Overview

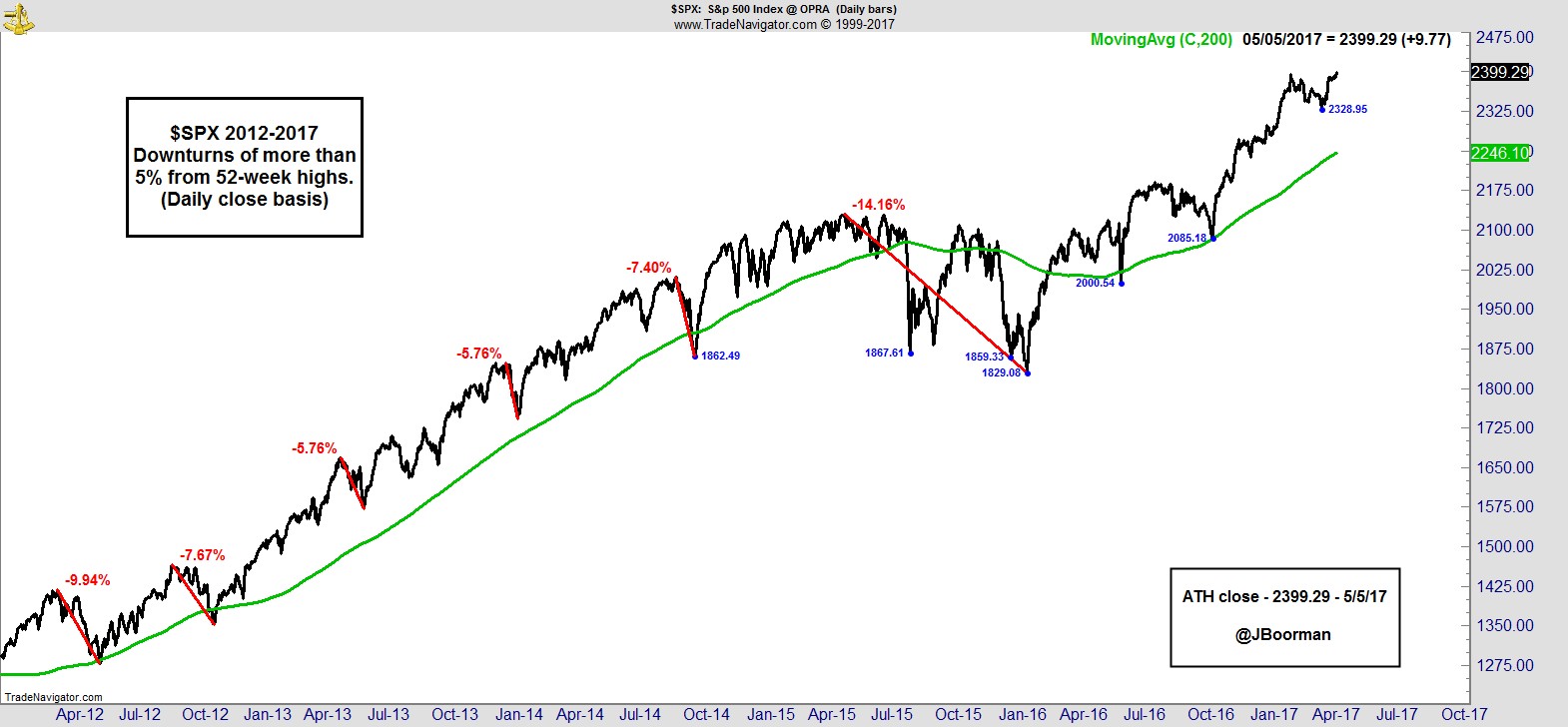

The S&P and NASDAQ closed at all time highs Friday. The new high on the S&P took out the previous level from March 1st. Its most recent pullback was only 2.8%, briefly penetrating its 50-day MA before resuming higher. Since this advance began over a year ago, we are yet to see a 5% decline.

.

