06/13/17

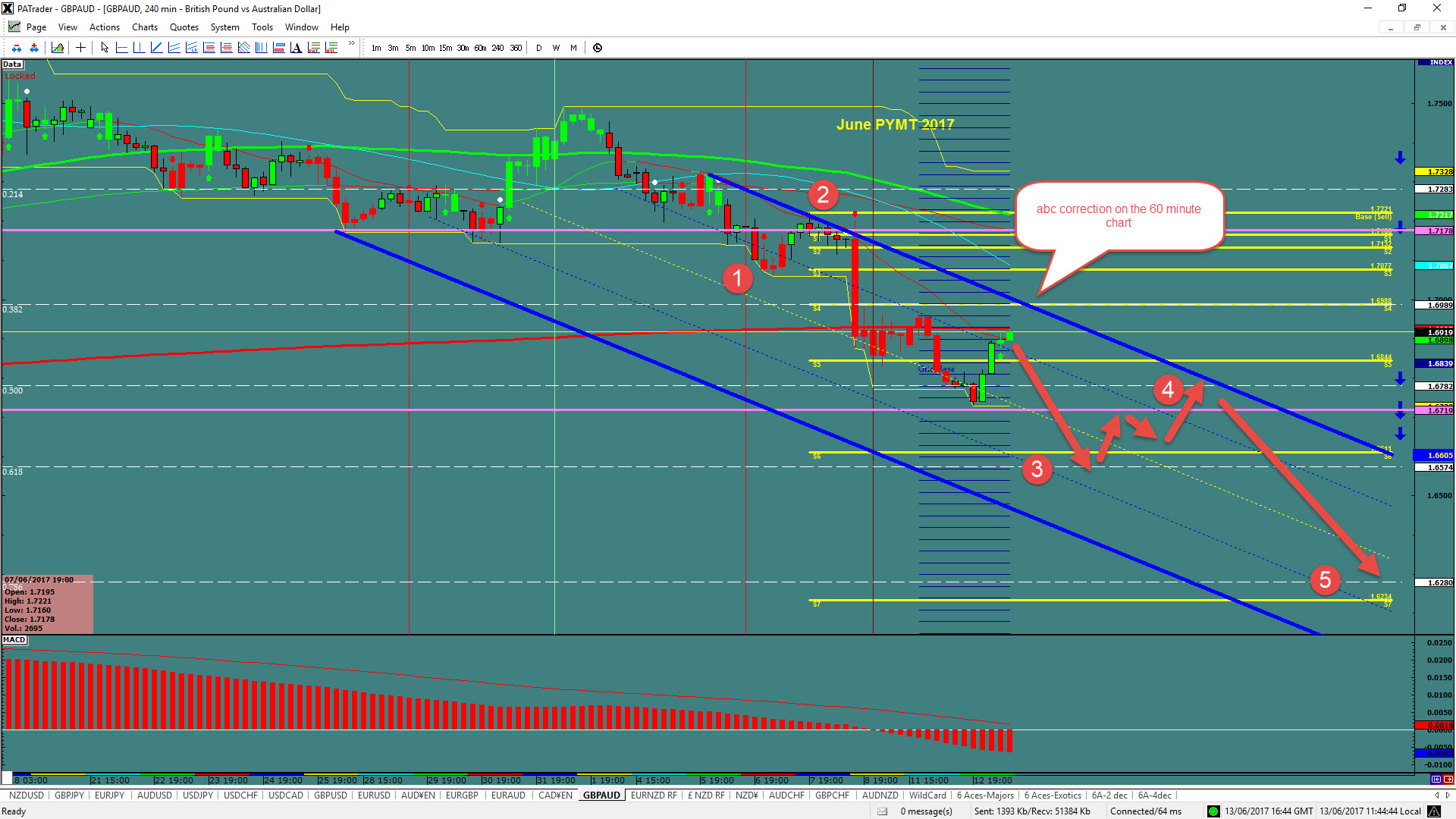

GBPAUD

We see that we are still in a 3rd wave to the downside and are waiting to finish this correction and then resume the move to the downside. The overall target from here is 682 Pips away @ the S7 (1.6234). The 4th wave could be 150 pips or so which would add that to the total if caught at the top.

How to trade it? You will need to wait for your set-up to show up, for London & New York traders, that will mean waiting for the reaction now in the current area. Take your first entry and use the respective risk reward ratio to start trading this currency pair. We have preplaced entry orders (sell stops) on the break of each Fib and barrier to the downside and any rally should be considered an area to add to the position. DO NOT TRY AND CROWD THIS PAIR WITH TIGHT STOPS. Remember the “pullback is your friend” in route so use those to add to the position.

Be careful at the 0.618 Fibo @ 1.6605 since that may be a bounce point to pullback and go up.

The pair typically has pullbacks in the 180 pips range so every pullback could add an additional 180 pips to the trade with another position. Currently the ATR (14 Day - Average True Range) of the currency is 183 Pips per day, so this might take about 2 weeks with pullbacks!

