Overview

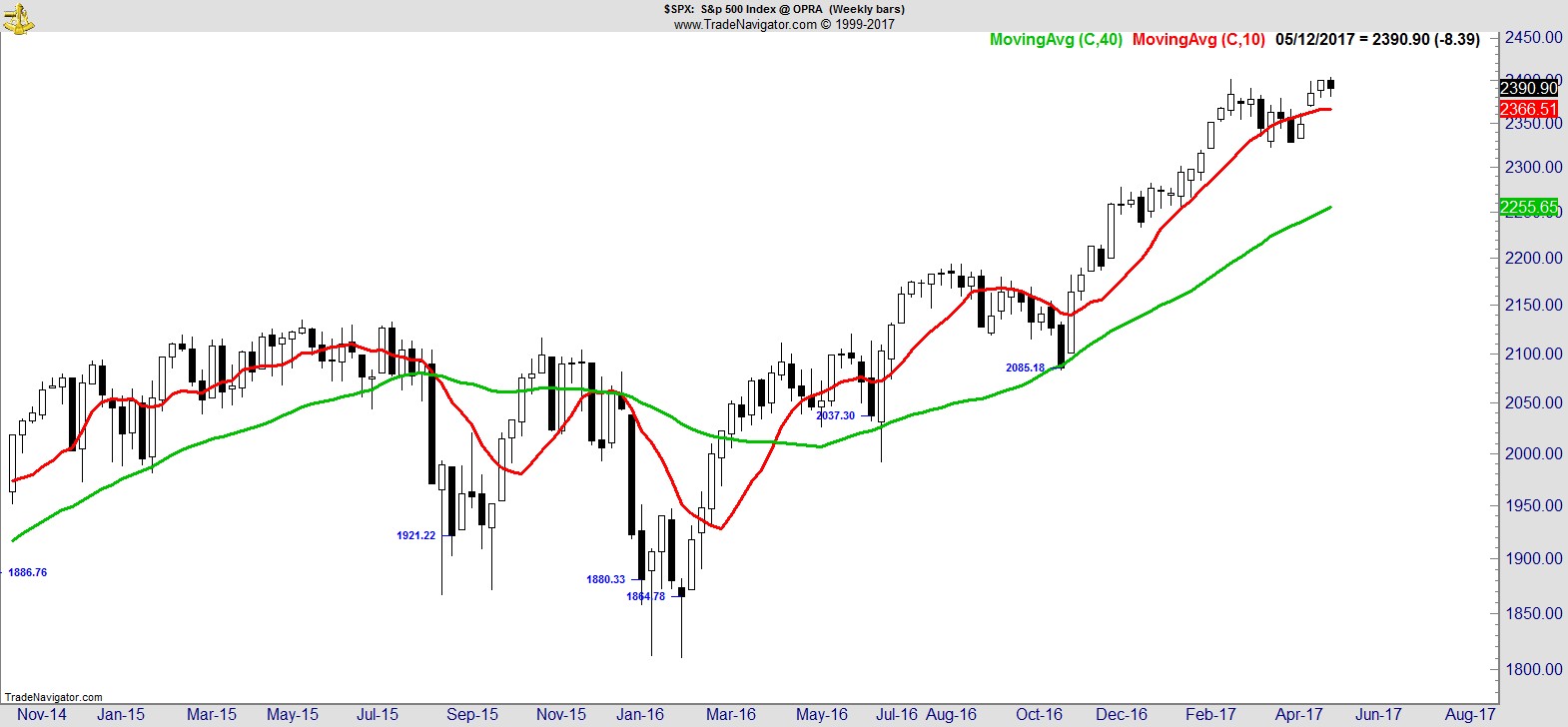

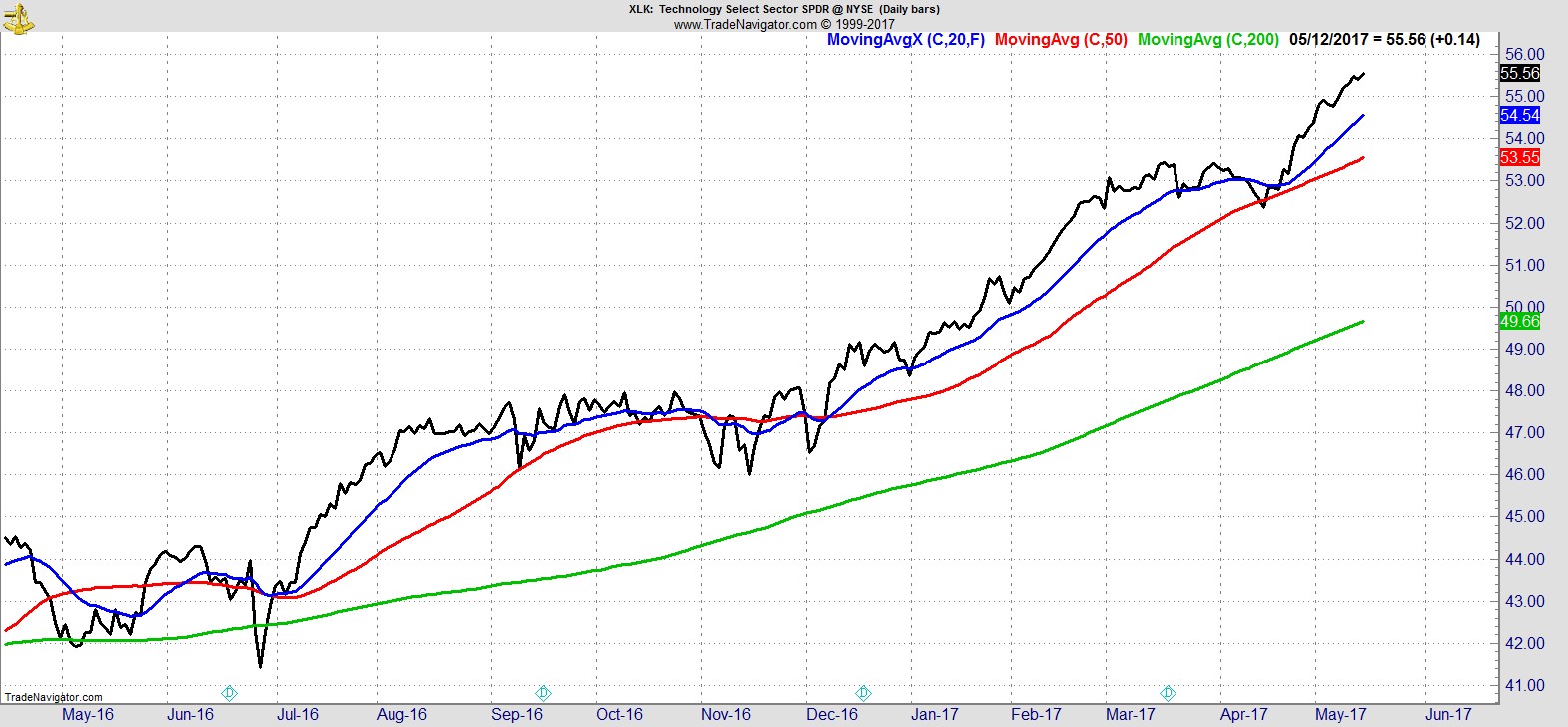

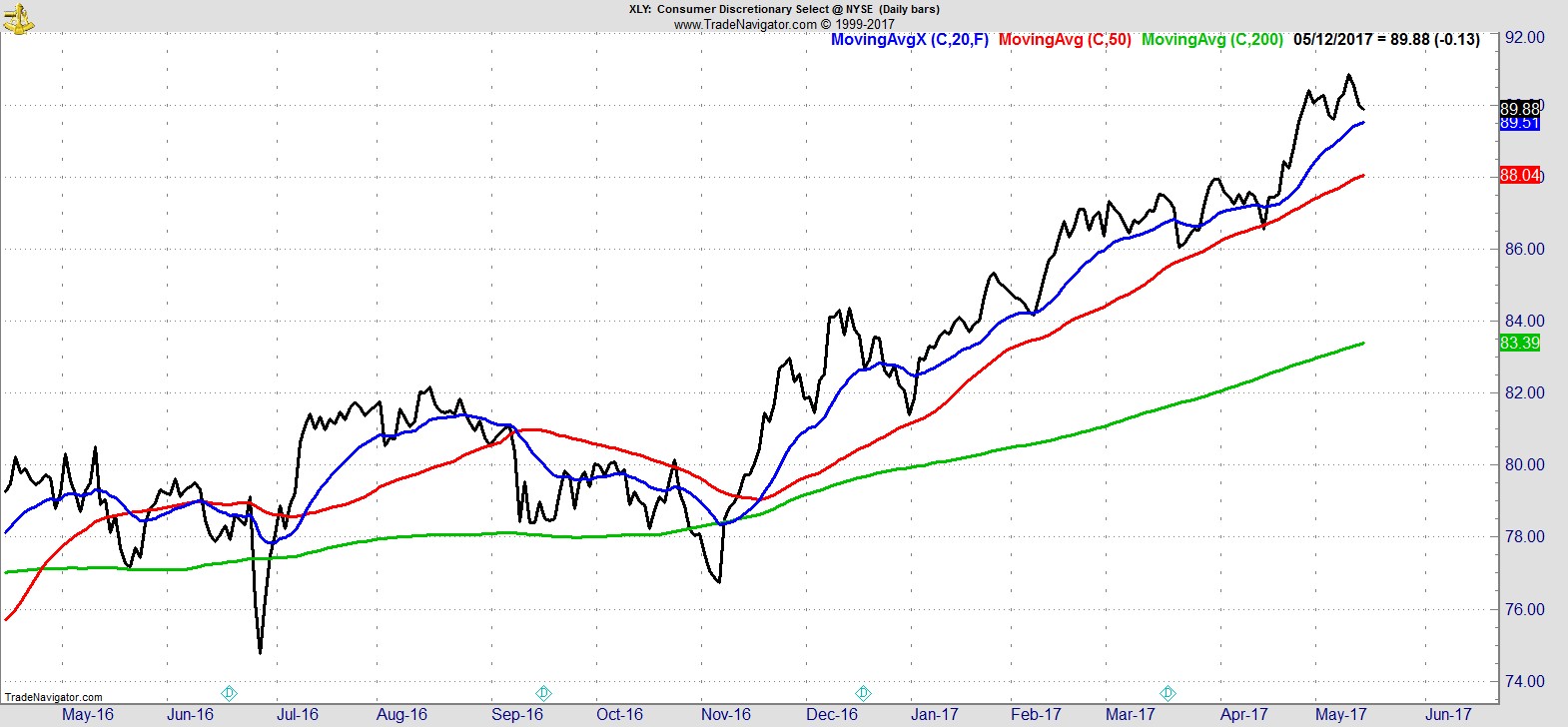

The S&P edged to fresh all time highs but finished modestly lower on the week. Technology, and Consumer Discretionary sectors continue to lead, despite the weakness in