UK-based GW Pharma (GWPH) is allowing long-term investors a good entry today following the release of Q1 results and a conference call that followed. The stock continued to retrace a good portion of its massive rally in early January today but has reversed:

Today's low was just above 70, but the stock lifted off of those levels quickly and has gotten back above the lows set near 72 last week and going into the number:

The report from the company as well as the conference call didn't really add too much new information. GWPH will be spending aggressively this year to move along several candidates in Phase 2 or Phase 3 clinical trials, and we should expect a lot of data throughout the year. On the call, the company suggested that it may present some data on Epidiolex, its drug under development to treat rare childhood epilepsy, at the April meeting of the American Academy of Neurology. Furthermore, management shared anecdotal evidence that Epidiolex may not only help control seizures, but it may also help improve quality of life in these patients in other ways. The company believes that the drug may prove helpful to patients with autism.

The big picture summary of today's report and conference call are that there are no changes to the cash flow guidance provided in December, the company continues to advance its rich pipeline and that Epidiolex remains the key but not exclusive part of that pipeline. The company will be sharing a significant amount of data as the year progresses on both Epidiolex as well as Sativex and other pipeline candidates.

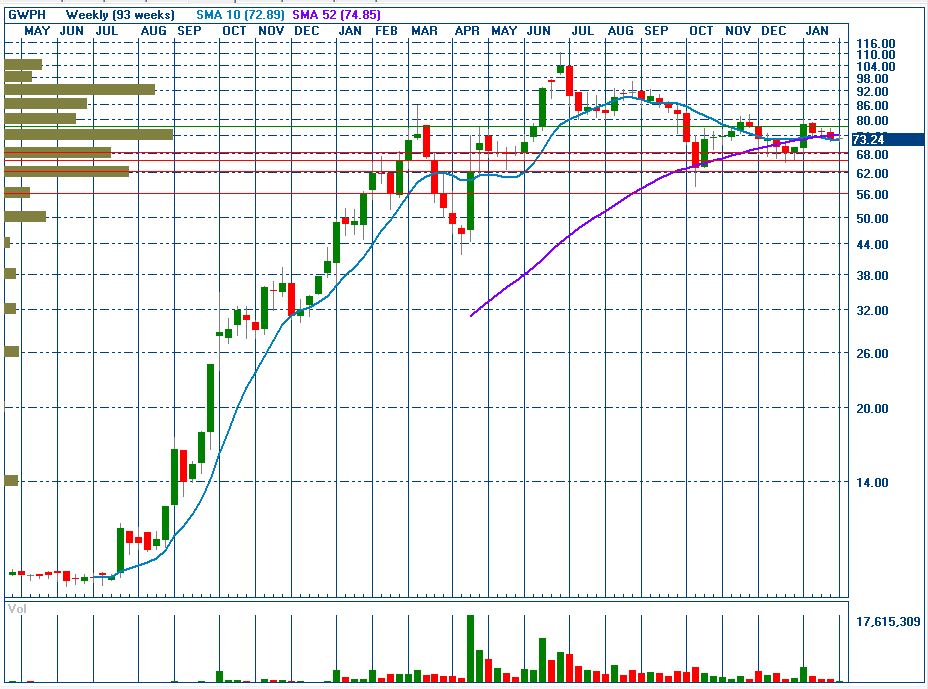

Taking a longer-term perspective, GWPH, which at $72 is worth about $1.44 billion, has not only solid fundamentals in terms of a huge war chest ($240mm) to fund its many opportunities along with a massive patent portfolio, but it also has a fantastic chart:

The stock has endured two large corrections of about 50% each, one last March and then a more protracted one from the all-time high near $111 in early July to the low in October. My own view is that if the stock can clear 81-83, it could test the prior highs, perhaps running into some resistance in the 96-100 area. At 100, the stock would have a market cap of about $2 billion. As I review biotech transactions over the past year and incorporate the potential of Epidiolex alone (the company has the potential to have orphan designation for two forms of rare childhood epilepsy but also a much larger potential market for a poorly treated syndrome with little innovation), I think that this level could prove to be about 50% of the ultimate acquisition value of the company, assuming it is successful in FDA approval. Failure of Epidiolex would be detrimental but not deadly, as the company doesn't rely exclusively on it.

Investors in GWPH need to be aware that the majority of the shares still are in the UK (GWP), though the U.S. market is dramatically more liquid. Just today, the largest shareholder, M&G Investment Funds, filed with the SEC to update its position, which has increased over the past year and is now 13% of the company. U.S. based Capital Research also owns about 10%.

One challenge for GWPH has been the swift decline in the UK currency relative to the dollar. For this reason, it is helpful to look at the stock chart for GWP:

Today's range has been 380-420, which, assuming 1.522 on the currency (and incorporating 12 shares of GWP for each share of GWPH), works out to 69.40-76.70. The U.S. range has been inside (70.01-74.87). Note also that the low in early January in the UK took place before U.S. trading had commenced. This was a most important day, in my view, for the stock, as it was a massive high-volume reversal following disappointing news on Sativex. In the UK, the stock held its October lows of 299 with a 310 low and traded as high as 440 the next day. Today's low of 380 represented a retracement of 46% of the rally.

In summary, GWPH is a unique biotech company focused exclusively on cannabis-derived cannabinoids to treat important medical conditions. The company has a rich pipeline beyond Epidiolex, which represents its largest opportunity. The valuation clearly reflects a lot of hope for its development, but continued success as well as success with other parts of its pipeline could lead to a much higher valuation. Today's extension of a consolidation following a massive reversal in early January affords long-term investors an opportunity to invest in my view.

Disclosure: At the time of posting this blog, I have positions in one or more model portfolios

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22