Markets Pop After Dovish Comments From Fed: SPX, Nasdaq, IWM, AMZN, MNST, AAPL, MPC, FDX, GMCR, PCLN, RL, SCTY, GILD, BIIB, CELG, VRTX, BMRN

After yesterday's steep drop, buyers responded by driving the stocks up to their best day of 2014, after the Fed released its dovish comments toward raising rates.

In the morning, SPX touched a low of 1925.25. But, before the day ended, SPX touched 1970.36: a 45-point swing!! The Dow jumped +275 points, while Nasdaq was almost up +2%!

We closed off our V puts at day highs, for a +58% profit, just when the market reached the bottom:

| Symbology | | | Entry | Exit | P/L ($) | P/L (%) | Entry Date | Exit Date |

|---|

| V Oct 18 2014 Put 210.0 | $2.27 | $3.60 | $1,330.00 | 58.59% | 10/07/2014 | 10/08/2014 |

The buying was broadly based. PCLN bounced $17.77. AMZN added +$5.72. Energy stocks finally had a good day, and MPC was particularly strong, up +4.26%. Biotechs were among the favorites: VRTX +4.07%; CELG +2.64%; BIIB +2.74%; BMRN +4.25%; GILD +4.39%. GMCR was on its second day of climb and recorded a new all-time high at $143.66. RL added $3. SCTY finally bounced off of a support at $54 and closed up +3.54%.

The Dow closed at 16994.22, just shy of 17,000; SPX closed at 1968.89, just below 1970; Nasdaq closed at 4468.6:

GDX (gold miners) was one of the strongest sectors, up +7.44%! XLF (financials) was up +1.9%. SOXX (semiconductors) gained +2.27%. XME (metals and mining) bounced +2.25%. IGV (software) popped +1.91%.

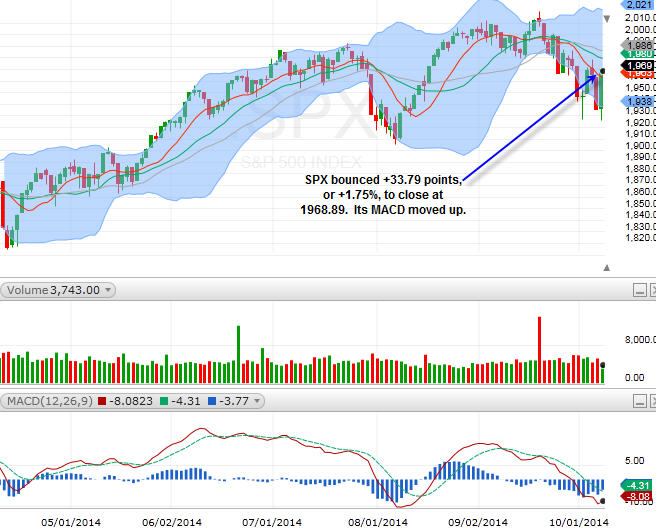

SPX

SPX bounced +33.79 points, or +1.75%, to close at 1968.89. Its MACD moved up.

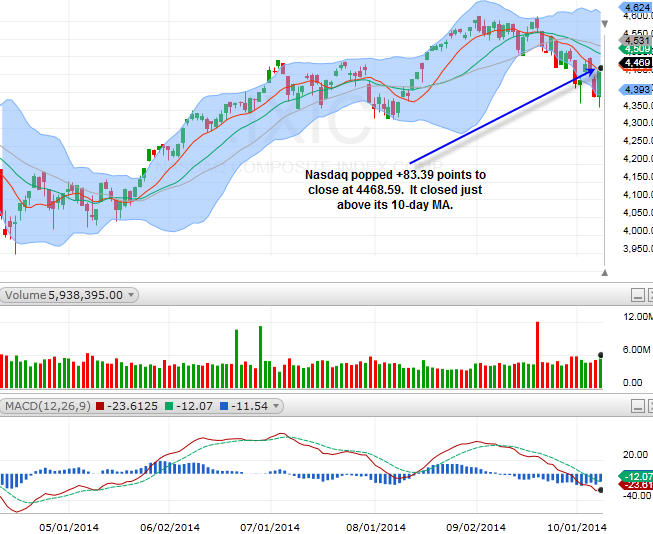

Nasdaq

Nasdaq popped +83.39 points to close at 4468.59. It closed just above its 10-day MA.

There are still a lot of dip-buyers out there! If you look closely at the charts above. In the past two weeks, after every long, red candle stick (big drop), we saw one or two long, green candle stick (big pop). As for this week, after 3 days of trading, SPX is "up" for the week! This is got to get some bears scratching their heads, say "Where is the pullback?!"

Well, mid-caps and small-caps haven't been doing all that well. Both MDY (mid-cap ETF) and IWM (small-cap ETF) are basically showing the same development. We'll look at MDY:

As you can see, the selloff here (and in the Russell 2000) has been much more severe. For a couple of weeks, there basically has been very little buying. This is very different from the SPX, Nasdaq, or the Dow. There's seems to be some support between $242 and $244.

We have discussed a bounce in my Market Forecast this weekend. Let's see how the markets do against the resistance levels.

I think gold plays could be very interesting in the coming weeks. So, I'll be keeping an eye on those.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16