specific retailers. Breadth has deteriorated slightly, but bullish sentiment has declined too, with most investors declaring themselves 'neutral'.

Here's the S&P on a daily and weekly:-

.

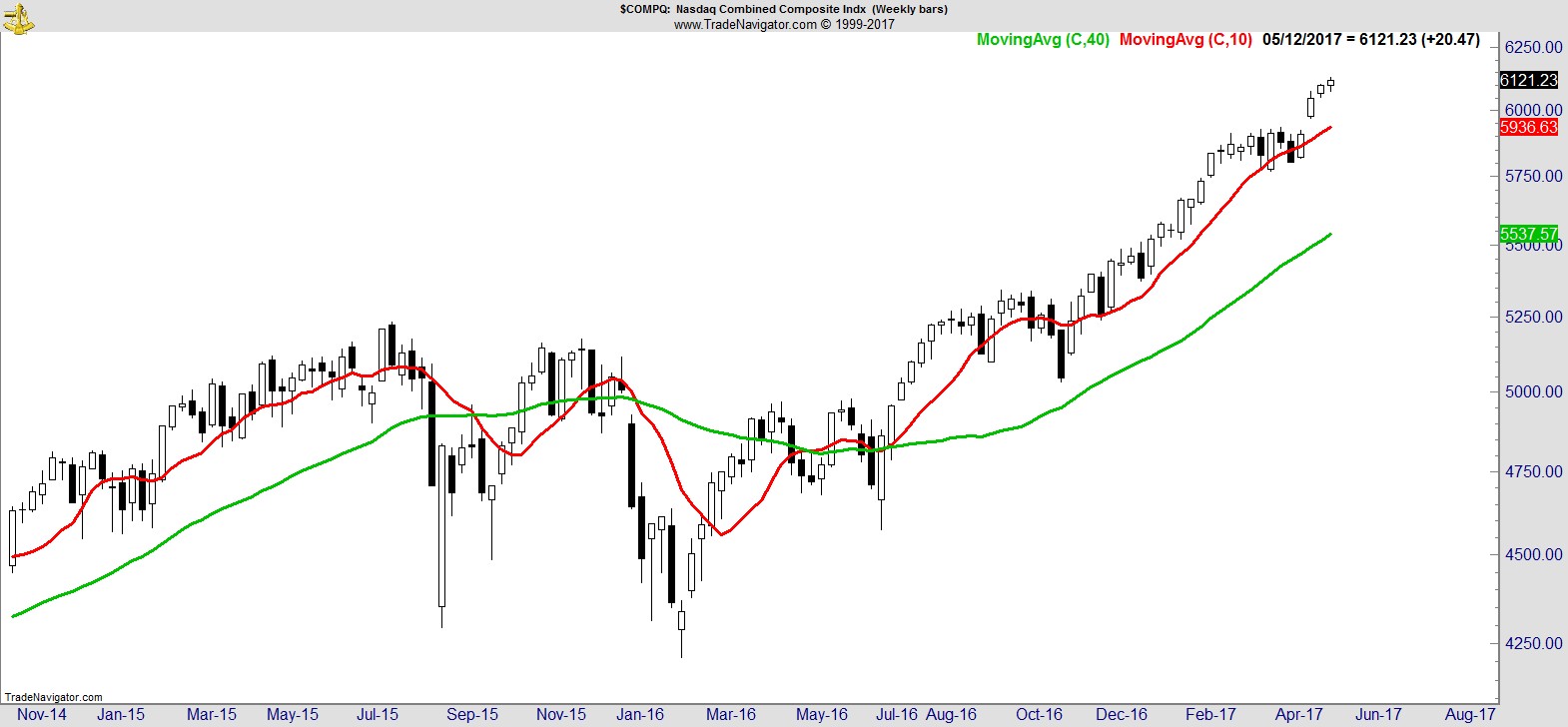

The NASDAQ posted its third straight all time high close on the weekly:-

.

