THE WEEKLY TOP 10

Table of Contents:

1) Don’t party likes it’s 1999.

2 & 2a) Narrow rallies are not healthy rallies (so it IS something to worry about).

3) The dollar has much further to bounce.

4) Higher dollar = more headwinds for several VERY overbought commodities.

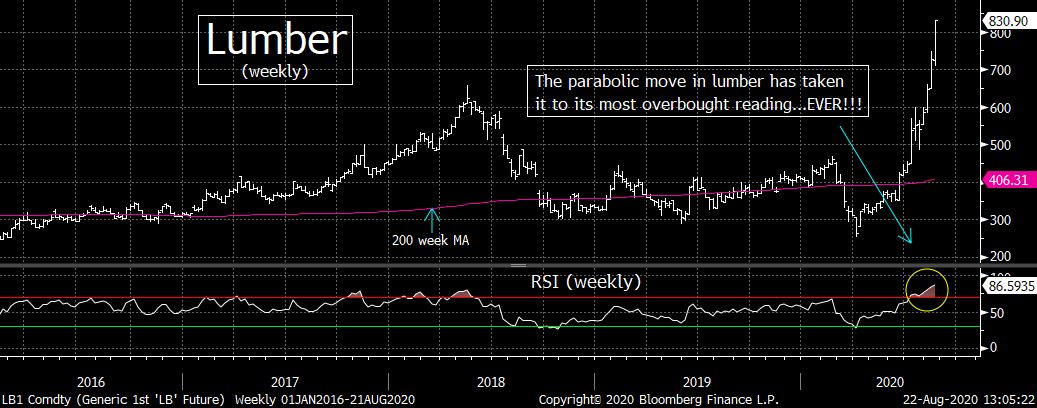

4a) Lumber is the most overbought it has EVER been.

5) TSM seeing some cracks...and NVDA is very overbought. Not good for the SMH.

6) Nobody cares, but another lock-down this fall/winter is highly likely.

7) Consumer discretionary stocks are getting quite overbought. Several “staples” look better.

8) We’ll keep saying it: The U.S. cannot let China gain control of Taiwan.

9) How ironic would it be if the stock market fell during the week of the GOP convention?

10) Summary of our current stance.

Short Version:

1) We have become more constructive on the stock market on a longer-term basis, but we do not see a rally above 3,600 by year-end. Also, we remain quite cautious on the shorter-term...and last week’s action merely emboldened that opinion. The stock market has become more expensive, more overbought...and, certain aspects of the stock market remind us of 1999/2000. The upcoming near-term top will see obvious in retrospect, but since too many people are making money right now (on both sides of the street)...nobody will say anything about the emperor.

2 & 2a) The “internals” during last week’s advance in the S&P 500 & Nasdaq we very, very poor. (Don’t listen to those who say that “narrow” rallies are nothing to worry about.)....Whether it be the shrinking number of stocks hitting 52 week highs, the lagging A/D line, the lagging Russell 2000 & S&P 500 equal weight indexes...this situation has only deteriorated. We’d also note that sentiment in the II data shows the spread between bulls & bears reaching levels not seen in over two years.....It all adds up to a near-term top very soon.

