There is no denying that the bulls have been on a roll of late. The S&P 500 has gained 9% since the post-BREXIT low seen on June 27 (the last time the pouting pundits were absolutely, positively sure that the next great calamity in the markets had begun) and has advanced 19.3% from the February 11 low.

Along the way, the market has produced several "breadth thrust" buy signals, which, while easier to come by in the high-speed trading era, have continued to be profitable 3-, 6-, 9-, and 12-months after the signals. In addition, Ned Davis Research tells us that a new cyclical bull market is underway.

I'd also like to point out on this fine Wednesday morning that the last nagging indicator group that I follow daily finally turned green this week. I'm talking about the set of models that determine whether the stock market is trading in a mean-reverting mode or trending in one direction or the other.

The bottom line here is that until this week, the indicators suggested that the market had been classified as being in a mean-reverting mode for much of the past two years. Thus, it was encouraging to see that first our Efficiency Ratio model (a model that determines how "efficient" a move in the market is) and then our Strength of Trend model both flipped to the "Trending" mode this week.

So, while there is also no denying that (a) stocks have become overbought from both a short- and intermediate-term perspective and (b) that the bears may find a raison d'etre at any point in time here, I think one has to remain upbeat about the outlook for stocks when looking out over the next year.

But...

It is also fair to note that the calendar is about to turn ugly as far as the historical patterns in the stock market are concerned. Although October may be the month that has contained the most stock market crashes, September has historically been quite volatile. And don't look now fans, but September isn't that far away.

In fact, our cycle composite, which is comprised of the 1-year seasonal cycle, the 4-year Presidential cycle, and the 10-year decennial cycle, peaks at the beginning of next week. And I'm sorry to report that the cycle then points to a steady downtrend through early October. Ughh.

So, there you have it. The trend may indeed be an investor's best friend from a longer-term perspective. But at the same time, things could easily get very sloppy and perhaps even a little scary in the near-term.

What's an investor to do with this situation, you ask? The answer is simple. Think longer-term. Don't freak out when stocks start to pull back or buy into the doom and gloom that will undoubtedly be espoused from the bear camp over the next two months. And finally, make a plan to use the anticipated decline to your advantage by, yep, that's right, buying the dip.

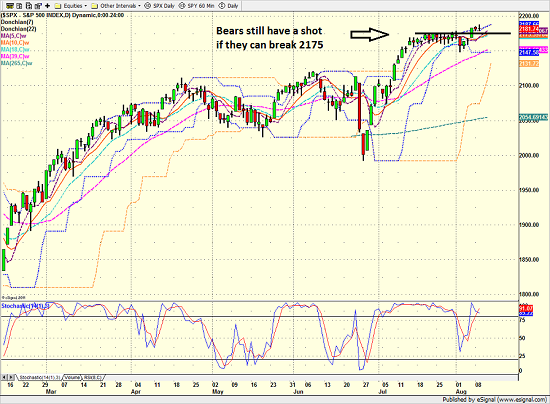

From a near-term technical standpoint, stocks are clearly overbought and the rally has stalled. Thus, it will be a game of key levels from here. The bears will first target the 2175 level as a way of announcing that it's their turn to run with the ball. Then the 2145 will become critical.

S&P 500 - Daily

View Larger Image

So, while things look positive from a longer-term perspective, it looks like it could be anybody's ball game in the near-term.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of Oil Prices

4. The State of U.S. Economic Growth

Thought For The Day:

"Get out when the market lets you out" -- Paul Tudor Jones

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member