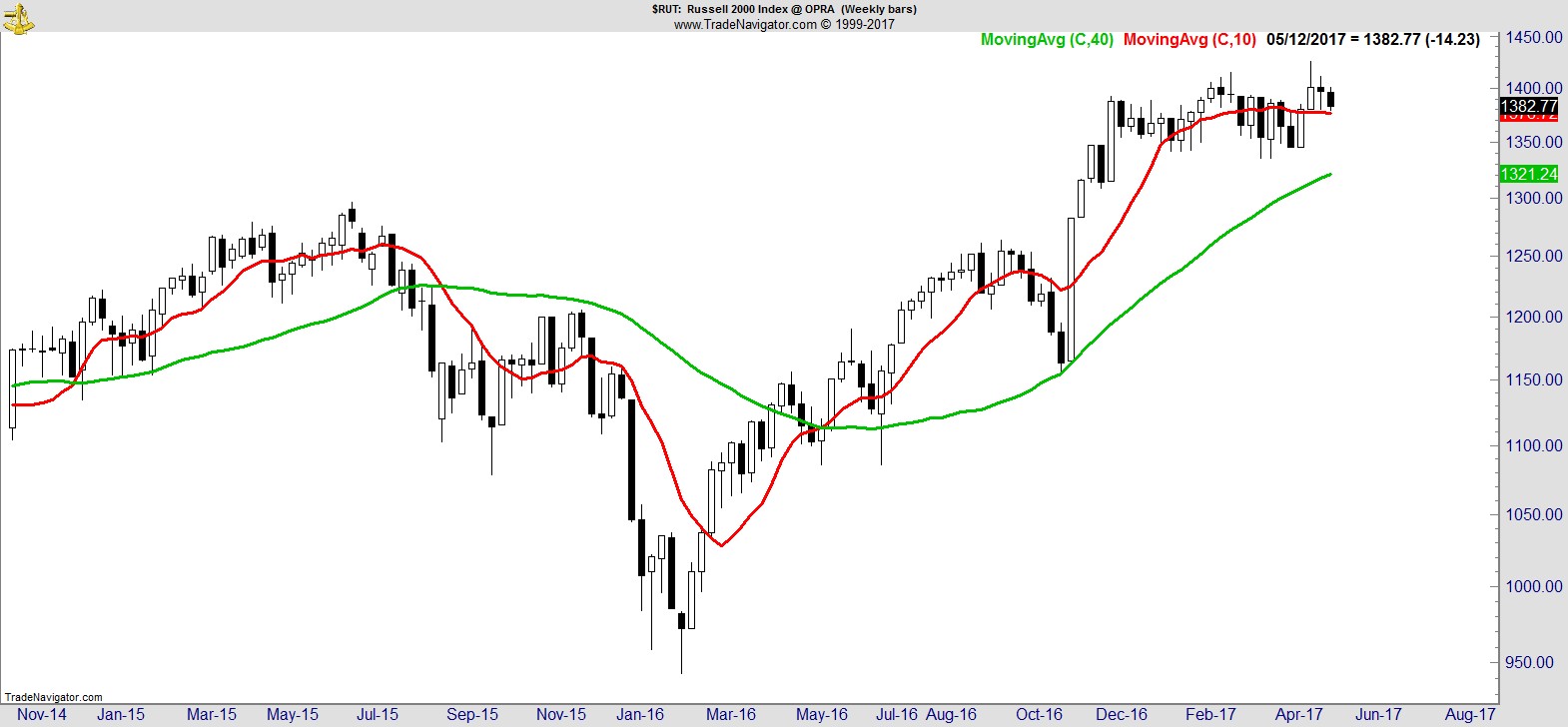

The Russell pulled back from its recent highs for a second straight week but remains above its 10-wk MA for now.

.

The Dow Transports is struggling to maintain any upward momentum and continues to toy with its 10-wk MA.

.