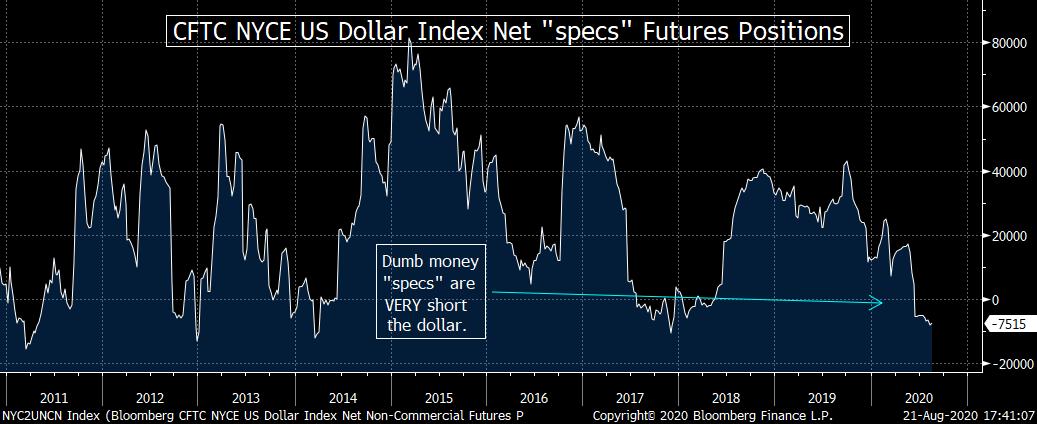

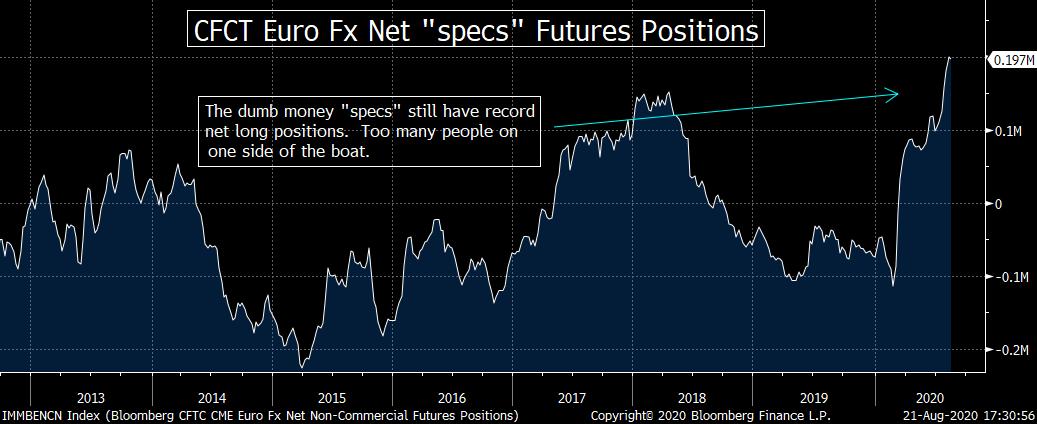

3) We want to pound the table on our call that we believe the dollar will see a “tradable” bounce. There are just too many people who are short the dollar and too many investors who are bearish on the green back. (The exact opposite is true for the euro.) With so many people on one side of the boat, there is no place for the dollar to go but up for a while...no matter what the fundamental picture tells us which way the dollar SHOULD move going forward.

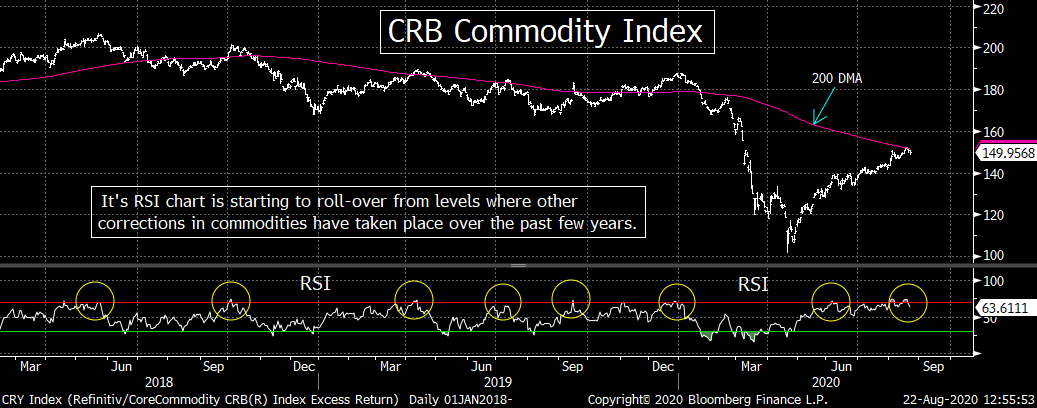

4) Since we’re looking for a “tradable” (multi-week) advance in the dollar, we are also looking for “tradable” declines in many commodities and emerging markets. The inverse correlation between the dollar and these two asset classes has been VERY strong over the decades, so the shift in the short-term trend in the currency market should create a multi-week shift in trend in these markets as well.

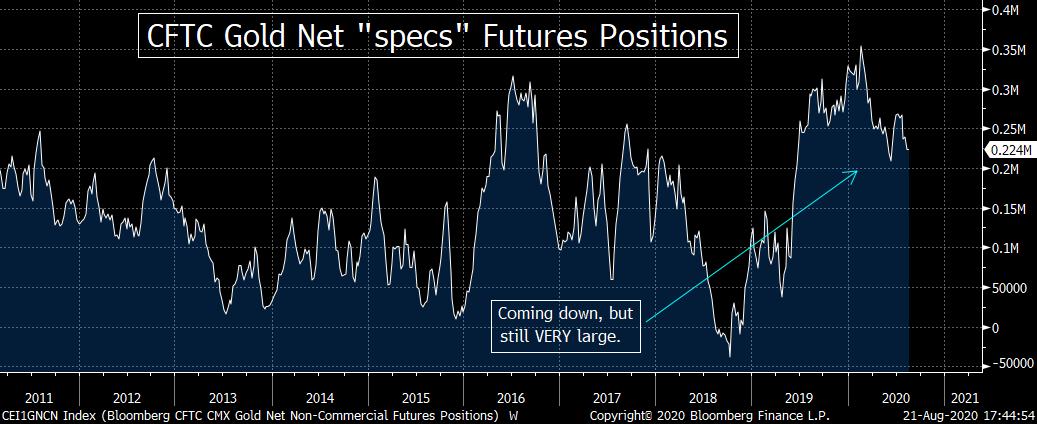

4a) Gold has fallen a bit from its recent highs, but our expectations of a further rally in the dollar leads us to think that gold has more downside movement before it sees another leg to its new bull market. The same should be true for copper....Actually, lumber looks the most vulnerable commodity right now...as has reached its most overbought reading it has ever seen on its weekly RSI chart.

