When thinking about the short-term outlook for stocks, I believe we can all agree that "Fed expectations" and the state of the U.S. dollar are the driving forces at this time. I also think it is a safe bet that Janet Yellen's merry band of central bankers is doing all that they can to help the market "reset" expectations for the potential of a rate hike this year.

Personally, I don't think a September move is really on the table. And I believe that Stanley Fischer's comments about the possibility of two rate hikes before the end of 2016 is more posturing than anything else. However, given the recent economic data and the accompanying fedspeak, it appears that traders had best get on board with the idea the Fed Funds Rate moving up in December.

From an intermediate-term perspective, I'm of the opinion that both seasonal factors and the outlook for the economy are the dominant issues at this time. As I've relayed recently, our cycle work turns decidedly weak from now through early October. This is due primarily to the seasonal cycles, which tend to produce a swoon in the early fall each year.

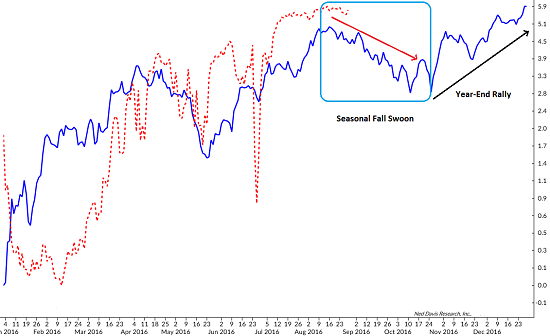

To review, the cycle composite I follow is comprised of 3 separate historical cycles: The 1-year seasonal cycle, the 4-year Presidential cycle, and the 10-year decennial cycle. When combined and plotted daily, the cycle composite (the blue line in the chart below) often does a very good job at projecting what might happen next in Ms. Market's game.

To be sure, there is no perfect indicator for the stock market. And as the late Marty Zweig was famous for saying, "Those who rely on a crystal ball will wind up with an awful lot of crushed glass in their portfolio." However, when the cycle composite is "on" it can be scary good as a projection of what comes next.

S&P 500 and 2016 Cycle Composite

View Larger Image

As you can see from the chart, the cycle composite now calls for a steady - bot not severe - decline into mid-October. This is due to the fact that (a) September/October tends to be weak and (b) the 4-year presidential cycle is in play this year. Historically, the outcome of a presidential election tends to be up in the air at this time of the year, which, of course, causes uncertainty in the stock market. And since markets hate uncertainty more than anything else, it isn't surprising to see the cycle composite projecting some downside action for the next 5-6 weeks.

The good news is that after the fall swoon, stocks traditionally embark on the "year-end rally." And according to the composite, this year will be no different.

So, what is an investor to do with this information, you ask? First, understand that this type of work is best used for setting general strategy - and not for day-to-day decision making. But given that we believe a new cyclical bull market began in February, it looks to me that investors may be presented with an opportunity here. In other words, the projected seasonal weakness over the next few weeks might be a good time to "buy the dip."

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of U.S. Economic Growth

3. The State of the U.S. Dollar

Thought For The Day:

Happiness depends upon ourselves -- Aristotle

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member