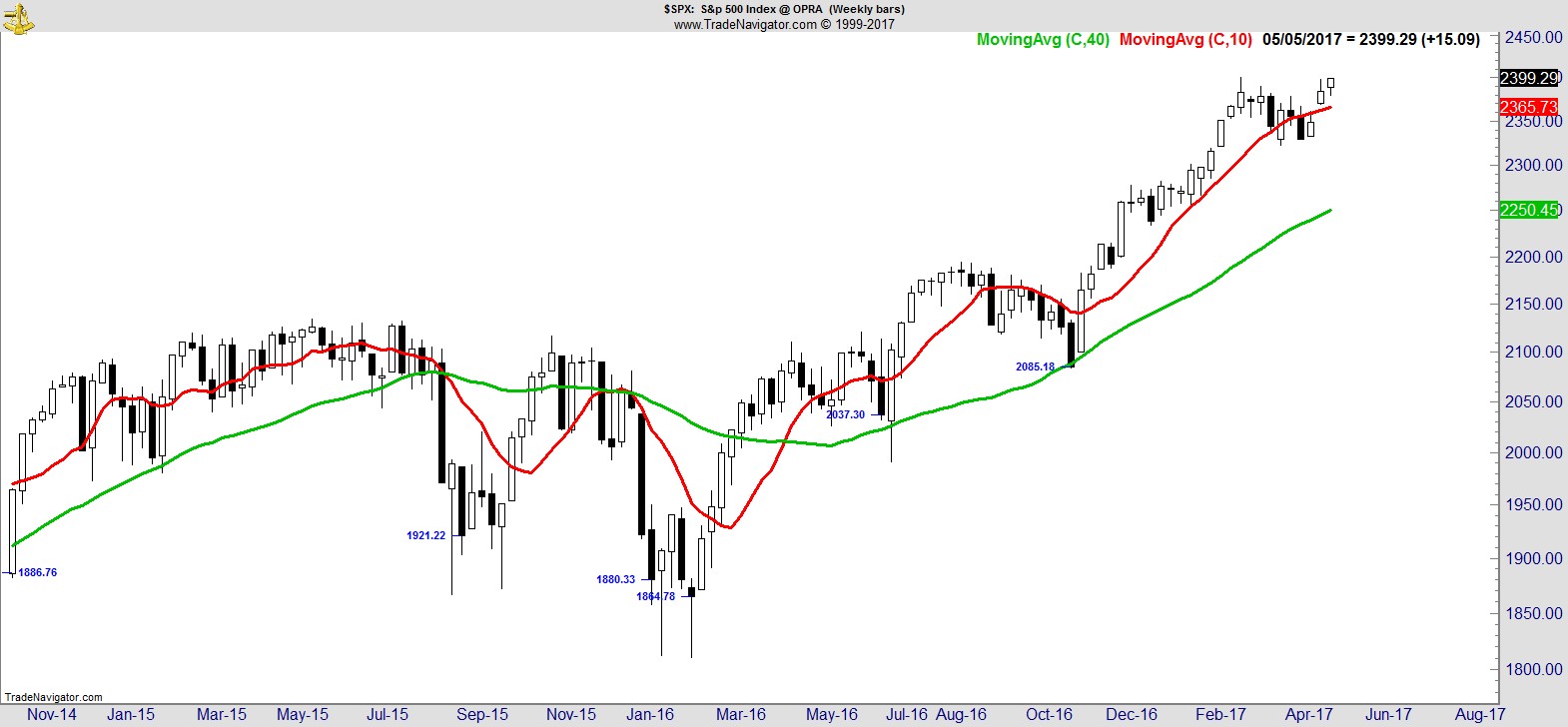

Here's the S&P on a daily and weekly:-

.

