If you want your own copy of this free report, along with details for all 3 keys, click here: Get My FREE Report

What is a Momentum Stock?

A momentum stocks is defined as a stock whose share price is in an uptrend, and in recent trading has seen that uptrend accelerate faster than the general market. Momentum stocks are typically some of the most widely traded of all stocks. Why is that? The answer is simple: momentum stocks move the furthest in price in the least amount of time. Further and faster than value stocks. Further and faster than growth stocks.

Forbes magazine claims that "momentum strategies can help investors beat the market and avoid market crashes." Even Nobel Prize winning economist Eugene Fama had to admit that his "efficient market theory," which otherwise discounts the possibility of predictable patterns occurring in the markets, could not account for the positive correlation between current price momentum and future market gains.

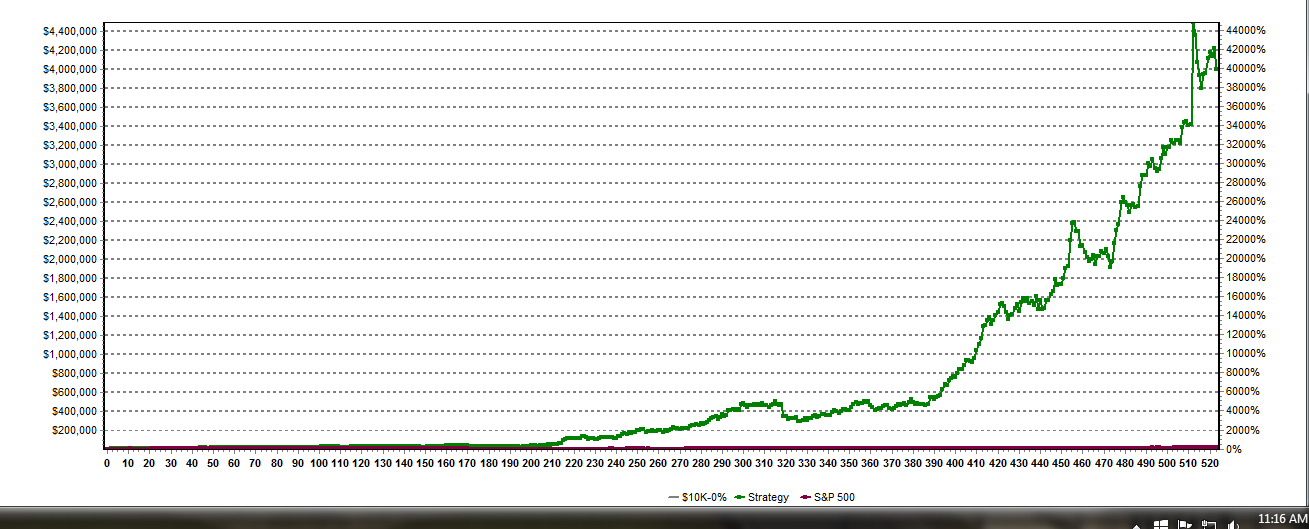

And it’s true: if rightly harnessed, momentum is arguably the strongest force moving the market. To show you what I mean, take a look at the back-tested returns for the system I use in The Momentum Letter. Over the past 10 years (through June 30, 2015), my primary longs-only momentum system has returned an astounding 39,000%:

With that kind of compounding, a $10,000 investment today could balloon into nearly $4,000,000 by the year 2025!

Most Momentum Systems Don’t Work

So is the key to successful momentum trading as simple as identifying the stocks with just the strongest price momentum at any given time? Hardly. In fact the dirty little secret about most momentum systems is that they tend lose money over time.

Let me prove my point. Consider the following data. The simple momentum scan defined below is based purely on percentage price change over three different time frames:

• Price > $10 per share

• Average Volume > 100,000

• 24-week % Price Increase = Top # 30 stocks

• 12-week % Price Increase = Top # 10 stocks

• 4-week % Price Increase = Top # 3 stocks

This scan teases out from the universe of over 5000 stocks the 3 that rise to the top of the list based only on upward price momentum. In this test I am using a 4-week rebalancing period over the past 5 years. I selected the five years that began at the bottom of the recent market crash (March 2009) to the then new market highs that were established in the S&P 500 in March 2014. This was an especially bullish period for U.S. stocks as they rallied sharply following the “The Great Recession” of 2007 - 2008. The S&P 500 rose 165% during this period for a compounded annual growth rate of over 22%.

How did the “momentum stocks" fare over this same very bullish period? Not well, I’m afraid. Take a look: the returns for the above screen when using a 4-week rebalance interval over a period of 5 years created a loss of -50%!

This clearly demonstrates just how “weak” momentum stocks (represented by the green line) can be, even in a strongly bullish market, when price momentum is the only criterion used to filter stocks. No, if you want to earn consistent profits from trading momentum stocks, you will need to find a system that goes beyond mere price momentum. You need to find the key parameters that sustain price momentum.

Here is the First Key

My years of research has led me to identify three keys that must be in place if one is to be successful trading momentum stocks. And I have built those keys into a momentum trading system – the very same system I use in The Momentum Letter – that can sustain steady gains over the long term.