5) We’ve all heard about how 7 or 8 names are accounting for the continued rally in the tech group (and the broad market), but it’s actually only 2 or 3 names. Besides AAPL, TSLA and NVDA...the rest of the mega-cap tech names have actually been stuck in sideways ranges over the past month or two. We’d also note that some cracks are showing up in TSM...& with NVDA getting extremely overbought...this could cause some problems for the chip sector near-term. Therefore, any decline in a small number of tech names roll-over....even if it’s only because they’ve become too overbought...it’s going to cause the rest of the market to roll-over as well.

6) We have spent a large amount of time trying to figure out what impact the coronavirus will probably have on the economy as we move into the fall and winter months. From what we can derive...from listening to those experts who no axe to grind...another wave of the virus is likely this fall/winter BEFORE a vaccine can be implemented. That, in turn, raises the odds that another lock-down will take place at some point in the coming months.

7) Even though we got some very good earnings reports out of several retailers, we’re becoming cautious on the consumer discretionary names at these levels. Too many of them have simply become too overbought on a technical basis.....Instead, we like several of the consumer staple stocks because they are breaking key resistance levels (including WMT, CLX and especially CLX). These stocks should give investors plenty of upside protection if the market continues to rally (due to their breakouts)...and their defensive nature should give them some downside protection if the market rolls-over.

8) We wouldn’t be surprised if the President made some sort of positive announcement vis-à-vis China this week...during the GOP convention. However, the tensions between these two countries will present some very large problems in the year ahead...especially over the Taiwan question (think chips). China has been taking advantage of the pandemic and the Presidential election to gain ground in several of their focus areas. Whoever wins in November will not want to become the next Neville Chamberlain and thus China will not be allowed to gain control of Taiwan under any circumstances.

9) It is amazing to us that so many Democrats and left-leaning pundits still don’t seem to understand that Trump did not create the circumstances that caused his election. Millions of people had become sick & tired of the DC establishment...and Trump was an outsider. He’s STILL the outsider in the 2020 election and if the Democrats don’t take this to heart, they could easily lose this election.

10) Summery of our current stance........Even though we have become more constructive on the longer-term picture for the stock market, we still believe that a short-term pull-back/correction is very likely. Last week’s action only emboldened this short-term stance...as the market became even more “narrow”...and several stocks have gone parabolic........We have a similar divergence between our short-term and longer-term stance on the dollar and euro...as well as the commodity market and emerging markets. There are just too many people on one side of the boat in those markets that they cannot continue on their trends from the spring/summer...no matter what their fundamental picture might tell us.....In other words, we are looking for some multi-week counter-trend moves going forward...and thus investors should look to remain very nimble.

Long Version:

1) After watching the stock market rally on 70% of the days over the past two months...and only seeing one time when the market has declined two days in a row over that time frame...it’s hard to be anything but bullish. (Actually, it went down two days in a row twice, but in the second example, the S&P fell less than 1 point on the second day, so we’re not counting that one.) In fact, we have become more constructive on the longer-term potential for the stock market. However, we think that the stock market’s action over the past month is starting to become very reminiscent of what took place in late 1999 and early 2000, so we believe that investors need to be very careful going forward.

It’s amazing to us how so few people are willing to make this comparison in a serious manner. Don’t get us wrong, many people DO mention the late 1990s in passing, but most of those people then go on to tell us why it’s different this time....or they say that the bubble will inflate for a considerable while longer before it tops-out......Yes, we realize that a lot of people working on Wall Street today are too young to remember the tech bubble of 20 years ago, but there are PLENTY of people who are still around from that period. Besides, plenty of people remember the credit crisis of 12 years ago, so it definitely amazes us how human nature allows people to forget the pain of those horrible periods in the markets.

Let’s step back a second........We DO have to admit that there are plenty of differences between now & the dot.com bubble...led by the fact that a lot fewer stocks are involved in the parabolic moves we’re seeing in the tech sector this time around. Thus it IS different this time...it is always different to a certain degree...and, of course, this bubble could last a lot longer (as “markets can stay irrational longer than investors can stay solvent”). However, there are definitely plenty of similarities...and in several cases, this bubble is even more extreme than the last two bubbles (which caused so much pain when they finally burst).

Ok, let’s move on. Back in mid-to-late March, we highlighted several indications that we were seeing some serious capitulation in the market and thus it was our opinion that a sharp bounce in the market was very likely. (We wish we had been more aggressive back then...like we were in late 2018.) We also said a lot of pundits would tell us AFTER the bounce had become well established that it was obvious that the bounce was going to take place. (All of the perma-bulls were in hibernation back in March.)

We now think the exact opposite is going to take place. The market is going to see a sharp correction...and pundits will again try to say, “I told you so” and tell us that the signs of a top were equally as obvious AFTER the market has fallen 10% or more. (Don’t get us wrong, some pundits are pointing out these developments...but not many....and very few are willing to stick their necks out and say that it’s stupid to be buying some of these tech names up at these ridiculous levels.)

We do not pretend to be alone it pointing out this stupidity right now...we’re just in a very small group. For instance, Byron Wien has become quite skeptical...and was quoted last week as saying that the action in Tesla (TSLA) shows that “the stock market is not rational” right now. We totally agree.

