So, did we learn anything from the resumption of the market's dance to the downside yesterday? Can the action be blamed on anything specific? Should we be concerned about the reversal of Monday's reversal? Or is this simply the latest edition of computers gone wild, or what I like to call, "Hedge Fund Follies?"

In my humble opinion, the answer to the first three questions is, yes. And as such, it is probably best to dig in and make sure we understand what the heck is going on here.

Cutting to the chase, it's all about bonds right now. Sure, oil is getting some attention. And yes, the action in the dollar is worth watching. But the bottom line is that fear and loathing in the bond market is the central theme here.

At issue is the macro fear that we're seeing the beginning of the end of the QE era. A period in time that will no doubt go down in history for an unprecedented degree of globally coordinated, central bank intervention. A period when interest rates around the world moved to all-time low extremes. A time when, according to Mr. Paul Singer, President of Elliott Management, some 30% of the world's government bonds yield nothing - or less. And a time that many folks expect to end badly.

I know what you're thinking. Dave, you're being melodramatic here. Please calm down and return to the land of objectivity asap!

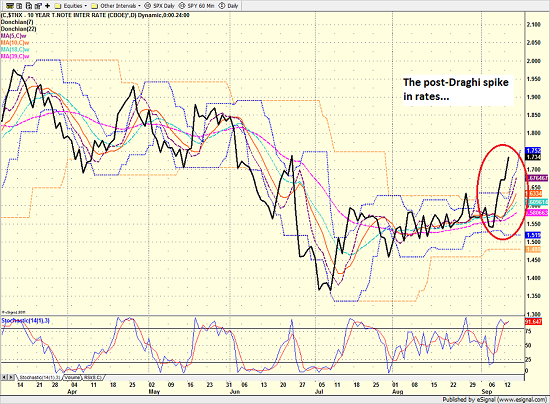

Okay, okay. In looking at the charts of the bond market, perhaps it is a bit premature to get overly excited about the recent spike in bonds - a move that is really just 4 days old. A spike that began after Super Mario disappointed the market last week by suggesting that the ECB may need to re-evaluate what they are doing.

U.S. 10-Year T-Note Yield - Daily

View Larger Image

When viewed from a longer-term perspective, there appears to be even less reason to get worked up. Sure, yields have moved up a bit from the low. But isn't big-picture the trend firmly entrenched and aren't countertrend moves always part of the game?

U.S. 10-Year T-Note Yield - Weekly

View Larger Image

The problem is I'm not the only one who can be accused of being dramatic about this issue. For example, Doubline Capital's founder and the newly anointed bond king, Jeffrey Gundlach, noted last week that this could be "a big, big moment" for the bond market.

Mr. Gundlach, who mangers a tidy $61.7 billion in the Doubline Total Return Bond Fund, pronounced last Thursday that interest rates have bottomed. "I think it's the beginning of something and you're supposed to be defensive," Gundlach said.

Next up, the aforementioned Mr. Singer told the crowd at CNBC's Delivering Alpha conference Tuesday that this is a very dangerous time for investors. Singer noted that the term "safe haven" for the bonds of G-7 countries is "just plain wrong" and there is a tremendous amount of risk in owning 10-, 20-, 30- year bonds at these rates. Singer finished up by emphatically encouraging investors to sell long-term bonds because this is "the biggest bubble in the world."

Then there were the comments from legendary investor, Bill Miller. The value stock guru said yesterday that global central banks are starting to rethink the efficacy of their policies. Miller's suggestion to investors was to go long stocks and short bonds.

And speaking of being dramatic, billionaire Carl Ichan piled on yesterday afternoon by saying that the market is "very dangerous."

Now toss in the fact that the auction of U.S. 30-year bonds did not go well, that European bonds are also tanking, and the suggestion by some that the risk parity trade is starting to unwind, and well, you've got a recipe for an emotional day in the markets.

To sum up, it would appear that anxiety over the end of the QE era is cause of the market's current difficulty.

Could it continue? Certainly. These types of emotional themes sometimes gain traction among traders for extended periods of time. And given that September is known for volatility, I wouldn't be surprised to see this theme stick around a bit.

The End of the Line?

But is this the end of the line for monetary stimulus? After all, this is the question of the day. From my perch, I seriously doubt it. Remember, the Bank of England just launched a significant stimulus program and the Bank of Japan isn't likely to back down from its goals any time soon.

In short, I believe it is unlikely that the global central banks of the world are going to suddenly switch gears. Could they be starting to rethink the QE-Infinity theme that has become so popular? Absolutely. But this does not mean that the world will suddenly be awash in bonds for sale from the globe's central bankers!

So, short of a serious spike in inflation or a meaningful pickup in global economic activity (both of which would be fundamental reasons for significantly higher rates), I'm thinking that the current freak-out in the markets is likely (a) to be temporary and (b) what I'd call an adjustment period. So, unless/until the macro picture looks to be changing, I'm still of the mind that dips should be bought in the stock market.

P.S. I promise to finish up my series on Why Tactical Strategies aren't Working - assuming the markets will ever calm down enough to give the time!

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

T1. The State of the Bond Market

T1. The State of Global Central Bank Policies

3. The State of U.S. Economic Growth

4. The State of the U.S. Dollar

Thought For The Day:

What worries you masters you. -- Unknown

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member