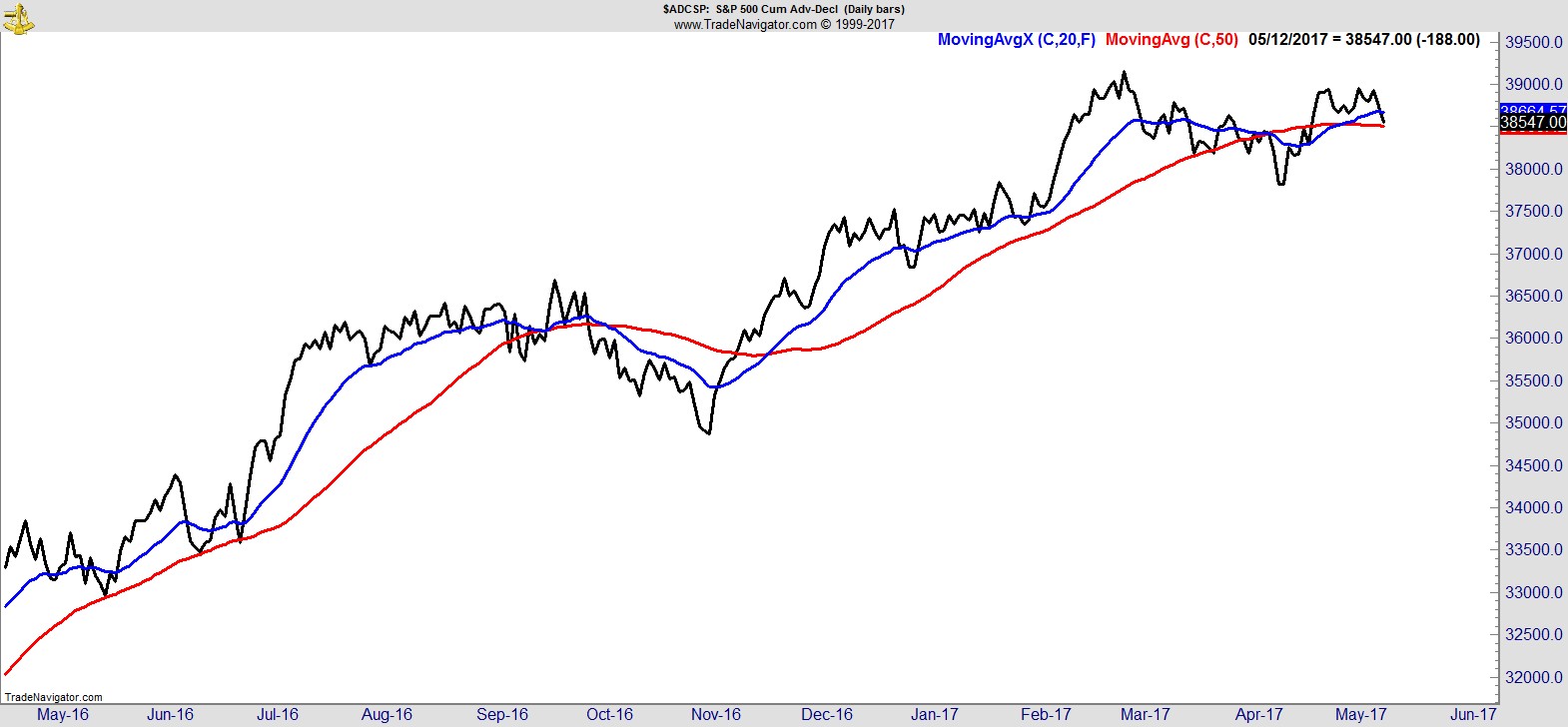

Breadth for the S&P 500 edged lower but remains in good condition overall.

The AAII survey is just one measure of sentiment but I find it remarkable that while the market is making new all time highs, bullish sentiment dropped 5.3 to 32.7% this week, while 'Neutral' jumped 5.1 to 37.1%. The overall impression I get is that many market participants are invested, but cautiously so, and far from being euphoric or complacent, many continue to be pre-occupied with anticipating when a correction will come.

.