On top of the uncertainties that we’ve been harping on for a few weeks now (in the areas of fiscal policy, U.S./China relations, further “waves” of the coronavirus, 2021 earnings, the election, etc.), the fundamental outlook has become incredibly stretched. Some items...like the P/E ratio on the S&P 500...are not as stretched as it was in early 2000, but at 26x 2020 earnings and 21x 2021 earnings, it’s still VERY extreme. However, there ARE readings that are MORE extreme than they were back in 2000...like the price-to-sales ratio. It has reached 2.5 last week...which is almost 3% higher than it was in February...more than 5% more than early 2018...and almost 6% higher than early 2000!.....Another glaring statistic is Warren Buffett’s market-cap-to-GDP. Using the Wilshire 5000 index, when the market cap stretches to 130% of GDP, it’s considered overvalued. It got to the outrageous level of 170% in 2000. Guess what, it has reached that level once again!

The biggest extreme, however, is in the leverage involved. No, we’re not talking about margin debt in brokerage accounts. We’re talking about the leverage in corporate America. Corporate America was already sitting on record levels of debt BEFORE the pandemic hit the global economy...when it reached $10 trillion early this year. Since the Fed fired its bazooka blast in March, corporate debt issuance has exploded even higher. So there is no question that the leverage that exists in corporate America has only become more extreme......This is especially true due to the fact that so much of the debt that has been accumulated over the past decade has gone to stock buybacks and such...and not to investments in their own businesses. In other words, the money that these corporations have barrowed has not gone to things that will help them service their debt. (This has also been true for the U.S. gov’t...who has borrowed more to give handouts and almost nothing that will give self-sustaining growth to our economy.....The handouts WERE needed initially, but a transition HAS to be made.)

We realize that the Fed is now buying corporate debt, so many believe that the corporate bond bubble will not burst any time soon. They may very well be correct, but the servicing of this debt (especially when so little of the money has gone to help service that debt) will STILL create further headwinds for earnings growth...and thus for economic growth. That, in turn, will have an impact on the stock market...especially one whose valuations have become so stretched.

Having said all of this, even though the market has become very reminiscent of what we was at the end of the tech bubble, we hare notexpecting another 50% bear market. The Fed is ready to help out when it is needed, so a stock market correction of 10%-15% should be met with another bazooka blast. However, there are definitely many obvious signs out there...that are now staring us STRAIGHT IN THE FACE. The problem is that most of Wall Street won’t tell you that they were obvious signs...until well-after the fact.

2) We are also seeing some remarkable extremes on the technical side of things. We (along with many other people) have highlighted that seven or eight of the big seven mega-cap names have accounted for all of the vast majority the rally over the past several months. However, most people don’t realize that many of these names have actually been stuck in sideways ranges over the past month or two...and that is still the case. (First chart below.).....We do admit that some of them...like AMZN...has moved to the top of their 1-2 month ranges, but they’re still range-bound.

