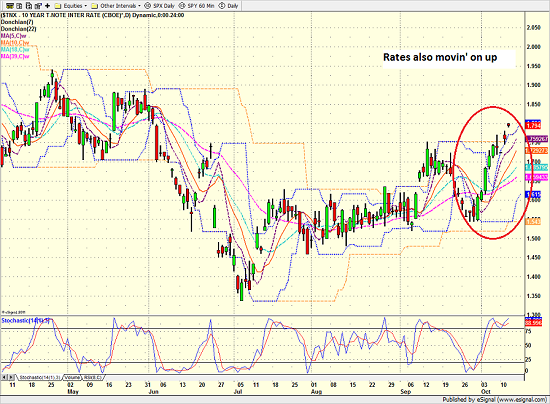

And finally there is the state of rates.

10-Year T-Note Yield - Daily

View Larger Image

With the comments from Evans came the realization that the Fed is more likely than not to raise rates. Couple this with some decent economic news lately and the bottom line is rates move up. The question of course, is how much farther rates will run in the near-term.

In sum, yesterday's rather violent reaction to the triple whammy of news got people's attention. However, we should remember that moves of this nature have been short-lived this year. As such, it will be interesting to see if the bears can produce any follow-through to yesterday's drubbing.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of U.S. Economic Growth

2. The State of Global Central Bank Policies

3. The State of the Earnings Season

3. The State of German/European Banks

Thought For The Day:

"There is nothing wrong with change, if it is in the right direction" -- Winston Churchill

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member