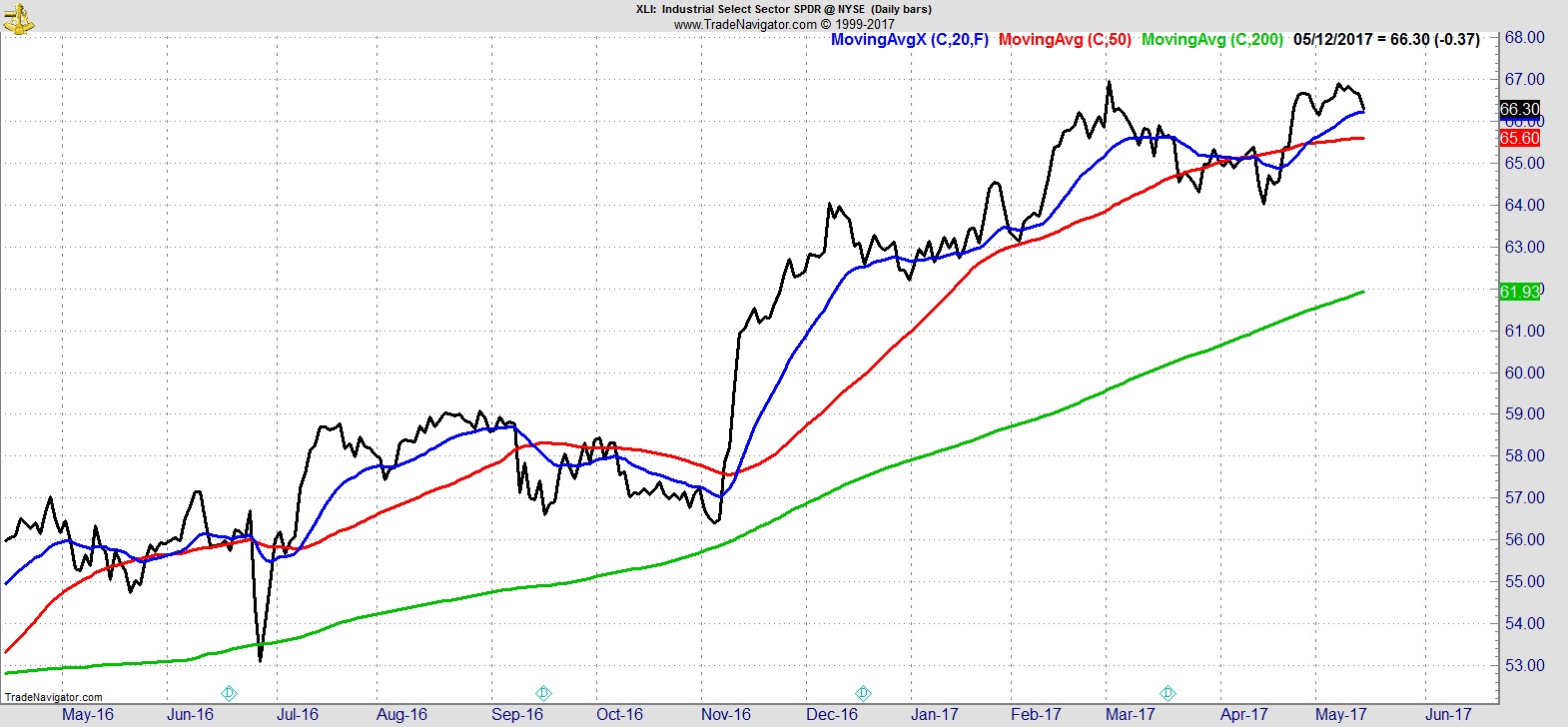

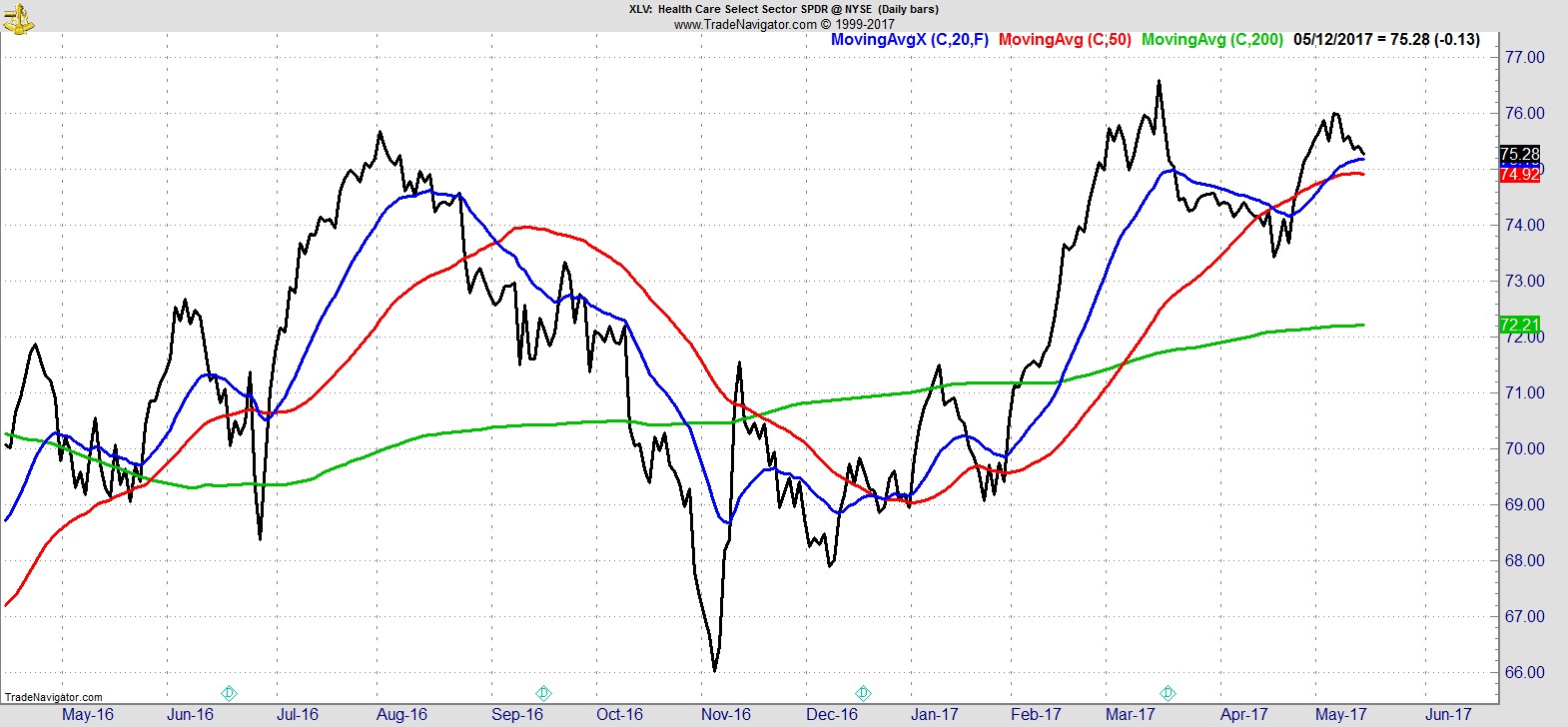

Sector Analysis

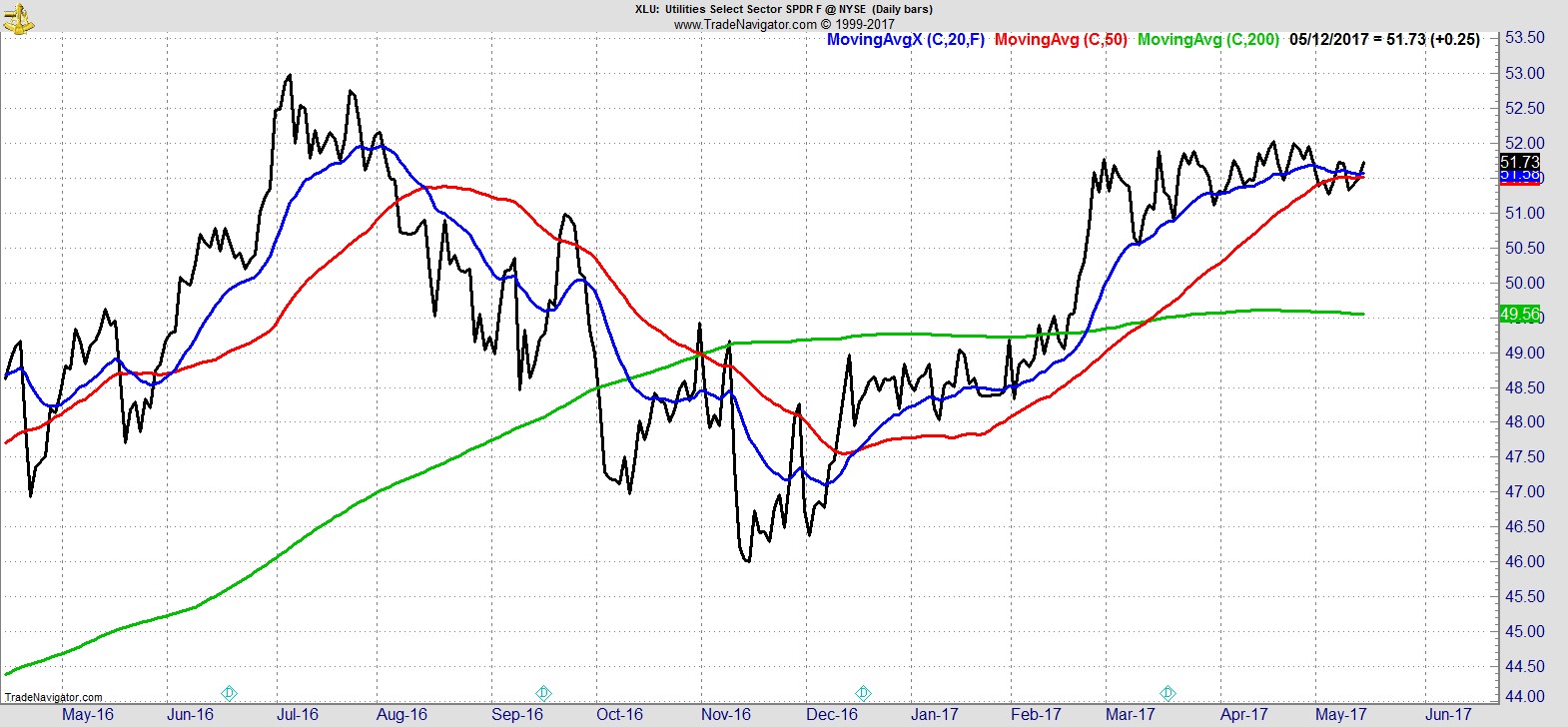

There's very little change to the S&P Sector SPDR rankings this week. Technology remains the clear leader, followed by Consumer Discretionary, Industrials, Utilities, and Healthcare, all of which are above their 20, 50, and 200-day MAs.

Then comes Materials, Staples, and Financials which are testing their 20 and 50-day MAs but remain above the 200-day. Bringing up the rear are Real Estate, and Energy.

.

Alpha Capture Portfolio

Our model portfolio continued its strong run, +2.1% on the week vs -0.4% for the S&P. It's now rallied 8.5% in 4 weeks, and remains fully invested with 10.7% open risk across 12 names.

.

Watchlist

A familiar story of late, with Technology and Consumer Discretionary accounting for most of our watchlist.