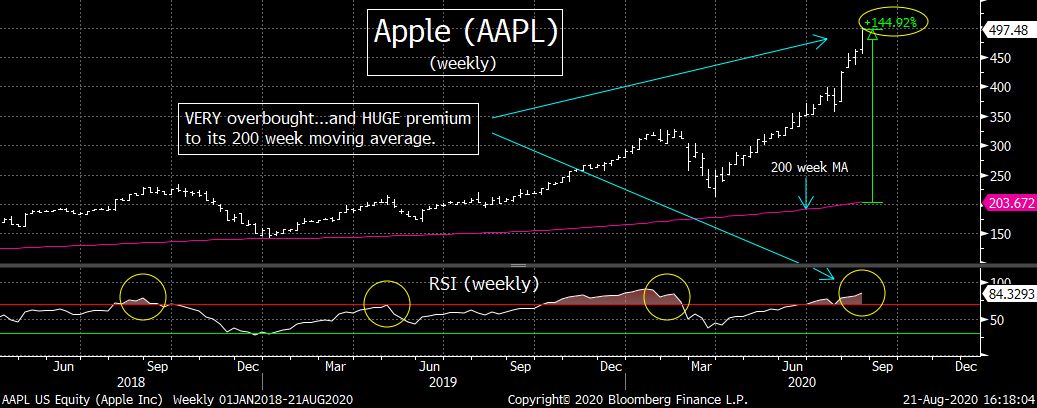

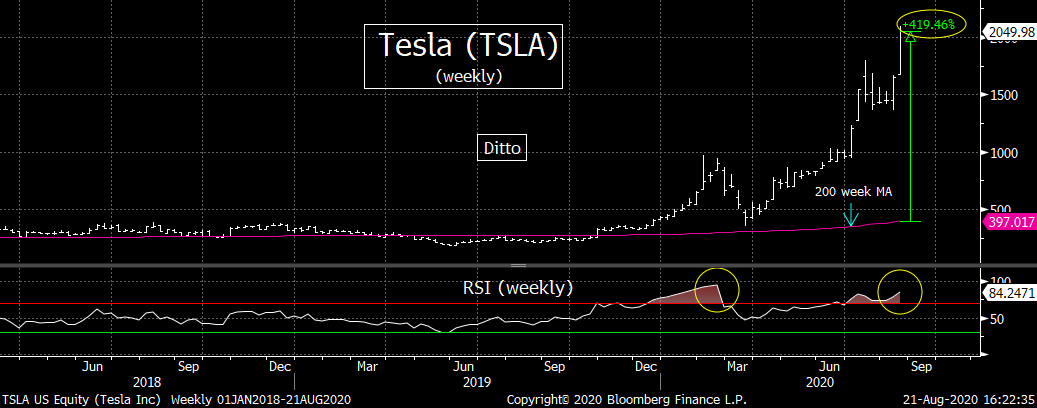

Two stocks, however, continue to really strongly...and many pundits point to them as examples of why we should all remain very bullish on the broad market right now. , but we believe they are getting out of control. These stocks are Apple (AAPL) and Tesla (TSLA)...and instead of thinking their recent action is bullish for the market, we believe they are getting out of control...and thus the action is a warning signal for the near-term potential of the stock market.

To be more specific, it’s great that many investors believe that the fundamentals will eventually justify the parabolic moves in these two stocks. That’s great, but as we have pointed out in the past, history is FILLED with examples of when stocks eventually surpassed the highs of a parabolic move...but only did so after a significant decline in between! The most obvious example is that of AMZN in 2000. It now stands more than 2900% higher than it did at the 2000 highs, BUT it still fell over 90% when the bubble burst......We do not expect AAPL and TSLA to fall 90%, but we do think they will definitely see some declines of 20%-40% in the future (especially since they have both seen those kinds of declines dozens of times). We also believe that the charts on AAPL & TSLA are telling us that they’re getting VERY ripe for significant declines very, very soon...no matter what their potential might be on a fundamental basis over the longer-term.

The weekly RSI charts on both of these names have become extremely overbought...with both moving above the 84 level! Those are not record levels for either of those names, but both readings are unquestionably extreme. Also, AAPL now trades at premium of more than 140% to its 200 week MA. The only time that reading was more extreme was in 2000. TSLA is even more exteme...as it stands at a premium of almost 420% to its 200 week MA!!!

These extremely overbought conditions do not mean that these stocks are going to fall 30%, 40% or more...but it does suggest that they have become ripe for corrections of 20%-25%. This would not be the worst thing in the world. If AAPL fell 20%, it would still be 21% above its old record highs from February!!! For TSLA, a 20% pull-back (something that it already saw once in August on an intraday basis) would still leave it a whopping 355% above its February highs!!!

What we’re saying is that a big correction in AAPL and TSLA would be normal and healthy even if they’re fundamental remain the same. However, if they did see the kind of pronounced corrections we’re expecting...especially if we see somewhat similar corrections in the other mega-cap tech names...it’s going to have an impact on the broad stock market over the near-term as well. Therefore, we strongly believe that investors need to be careful chasing these names (and the broad market) at these levels. We also think that traders should take some profits up at these levels. In other words, we believe that investors & traders alike will be able to buy these names at materially lower levels than they’re trading now...EVEN IF they eventually move a lot higher than today’s levels in the next 6-12 months.

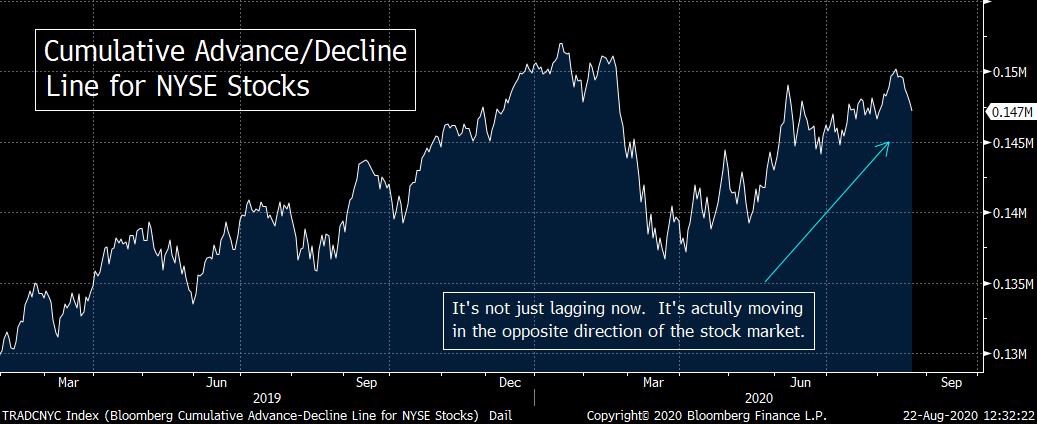

2a) We’d be remiss if we did not talk about another technical aspect of this market at this juncture: the “narrow” nature of this rally. This is something that we’ve been harping on for a while now...as have many others. However, the situation deteriorated even more last week, so we thought we’d touch-on (quickly) once again.

We had a situation last week where the stock market rallied strongly on two different days, but the breadth was actually negative. Yes, the market has hit new record highs on days with negative breadth in the past...only to rally further. However, that is a meaningless statistic. The real issue when it comes to the breadth in the stock market is that this rally has been a narrow one for many weeks now (actually several months). So the fact that it is getting even MORE narrow over the past week should be a big warning flag for everybody.