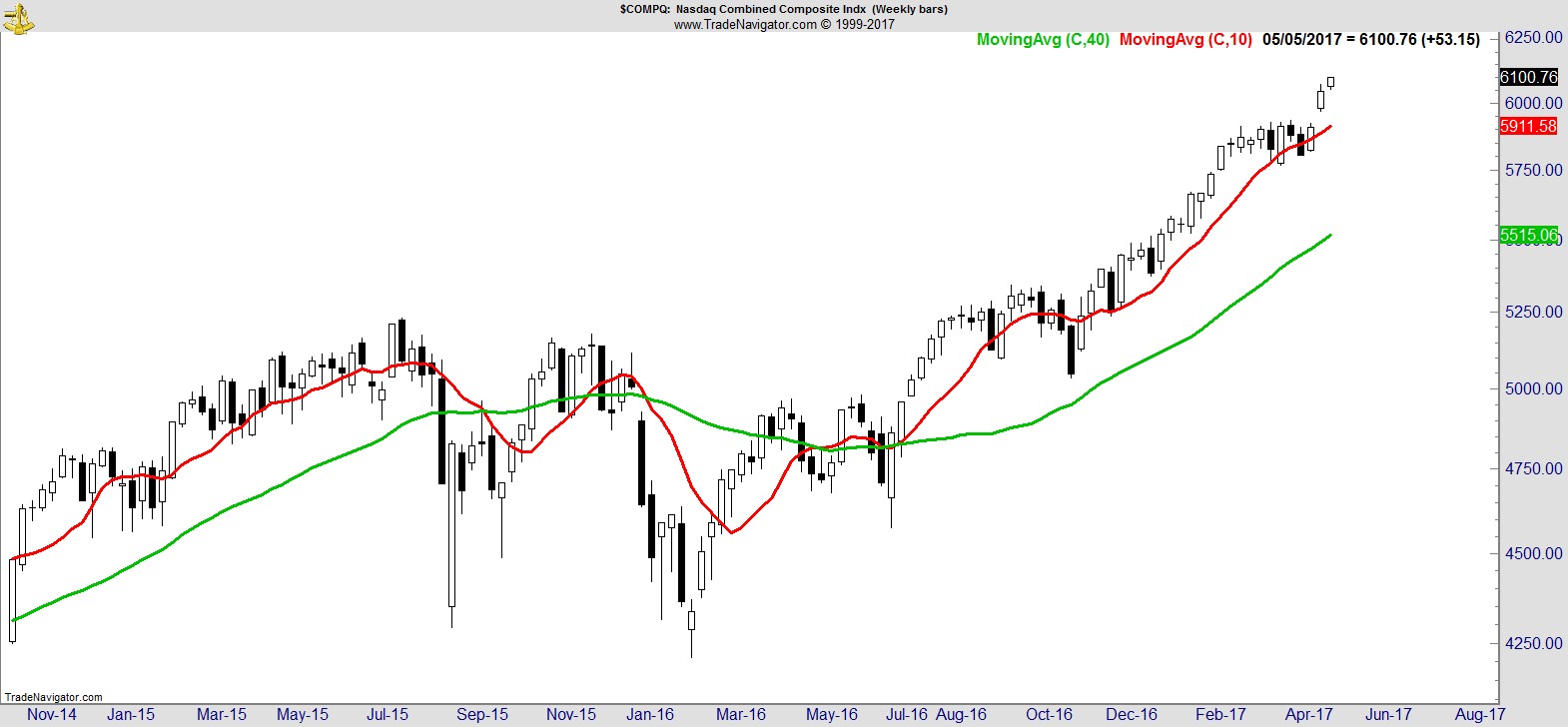

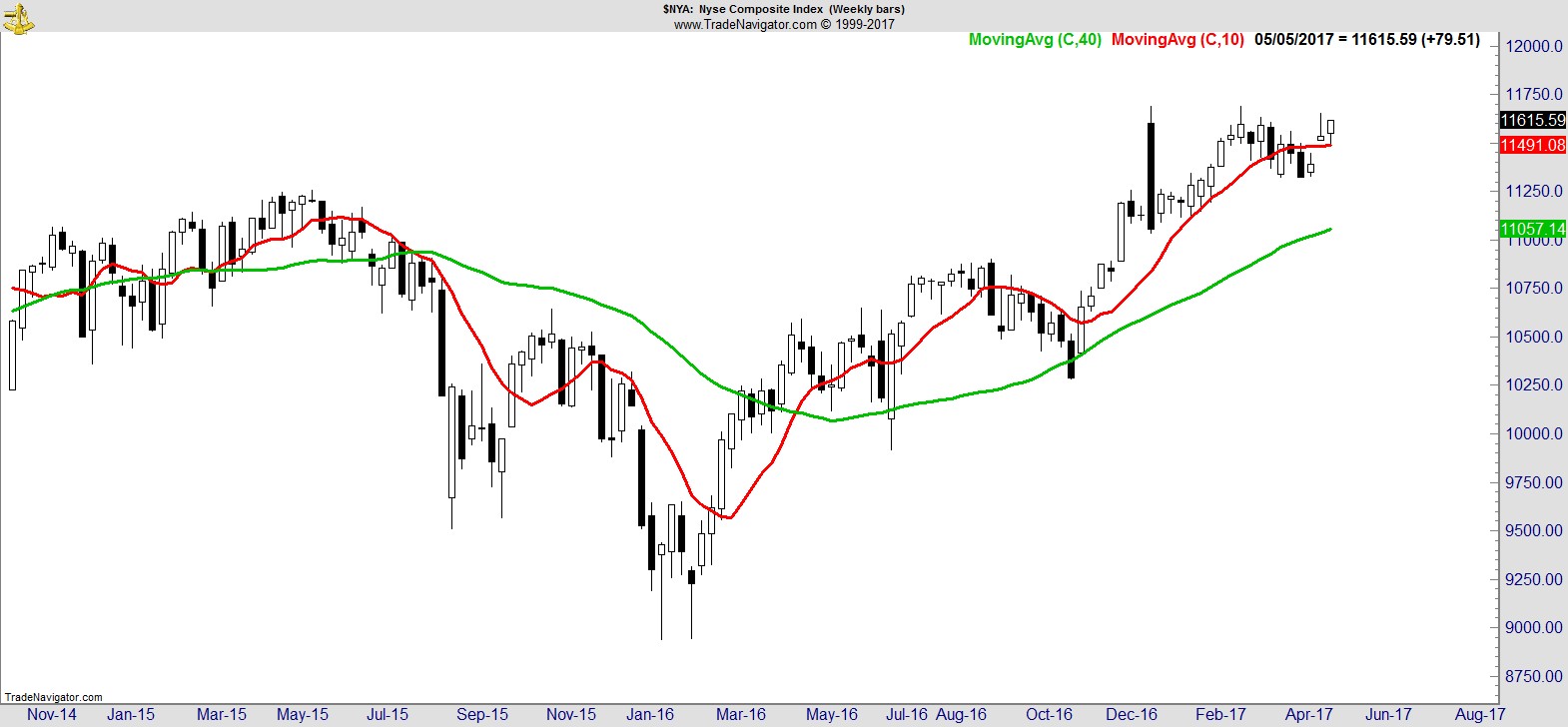

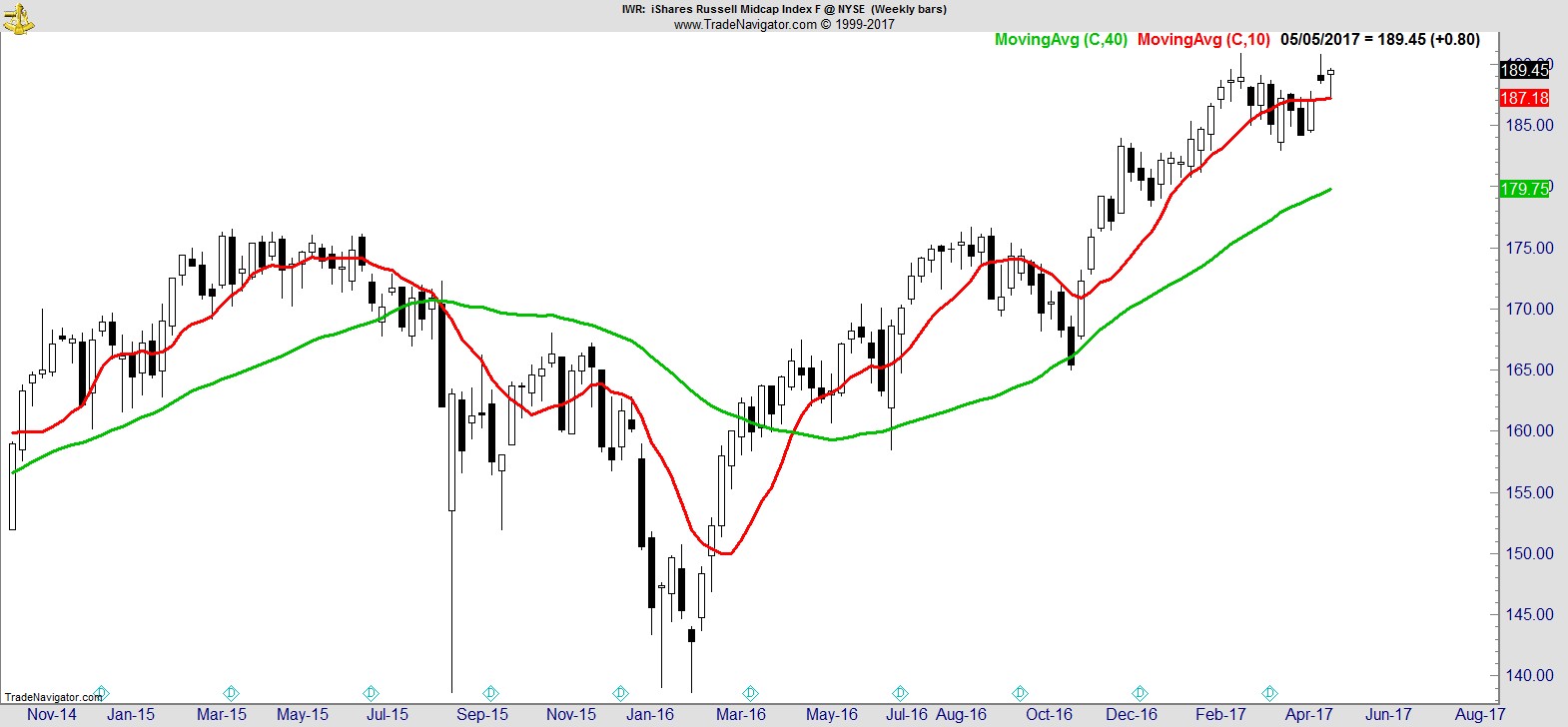

There were also new weekly closing highs for the NASDAQ, NYSE Composite, and Midcap Index:-

.