Here's a sample from the full list of 25 names:-

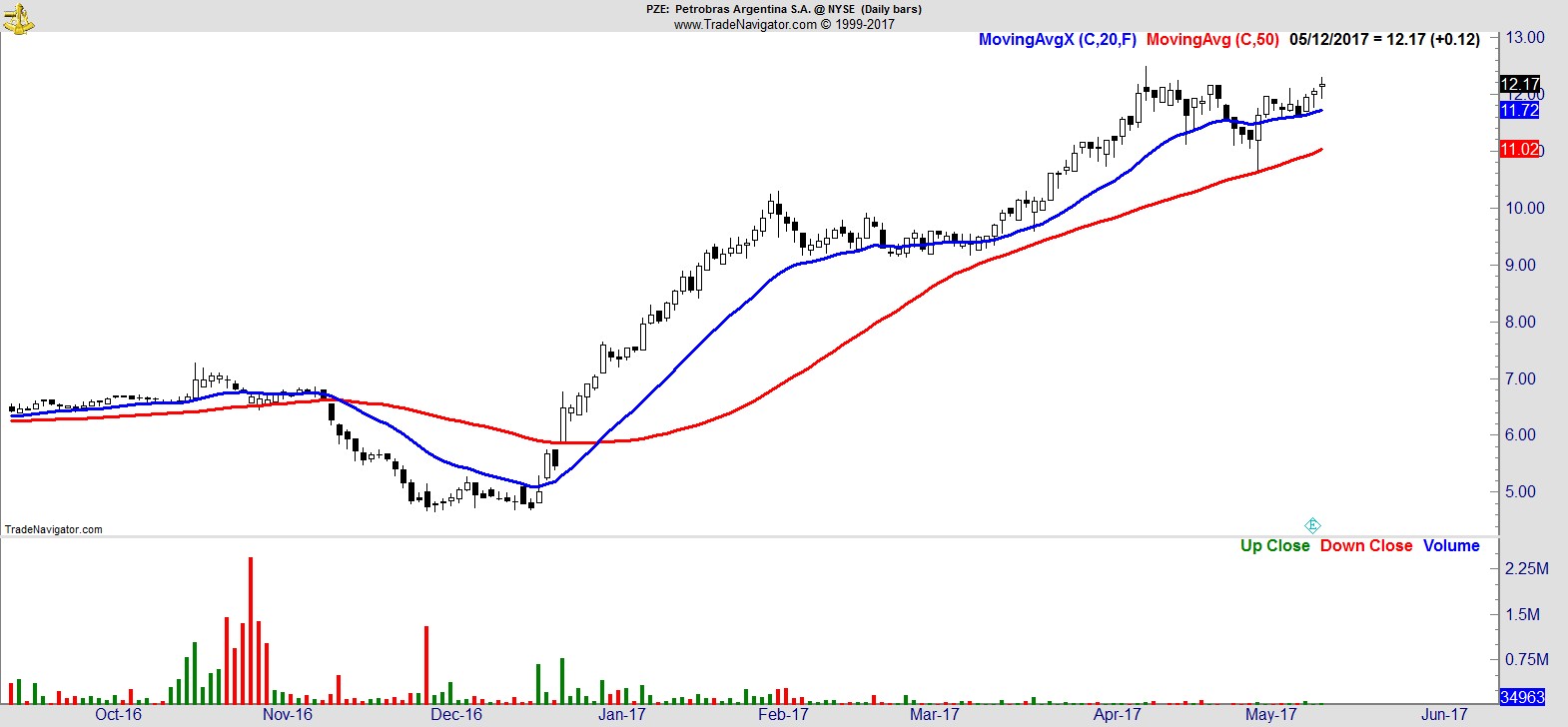

$PZE

.

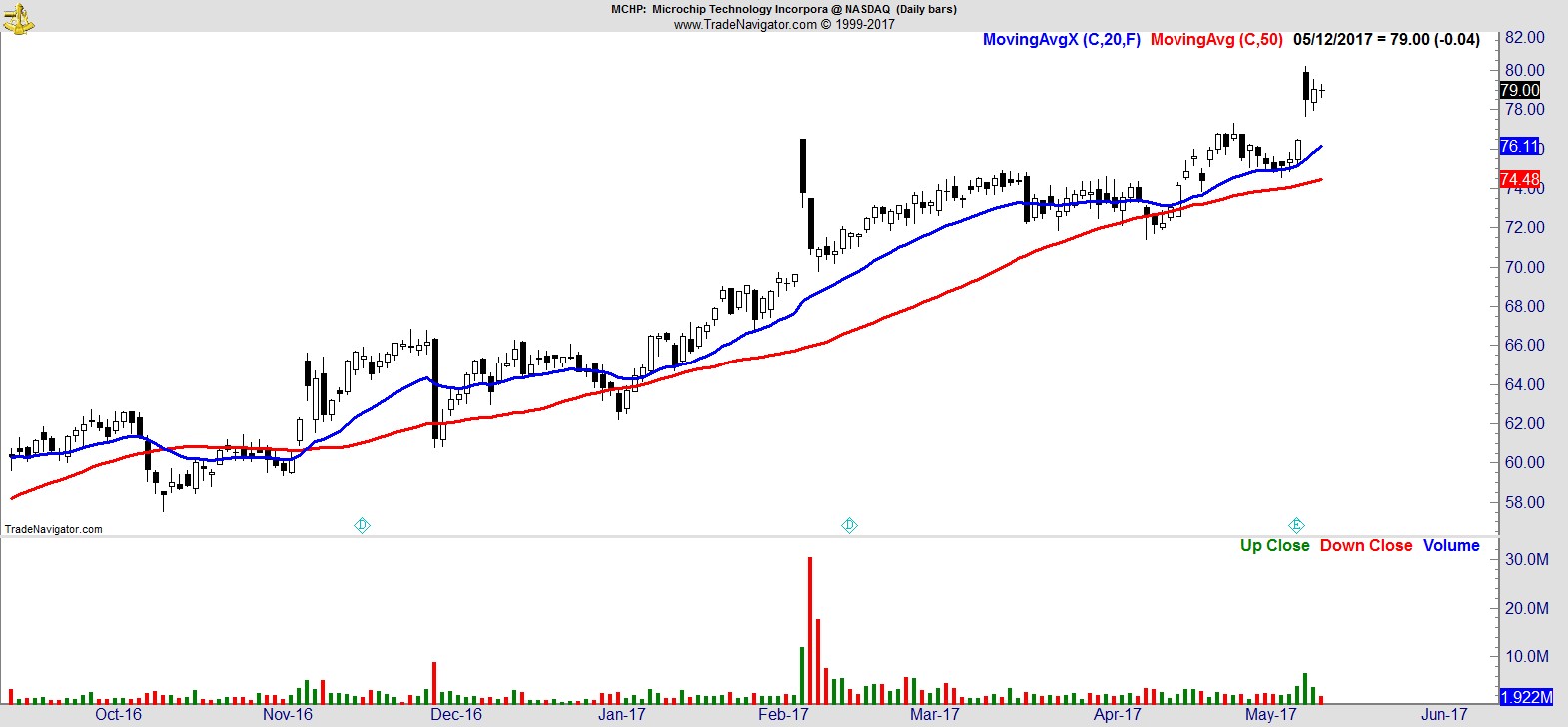

$MCHP

.