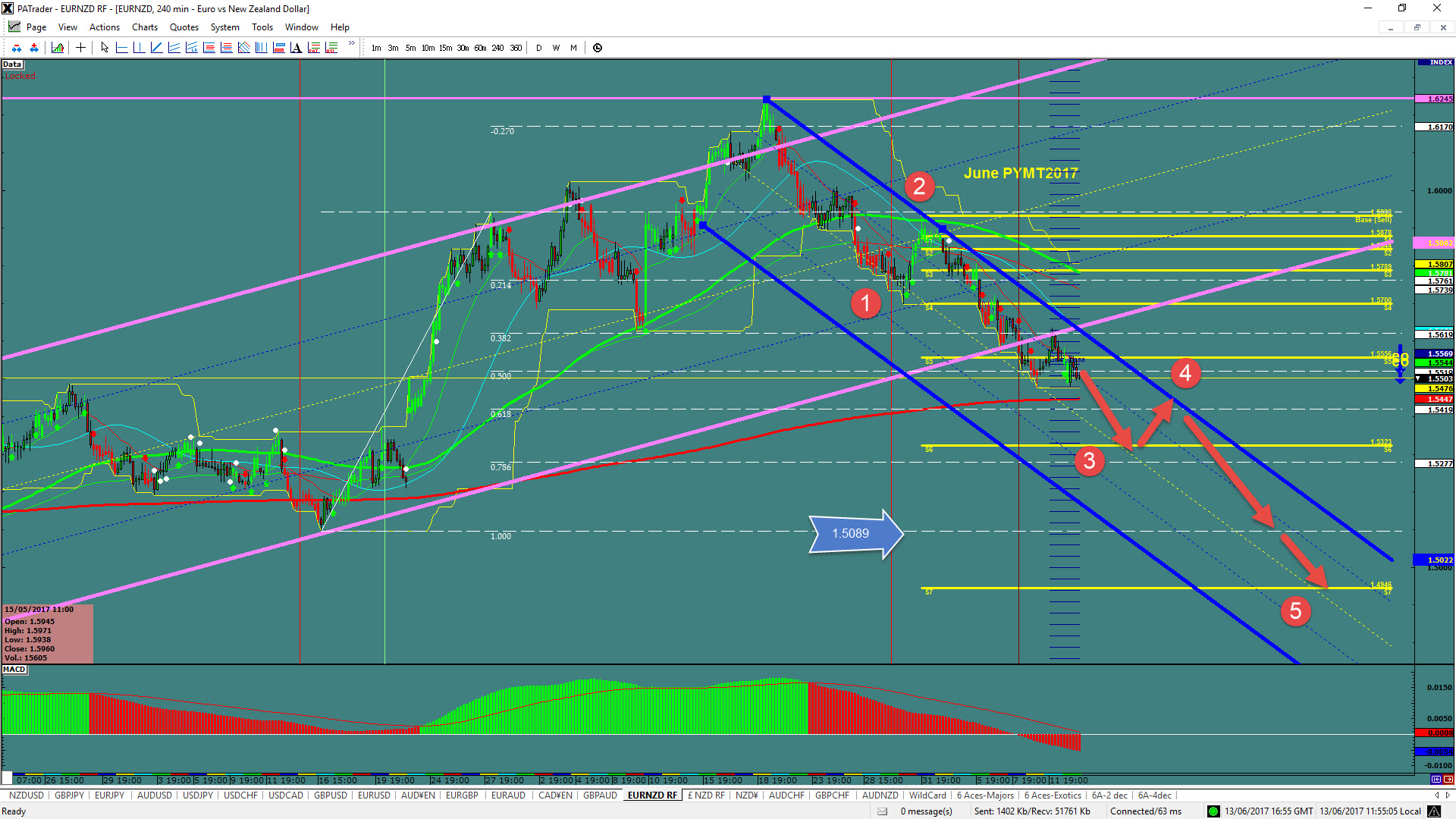

EURNZD

We see that we are still in a 3rd wave to the downside and are targeting the 0.786 Fibo @ 1.5277 as the target for the 4th wave bounce. The overall target from here is 557 Pips away @ the S7 (1.4946). The 4th wave could be 150 pips or so which would add that to the total if caught at the top.

How to trade it? You will need to wait for your set-up to show up, for London & New York traders, that will mean waiting for the reaction now in the current area. Take your first entry and use the respective risk reward ratio to start trading this currency pair. We have preplaced entry orders (sell stops) on the break of each Fib and barrier to the downside and any rally should be considered an area to add to the position. DO NOT TRY AND CROWD THIS PAIR WITH TIGHT STOPS. Remember the “pullback is your friend” in route so use those to add to the position.

Be careful at the 0.786 Fibo @ 1.6605 and also the 1.5089 area since these may be bounce points to pullback and go up.

The pair typically has pullbacks in the 150 pips range so every pullback could add an additional 150 pips to the trade with another position. Currently the ATR (14 Day - Average True Range) of the currency is 124 Pips per day, so this might take about 2 weeks with pullbacks!

++++++++++++++++++++++++++++

Our trading methodology is based on proprietary technical indicators. We pay attention to what the big banks are doing in the markets (the Big Boys) and specifically look for opportunities that have a high opportunity and low risk. We always identify our target before entering a trade, and we focus on the risk of the trade instead of the reward. We have (and follow) rules, and we press our winning trades without exception.

Remember that we recommend that you always trade with stops. And if you don't trust yourself or think you'll get cold feet in a long trade like this, then place the trade and walk away. Better to get taken out by a stop or target than to second guess an active trade and take yourself out. Do your research before you place your own trade. Trust your research.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recent free content from Pro Act Traders

-

USD/JPY – Bears taking control

— 1/09/25

USD/JPY – Bears taking control

— 1/09/25

-

CHF/JPY – Big channel underway

— 1/08/25

CHF/JPY – Big channel underway

— 1/08/25

-

GBP/USD – to the top of the box

— 1/07/25

GBP/USD – to the top of the box

— 1/07/25

-

GBP/AUD – Bear run next

— 1/06/25

GBP/AUD – Bear run next

— 1/06/25

-

CHF/JPY – in position to do a down run

— 1/02/25

CHF/JPY – in position to do a down run

— 1/02/25

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member