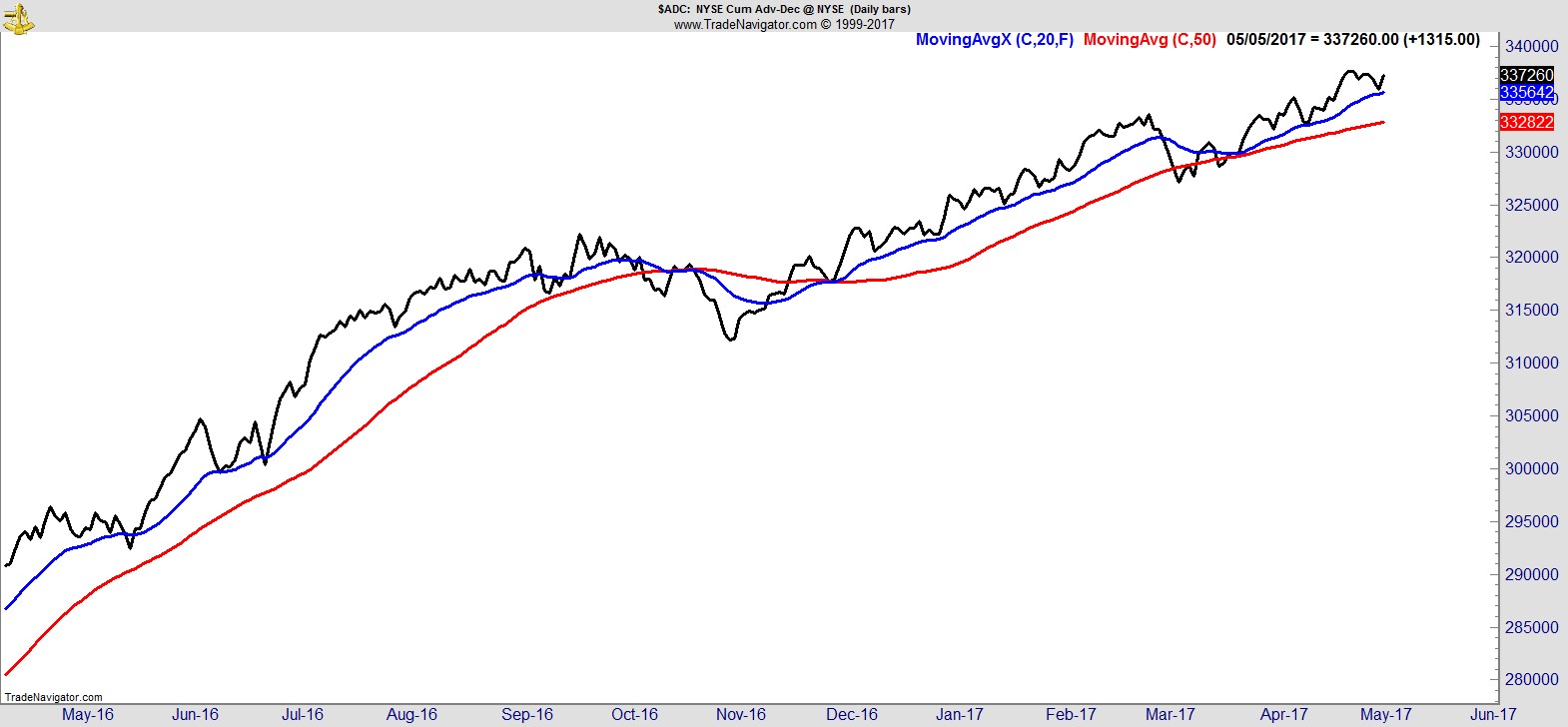

Sentiment was barely changed during the week, and breadth is yet to make fresh highs but is still very healthy:-

.