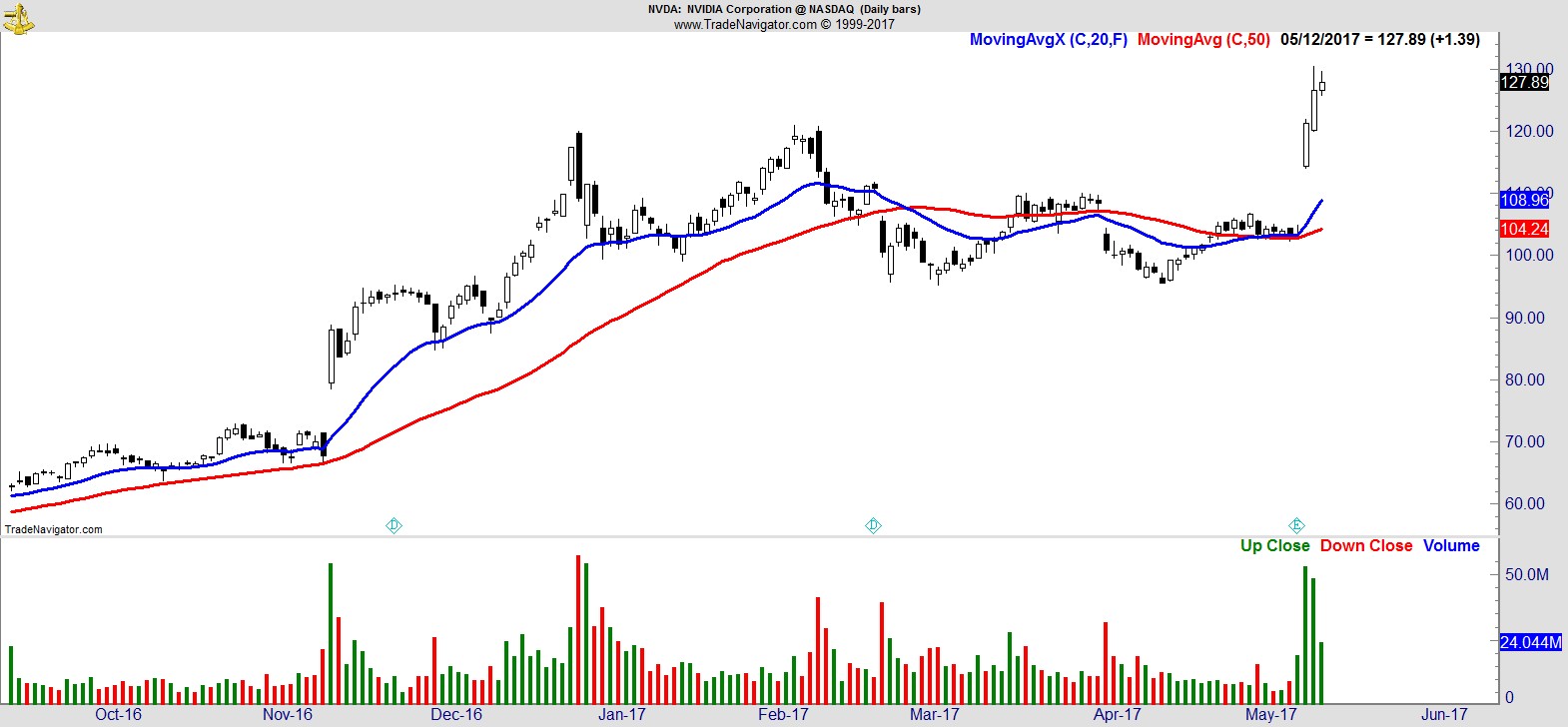

$NVDA

.

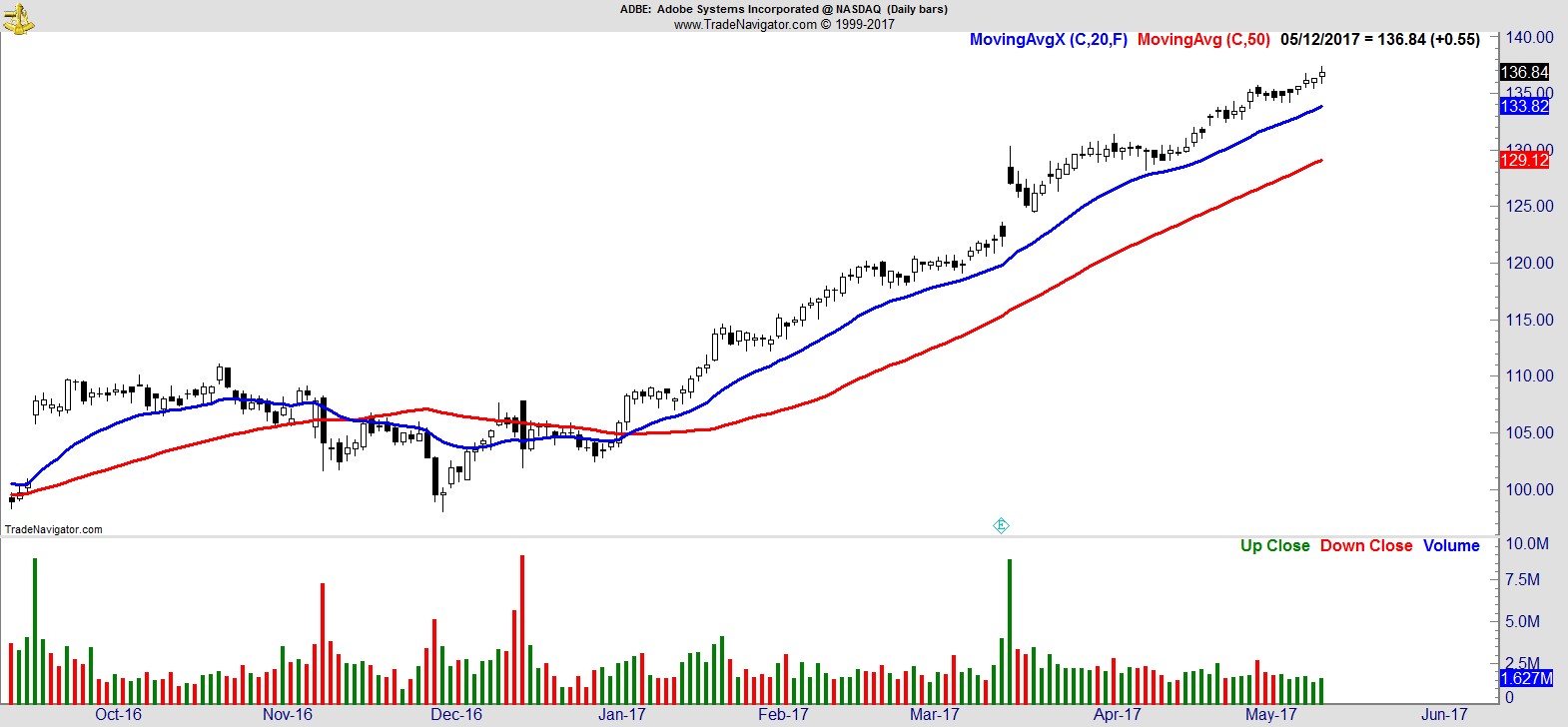

$ADBE

.

