AAPL announced last night that they will miss their quarterly revenue target due to the coronavirus…and that “it will be a slower return to normal” as well……..The decline in AAPL is not a disaster…as it is trading only 3% lower. No, -3% is not a small decline, but that’s not a lot given the fact that AAPL has rallied over 125% over the past 14 months. (A decline of 3% is also not a lot compared to the drop we’ve seen in several other stocks after they reported negative news recently.)

We do need to point out, however, that AAPL has actually slightly underperformed over the past month. That would probably surprise most people. It’s 2.5% rise is a bit less than the 3% rise in the S&P…and well behind some of the other high flying names that AAPL had been leading for most of last year. For instance, MSFT is +15% over the last month, NVDA is +16%, AMZN is +14%, GOOGL +7%. We’d also note that the NDX Nasdaq 100 is up 6% over the past month as well……....Again, AAPL’s recent action has not been horrible at all, but its trajectory has certainly flattened out. This has to be at least a little bit disappointing…given that in the middle of its range-bound trading of the last month, they released one of their best earnings report EVER!

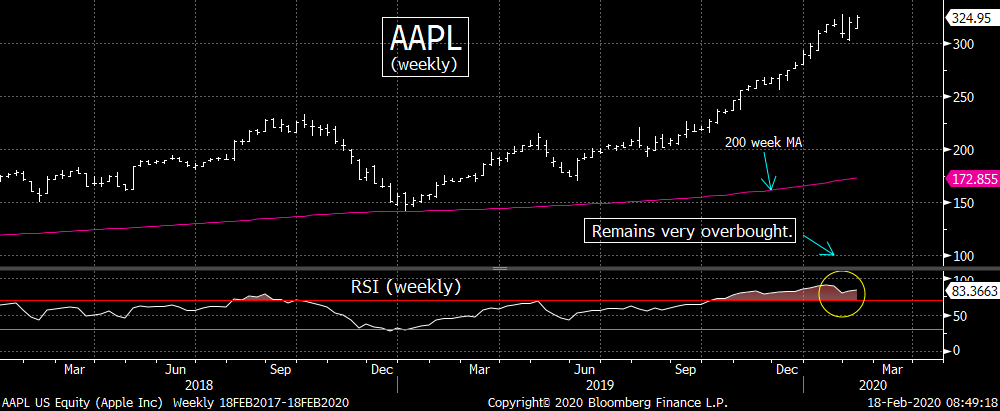

In other words, sometimes even the best companies become extended vs. their fundamentals…and/or become overbought on a technical basis. Therefore, even though they continue to be GREAT companies, their stocks can sometimes see an outsized decline (a correction). That might not happen to AAPL right now, but there is no question that AAPL’s multiple is much higher than its 5 year average. (It now trades at 25x earnings vs. its 5-year average of 16x). We’d also note that its weekly RSI chart remains very overbought…despite its relatively sideways action of the past month. That weekly RSI is still well above 80!!! No, that’s not as high as it was in late January…when it reached 89…but it’s still very high and shows that AAPL is still very overbought on an intermediate-term basis.

Again, the fact that it is overvalued on an historical basis and remains quite overbought does not mean that the stock is going to see a strong decline over the coming days and weeks. On the fundamental side, its earnings could play catch-up over time…and/or the stock’ acceptable multiple could be re-assessed to a higher level……On the technical side, the stock could work-off its overbought condition by trading in a sideways range for an extended period of time (something it has already been doing in recent weeks).

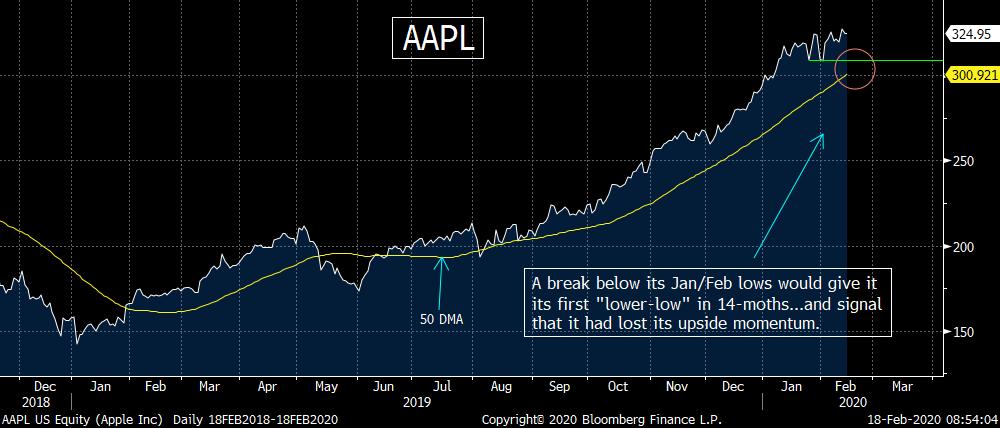

However, there will be some key levels to watch on AAPL…which, if broken, would signal that the stock is going to work-off its overbought condition by declining…not by continuing to move within a sideways range. The first level comes-in just below $310…at the $308.50 level. That was the closing lows from both January and February…and it is also where the 50 DMA comes-in. Thus any meaningful move below that level will send up a big yellow warning flag on the stock. (Again, it would send up a warning flag on the STOCK, not the COMPANY. As we said above, sometimes the stock of a great companies can decline in significant way…especially after the stock becomes extended by several measures.)

A meaningful decline below that 308.50 level would leave it vulnerable to a drop down towards the 250 level. (Just above that level…at 256.50…would give it a Fibonacci retracement of 38.2% of its huge rally of the past 14 months…AND it would take it down to its trend-line from the lows at the beginning of that rally. That kind of drop would give AAPL a 20% decline…which probably sounds pretty extreme to most people…and therefore make people think that this kind of decline is unlikely. However, during its 1,000% rally over the last two years of the tech bubble, AAPL saw SEVEN declines of about 20% or more. So a severe decline CAN take place…even if AAPL is going to rally a lot further in the years ahead.

HOWEVER, it is important to highlight that we are NOT saying that if AAPL breaks below $308.50, it will PROBABLY drop down towards $250! We merely saying that a break below that level WILL be a sign that AAPL has lost its upward momentum…and that the stock would become very vulnerable to an outsized decline. That “outsized decline” could take it as low as $256ish, but that kind of big drop is far from guaranteed.

What is really interesting about this situation…is that even a 20% decline like that would not do any technical damage to AAPL’s long-term chart! It would leave the stock well above its old highs from 2018 (of $233) and would keep it above its trend-line from that all-important low from 14 months ago. Therefore, as scary as this kind of decline will be (if…repeat, IF…it takes place)…it really won’t be particularly negative for the stock on a long-term technical basis.

Again, we also readily admit that a break below $308.50 does NOT guarantee that the stock will fall all the way down towards the $250 level by any means. However, a meaningful break of that level should still raise some serious warning flags…and also raise the odds (considerably) that the stock will still see a correction of 10% or more…even if it doesn’t fall the complete 20% we just highlighted in the above scenario. Yes, a 10% correction will be a little bit scary as well…but it will actually be quite normal…and Apple Inc will still be a great company if something like that does indeed takes place. (3 charts below.)

To receive insights like these on a daily basis...and to get my weekend piece ("The Weekly Top 10"), please click here to subscribe to "The Maley Report" (TheMaleyReport.com).

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member