Sector Rankings

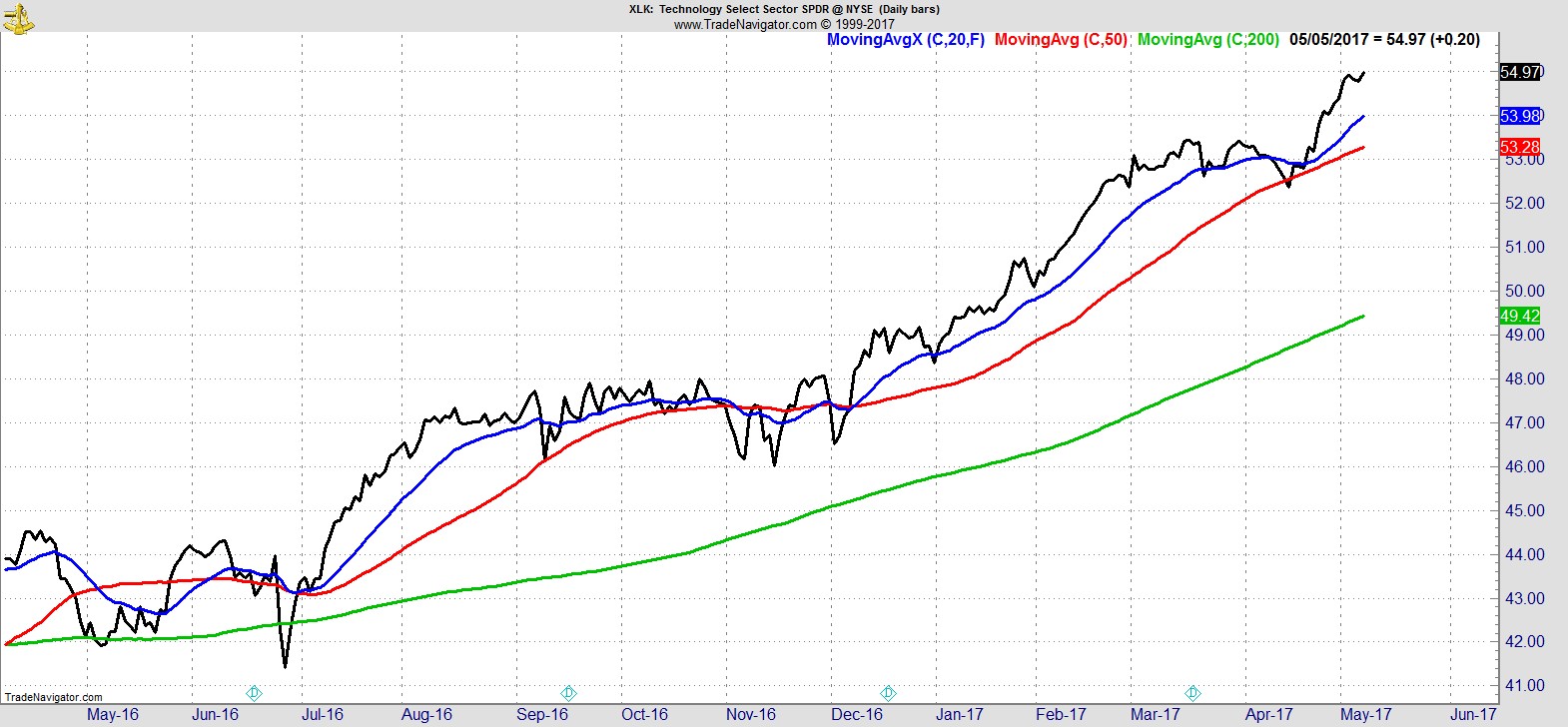

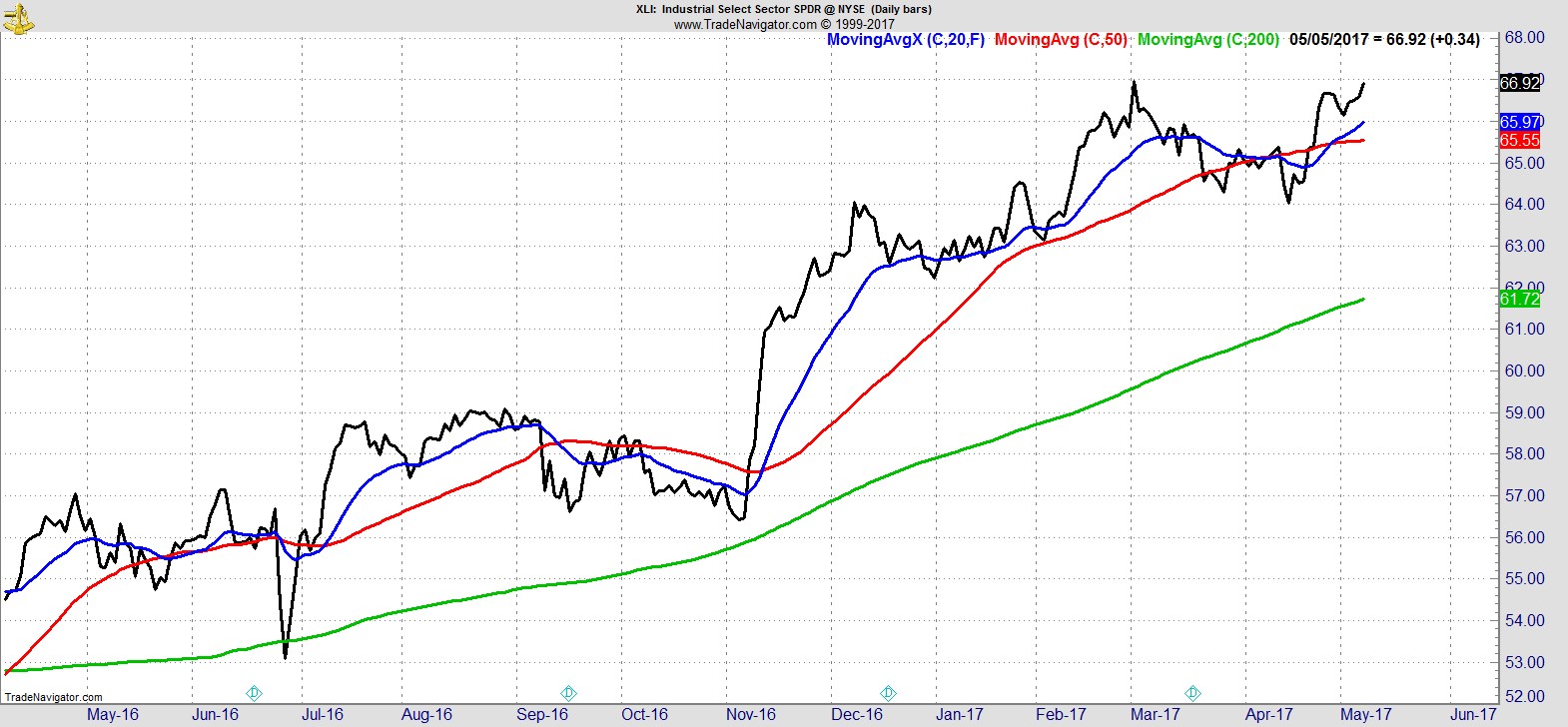

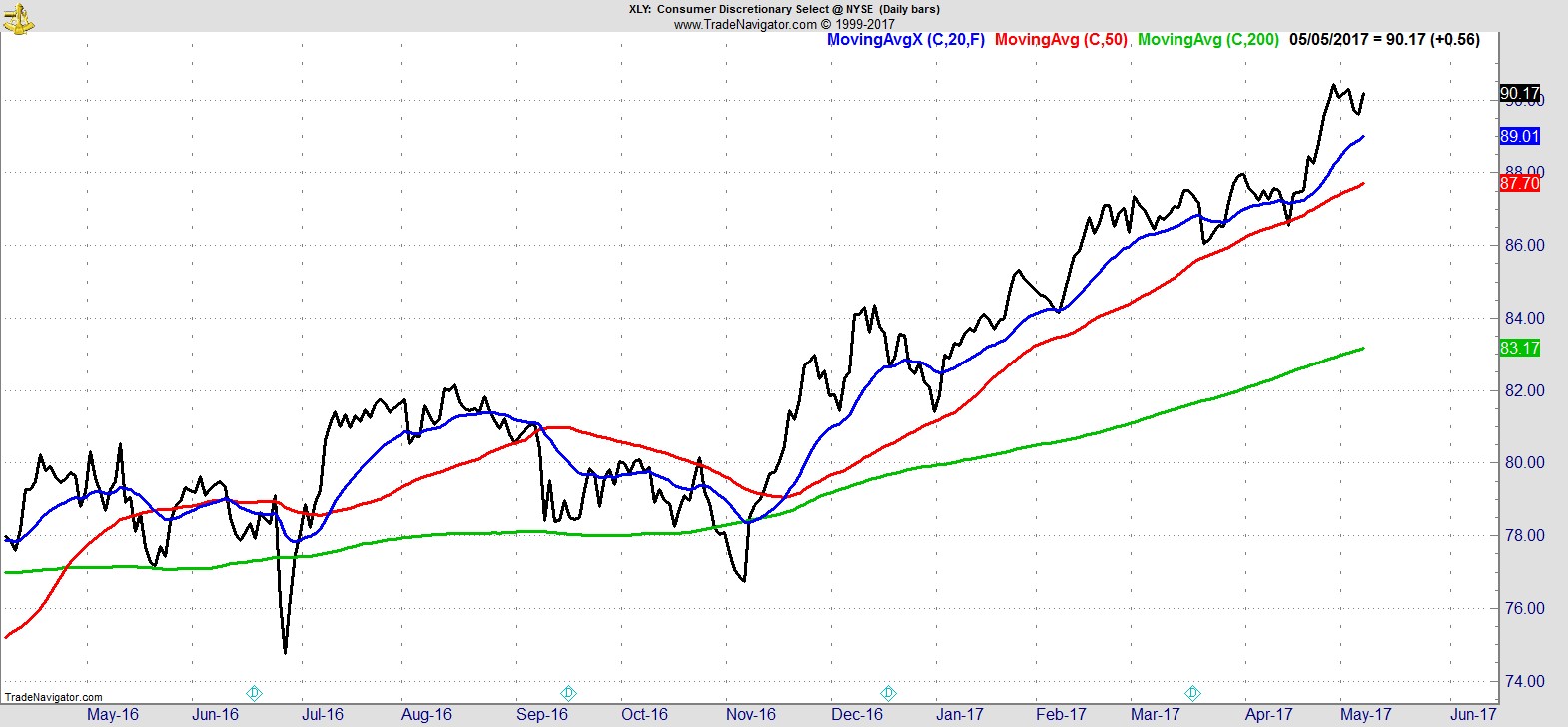

There was also little change ranking the S&P Sector SPDRs this week. Technology remains the leading sector, but is now followed by Industrials ahead of Consumer Discretionary.

.