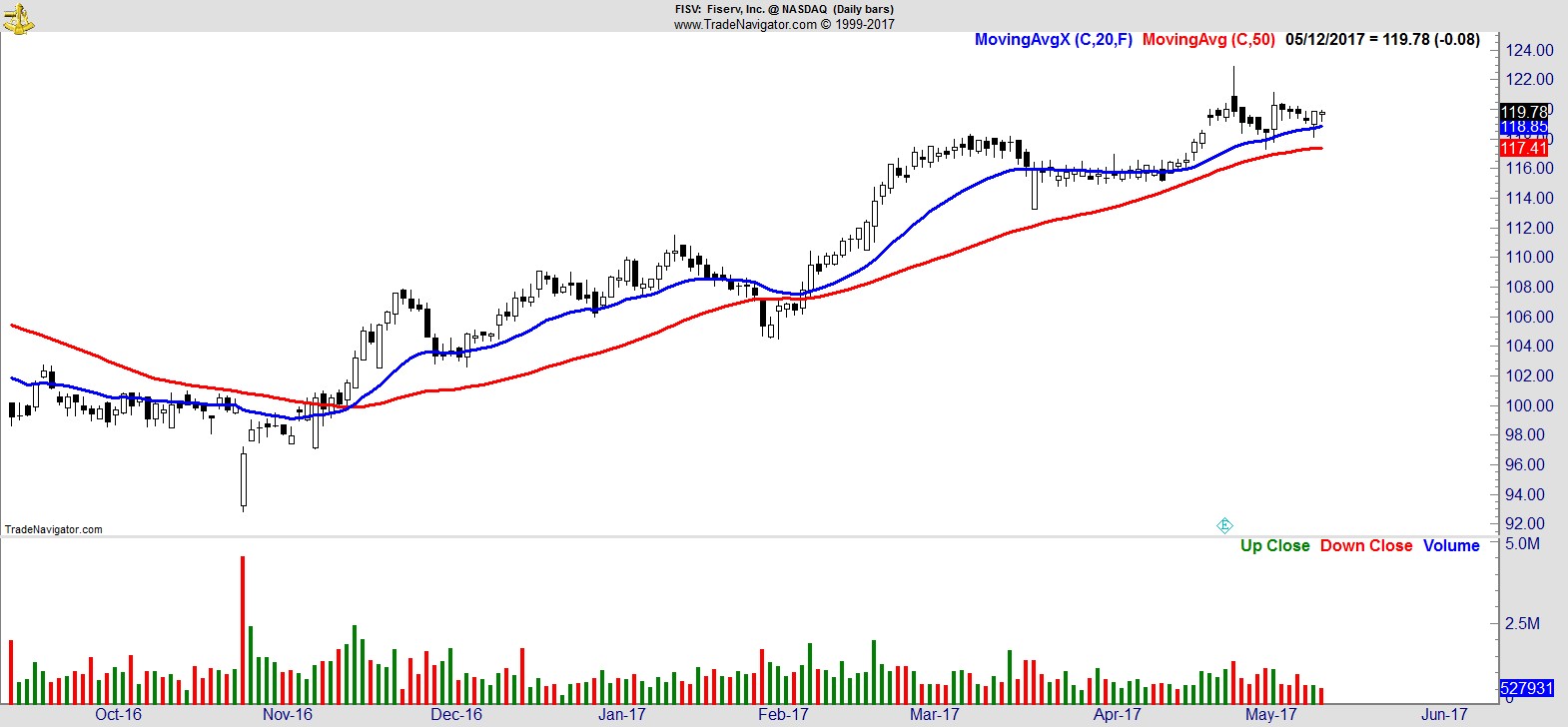

$FISV

.

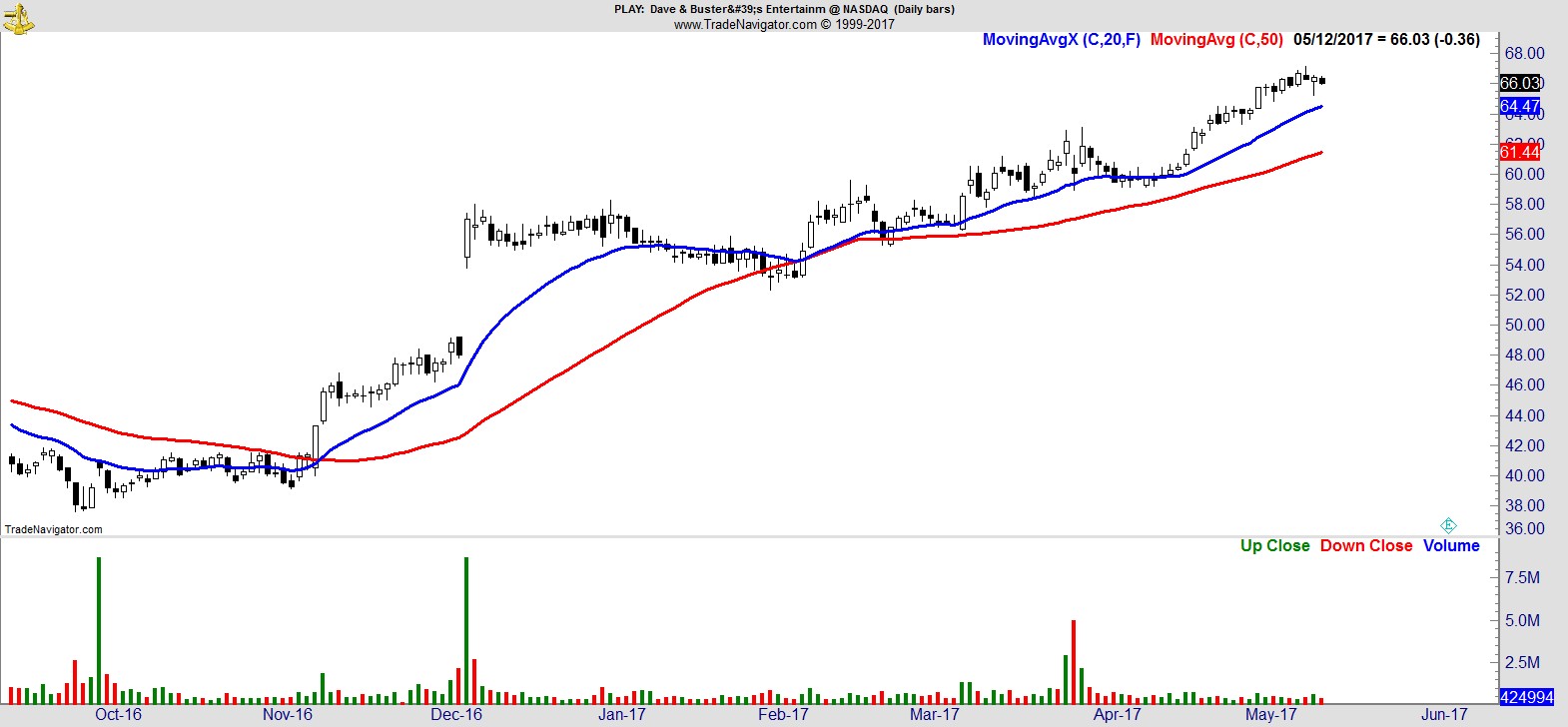

$PLAY

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17