Narrow markets mean that investors only have confidence in a small number of companies...and do not have a lot of confidence in the broad economy. Eventually, the weaker economy bites these narrow number of companies and their stocks go down...OR the stocks of the small number of companies get too far ahead of their fundamentals that the fall under their own weight. Either way, “narrow” rallies almost always see significant declines at some point.

We’ll finish this point by highlighting that despite the 1.4% gain in the S&P 500 last week...and the 2.7% rise in the Nasdaq Composite (with both closing at new record all-time highs highs)....the S&P equal weight Index FELL 1.5% last week and remains 7.7% below its February record highs. Similarly, the cumulative Advance/decline line fell by 1.7%...and still stands 3.2% below its Feb highs (which is a very wide divergence for this measurement).

3) As we have said many, many times over the years, sometimes the market (any market) can move in the exact opposite direction that the fundamentals are telling you it “should” move. This tends to happen when a given market becomes overbought, over-owned and over-loved....or oversold, under-owned and over-hated. We just discussed the possibility in the case of the tech stocks getting ripe for a downside move in the first two points when it comes to the tech stocks. We’re also seeing this situation develop in the dollar and commodities...with the dollar ripe for a “tradable” rally...and commodities ripe for a “tradable” decline.

After a short-term bounce two weeks ago, the DXY dollar index rolled back over and made new lows early last week. We would usually view this “lower-low” as something that was confirming the downward trend the dollar had been in since March, BUT since several indicators had become SO extreme at that point (early last week), we called for (and are still calling for) a “tradable” bounce in the dollar...one that will last several weeks.

The first extreme we’ve seen is technical in nature...as the weekly RSI chart had reached the same extremes last week that it saw in 2017 and 2018...just before it began multi-month bounces. Second, the “positioning” on the dollar had become very extreme recently as well. For instance, Bloomberg reported last week, hedge funds are short the dollar for the first time in two years. On top of this, we’d note that the euro...which has the largest weighting in the DXY index (by far) has become extremely “over-owned!” The COT data shows that the dumb money speculators (“specs”) now have a record long position in the euro. In fact, their net position is more than 30% larger than it was in early 2018...just before the euro began a 22 month decline! Therefore, there are A LOT of people are now on one side of the boat in the currency market. They’re short the dollar and long the euro, so there doesn’t seem to be a lot of people left to push the dollar lower...or the euro higher.

On top of this, the Daily Sentiment Index (DSI) data showed that the percentage of futures traders who are bullish on the dollar fell to only 9% mid-week last week (and reached 92% bullishness for the euro). You don’t see sentiment get this extreme on any asset very often at all, so you can see that the dollar had become extremely over-hated (and the euro has become extremely over-loved) in the middle of last week.

We understand that that this goes against the fundamental backdrop for the dollar. Low interest rates, open swap lines between the Fed & other central banks, and high levels of liquidity are all reasons to think the dollar should fall further. Our point is that even if it IS going to resume its recent trend before the end of the year and fall further, it could still rally more over the coming weeks.

So to review, we believe that the extremely oversold condition in the dollar...along with the extremes we saw last week in terms of “positioning” and “sentiment” in the dollar (and the euro)...make the odds of a surprising reversal in the currency markets over the coming weeks a much more distinct possibility than the vast majority of investors realize right now.

Therefore, as we all continue to watch how things playout in the fiscal-plan negotiations...in the political conventions...in the tensions between the U.S. and China...we should also still keep a VERY close eye on the currency markets. Their next move may not playout the way most people think they will. If that’s the case, it could create a big jump in volatility in many different markets!

4) If we do indeed see a “tradable” reversal in the currency market over the coming weeks, it should have an impact on other markets as well. First of all, a lot of people have been pointing at the weaker dollar as a reason for the further rally in the U.S. stock market over the summer months. So any meaningful bounce in the dollar (& drop in the euro) could case domestic stocks to correct.

However, we readily admit that there have been plenty of examples in the past when the stock market rallied at the same time the dollar was bouncing, so it is not a lock that stocks will correct if the dollar bounces. HOWEVER, the correlation between the dollar and other asset classes (like commodities and emerging markets...which is an inverse correlation) is very, very strong one. Therefore, traders need to be VERY careful about buying commodities and EM’s on a short-term basis. In fact, those short-term players should consider taking some profits in these asset classes. As for longer-term investors, they should avoid chasing these asset classes...and look to buy them at lower levels down the road...after they pull-back in reaction to a rally in the dollar.

On top of our call for a tradable bounce in the dollar, we’d note that both the CRB commodity Index and the EEM emerging market ETF are getting quite overbought, so they were getting ripe for a pull-back on a technical basis anyway. For instance, the daily RSI chart on the CRB is getting extended...and this is taking place at a time when the CRB is testing its 200 DMA. Therefore, this would be a perfect place for commodities to see a pull-back...even if they are headed higher over the longer-term.......Similarly, the weekly RSI chart on the EEM is reaching a level that has been followed by pull-backs over the past several years, so it is getting ripe for (at least) a breather as well.

