By the time we reached midday yesterday…and the stock market was up 10% from last Friday’s close…it seemed like the bullish talk within the market place had begun to grow. In other words, the number of people who (like us) were calling for a retest or undercut of the March lows seemed to be shrinking. That said, that cautious stance is still quite prevalent around the Street, so if there was one thing that concerns us about our stance on the stock market…it is that it was not a contrarian call.

Back in January and the first half of February…and then again two weeks ago…we were in tiny minority in our stance on the stock market. In January & February, we were one of the few calling for significant pull-back in the stock market…and then two weeks ago, we were pretty much all by ourselves in calling for a strong bounce. Therefore, we felt a bit more comfortable with our stance on the market on both of those occasions. With many others still looking for a retest, it makes us a little nervous about our present cautious stance.

That said, yesterday’s action did raise questions about the viability of the most recent bounce in the stock market….as the morning rally in the failed…and the S&P 500 index closed a 3.6% below its morning highs (and moved slightly into negative territory by the end of the day). The main culprit for the decline was the 8% reversal (lower) in crude oil. WTI closed more than 11% below its own morning highs and finished the day 9% below Monday’s close. When you combine the first two days of trading in crude oil, it shows that the black gold had fallen almost 17% in two days (before bouncing-back slightly this morning). So as you can see, the stock market is not moving tick-for-tick with the price of oil…as it has done on occasion over the years…BUT stocks are certainly paying attention to the price of this key commodity.

However, the coronavirus…and the long-term impact this healthcare crisis could have on our economy…is still obviously the number one issue for investors. Of course, a large part of the movement in crude oil will also be determined by the coronavirus due to demand issues, but OPEC+ issue will also play a role. Therefore, healthcare crisis will certainly be THE focus.

At some point, however, the focus will morph from the “curve” of the virus…to the intermediate and long-term “impact” COVID-19 will have on the economy. If the stock market was still flat on its back right now and sitting at/near its lows for this move, all we would need to see is an improvement in rate of new cases and deaths to help the stock market rally. However, since the stock market has bounced almost 20% off of those lows, the focus is going to start to shift at some point towards the longer-term impact of the healthcare crisis. In other words, when trying to figure out how much more the stock market can bounce on a longer-term basis, investors are going to have to decide if the economy…and more importantly earnings (which were flat last year)…are going to rebound strongly enough and fast enough to enable the stock market to rally back towards its old highs.

In other words, a flattening of the coronavirus “curve” will only be enough to help the stock market bounce. It will take a strong and sustainable improvement in earnings to enable the stock market to rally a lot more than it already has. Yes, when this healthcare crisis recedes, it’s going to be very positive on many, many levels. However, in order to determine how much of an impact it will have on the markets, we’re going to have to figure out how much of a lasting impact it will have on fundamental growth. This is especially true given that the stock market has already seen a very strong bounce.

Anyway, it’s going to take some time before we get a better idea of the intermediate-to-long-term picture on the future growth of GDP and earnings. (In fact, it’s going to take some time before we know when the coronavirus has begun to subside in a lasting way.) Therefore, it’s a pretty good bet that we’ll continue to see an elevated level of volatility in many different markets going forwards…even if they’re not as wildly volatile as they were in mid-March.

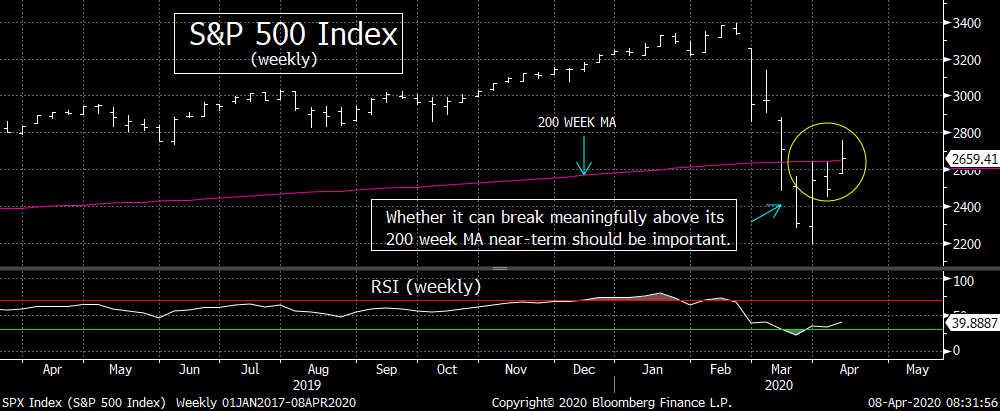

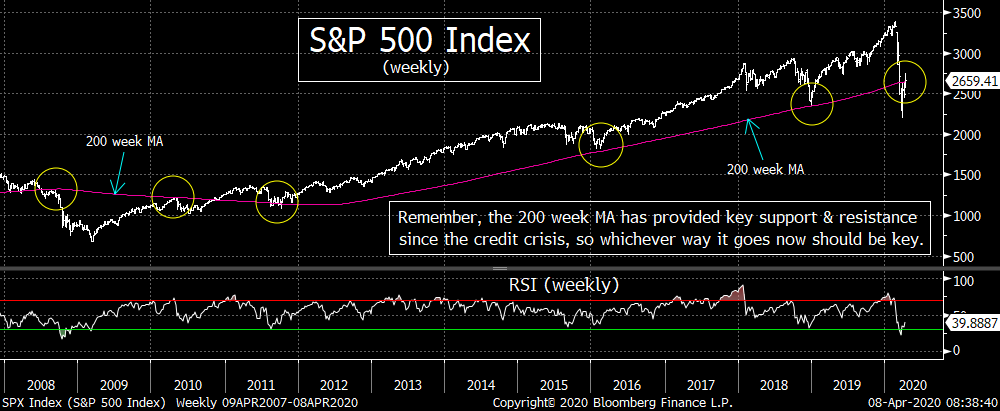

With this in mind, we thought we’d look at the technical picture of the S&P 500 on a very short-term basis. It’s becoming more and more evident that the 200 week MA on the S&P 500 index is quite important. (Remember, that line has been VERY important ever since the credit crisis. It provided strong resistance in 2008 and 2010…and once it was broken to the upside, it then provided EXCELLENT support during the rest of the great bull market of the past 10 years…bouncing strongly off of it in 2011, 2016 and 2018.)

So the 200 week MA has shifted once again…after it was broken to the downside in the first quarter. That “old support” level has become the key “new resistance” level. The stock market got RIGHT UP to that line in each of the previous two weeks, but pulled-back each time. This week, the SPX has closed very slightly above that line on both days so far, but it hasn’t been able to pull away from it. In fact, yesterday’s failure to do so was pretty concerning.

Having said this, sometimes it takes several attempts before a key resistance level is broken to the upside. (The same is true for key support levels to the downside.) Therefore, if the stock market can see some upside follow-through at some point this week…upside follow-through that HOLDS…it should be quite positive on a short-term basis.

As we said yesterday, bear markets rallies frequently retrace 50% of their initial declines before they roll-over. Therefore, even if we eventually see a retest or undercut of the March lows at some point down the road, the S&P could still rally above 2800 before it ends. However, if this morning’s rally in the futures does not hold again…and if (repeat, IF) we see a significant drop below that 200 week MA (of 2648) at some point soon…it will raise concerns in our minds that this near term rally has run out of gas……….So on a technical basis, we’ll be watching that 2648 level very closely over the rest of this week.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member