We are definitely bullish on these asset classes over the longer-term...and ESPECIALLY bullish on commodities. However, we’ve done this long enough to know that even when an asset class is seeing a major change in its long-term trend (like the commodity markets are), it does not happen in a straight line. When too many people move to one side of the boat, short-term reversals can and do take place...and when we say, “short-term,” we’re talking about “tradable” reversals...not just ones that last for 2-3 days. We believe that this is what we’re seeing right now in the currency markets, so we STRONGLY believe that investors should look for a bit of a change in the movement in the currency, commodity and emerging markets over the coming weeks.

4a) Within the commodity sector, lumber looks particularly vulnerable at these levels as well in our opinion...as its more than 200% rally since the April lows has gone parabolic over the last month. This has taken its daily RSI chart above 90 and its weekly RSI chart above 86! That’s the most overbought condition lumber has EVER reached!!! That’s right, our charts go back to 1984...and we cannot find another time when lumber was as overbought based on this weeky RSI reading!.....On top of that, this commodity also stands at a 92.5% premium to its 200 week moving average. You have to go all the way back to 1993 to see a bigger premium! So there’s no question that lumber is becoming very, very extended.

We understand why lumber prices have been rallying...and we have been bullish on the commodity (and housing) for quite a while. However, it has reached the kind of nose-bleed levels that make it very, very tough to rally any further over the near-term. (The housing stocks are getting overbought as well, but they have not reached the kinds of extremes that lumber has. Therefore, we would not be surprised if the housing stocks...and their ETFs...saw a pull-back soon, BUT the decline should not be as substantial as it will be for lumber. In other words, lumber has become SO overbought on a near-term basis that it can fall in a pronounced way without clobbering the home construction stocks in a similar manner.)

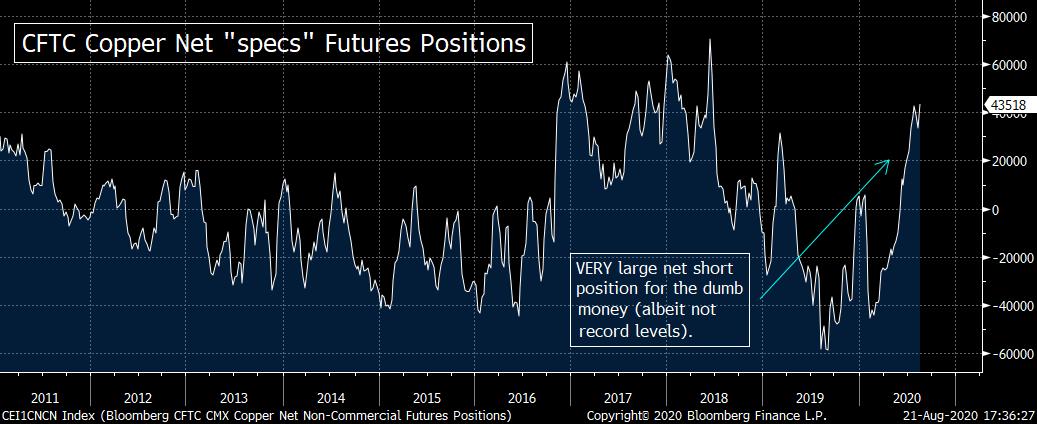

We’d also reiterate that we believe gold and copper had become very overbought and quite over-owned as well. Therefore, we look for those commodities to trade lower over the coming weeks as well. (COT charts on gold & copper are provided below.)

We DO want to reiterate that we are quite bullish on the commodity asset class on a longer-term basis. We just believe that the technical condition of the currency market and for many commodities...as well as the “positioning” and “sentiment” readings for both asset classes...have become so extreme that we will see the kind of reversals in these markets that will last several weeks (and therefore will become “tradable” moves).

5) Let’s go back to the tech stocks...but talk about the important names OUTSIDE of the FAAMG names that everyone is focused on right now......As one pundit who we respect greatly mentioned last week, the tech rally seems impossible to kill. That sure seems to be true, but we also have to realize that not only are several of the mega-cap tech names leveling off, but so is the rest of the group (especially two large-cap names that are not included in the FAAMG group). So even though the rally is not dying yet, it is still showing some cracks.

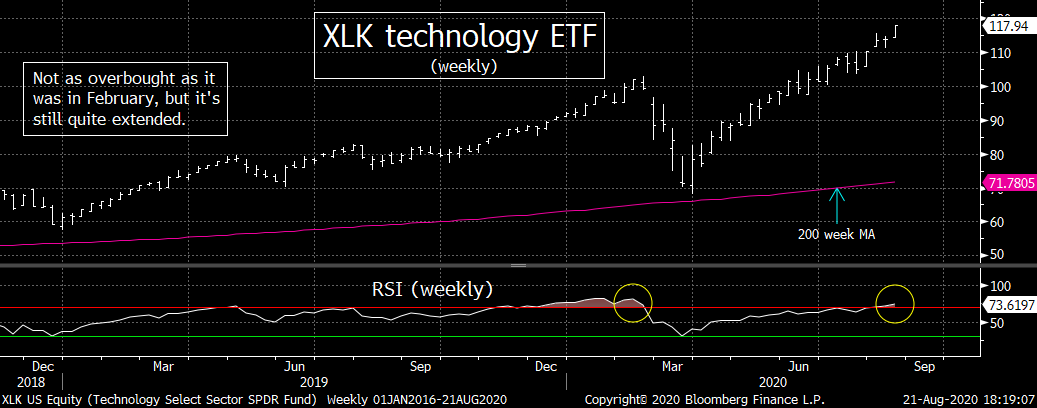

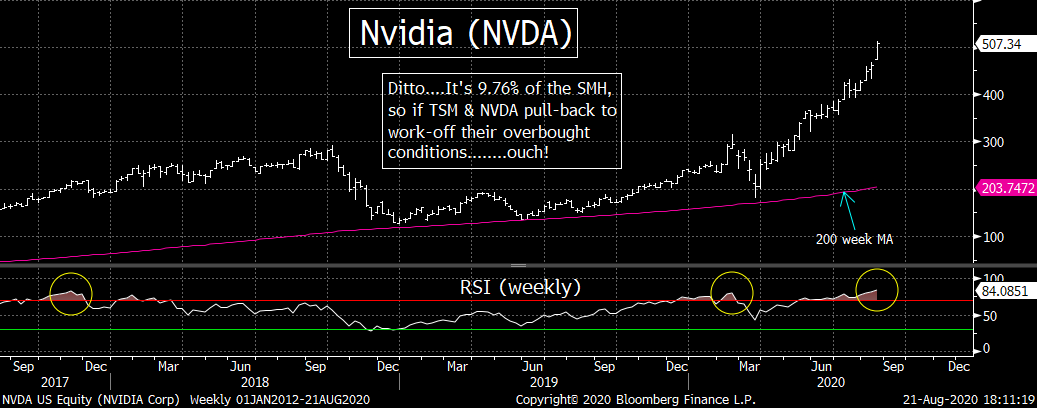

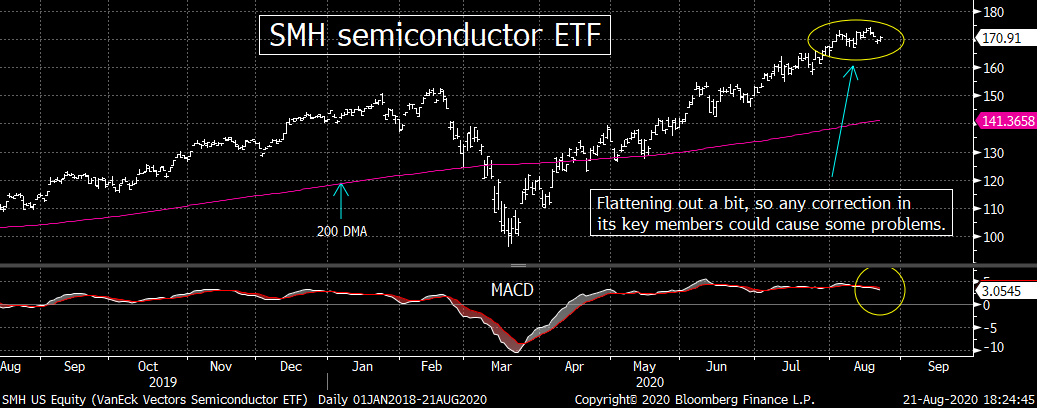

Just look at the montly moves in the XLK technology ETF. It rallied 13.4% in April...and that has been followed by rallies of 7.2%, 6.7%, 5.7% & 4.7% in May, June, July and so far in August. This might seem to be a very mild “flattening out” of this rally in the XLK, but when you take away the first day of trading in August, the rally so far this month has only been 2.4!......Don’t get us wrong, a 2.4% monthly gain is still be a 28.8% gain if it is annualized, but it definitely shows that the the rally in the broad tech group has flattened out over the past few weeks......The exact same development is taking place in the chip stocks...as the SMH semiconductor ETF has flattened out even more. After a 14.2% rally in April, it then rallied 5.5% in May, 8.4% in June, 8.8% in July...BUT only 1.3% so far in August (and that includes the first day of trading this month).

Another high-flying tech stock that flattened out significantly over the last month has been Taiwan Semiconductor (TSM). After reporting earnings in July, it rallied further...in a parabolic manner (rising 24% in just a few days). This really pushed TSM to a very overbought condition...with its weekly RSI reaching levels that have been followed by material pull-backs in the past. The stock did give some of its gains back last week...so if it sees any more weakness going forward, it would not be good for the stock on a technical basis.

It would not be good for the SMH either...as TSM is more than 14% of the chip ETF. We’d also note that Nvidia (NVDA) is also becoming VERY overbought...with a reading above 84 on its weekly RSI chart!!!!......TSM & NVDA make up 23.7% of the SMH, so if they roll-over in any material fashion...even if it’s only for technical reasons (to work-off their extremely overbought conditions), it’s going to weigh heavily on the SMH (by definition). In other words, we have to add TSM and NVDA to the list of big-cap tech names to keep a close eye on over the coming weeks. MANY of them are getting ripe for meaningful pull-backs.

6) One theme we keep harping on is our belief that the odds are high that we’

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member