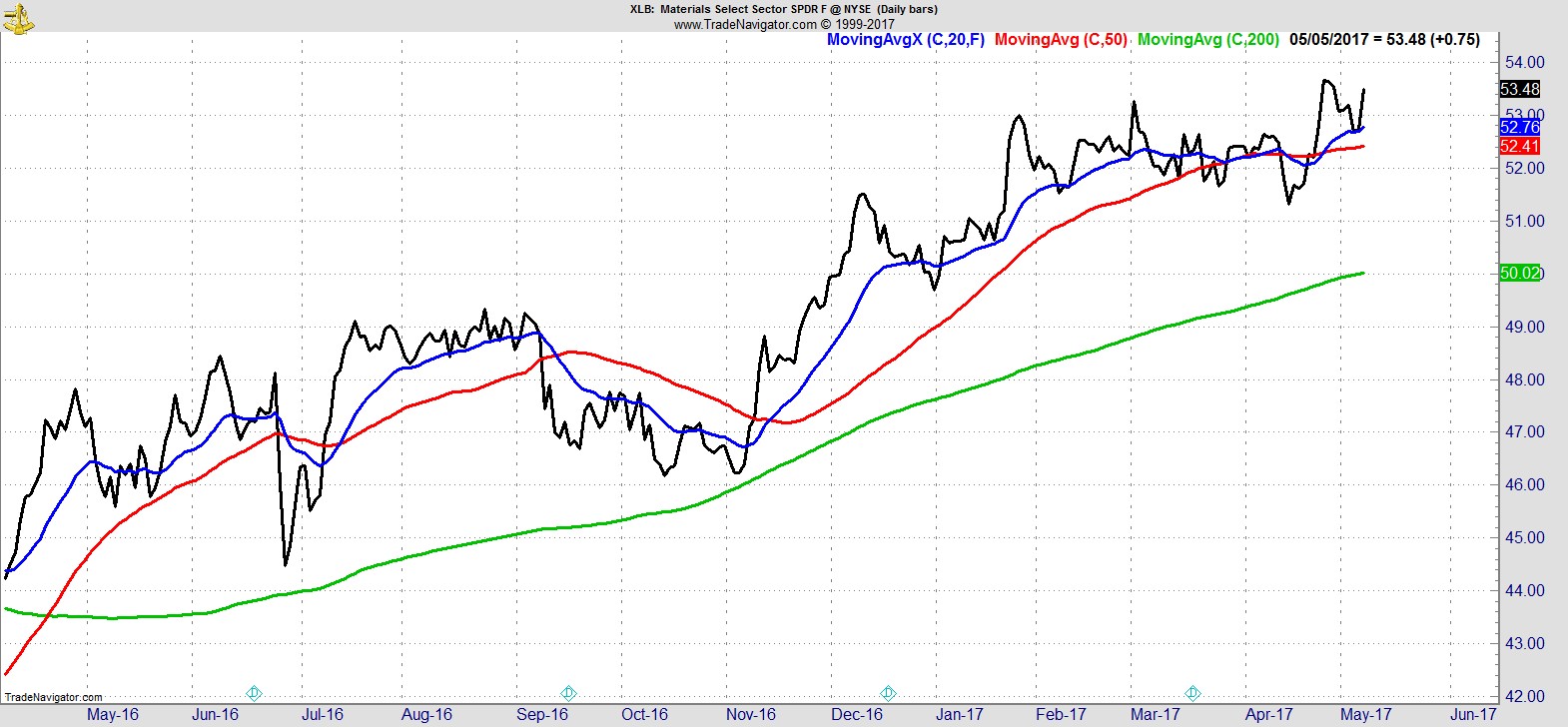

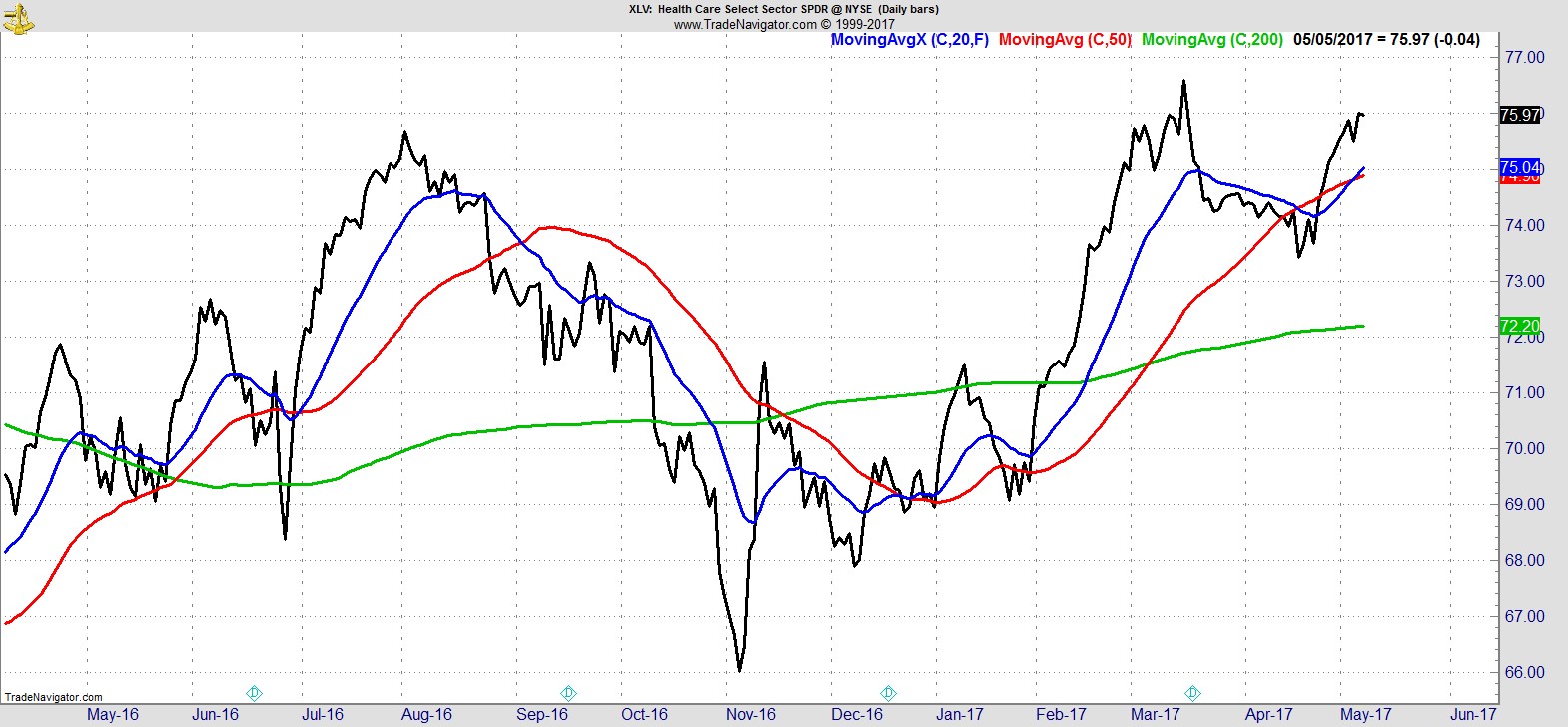

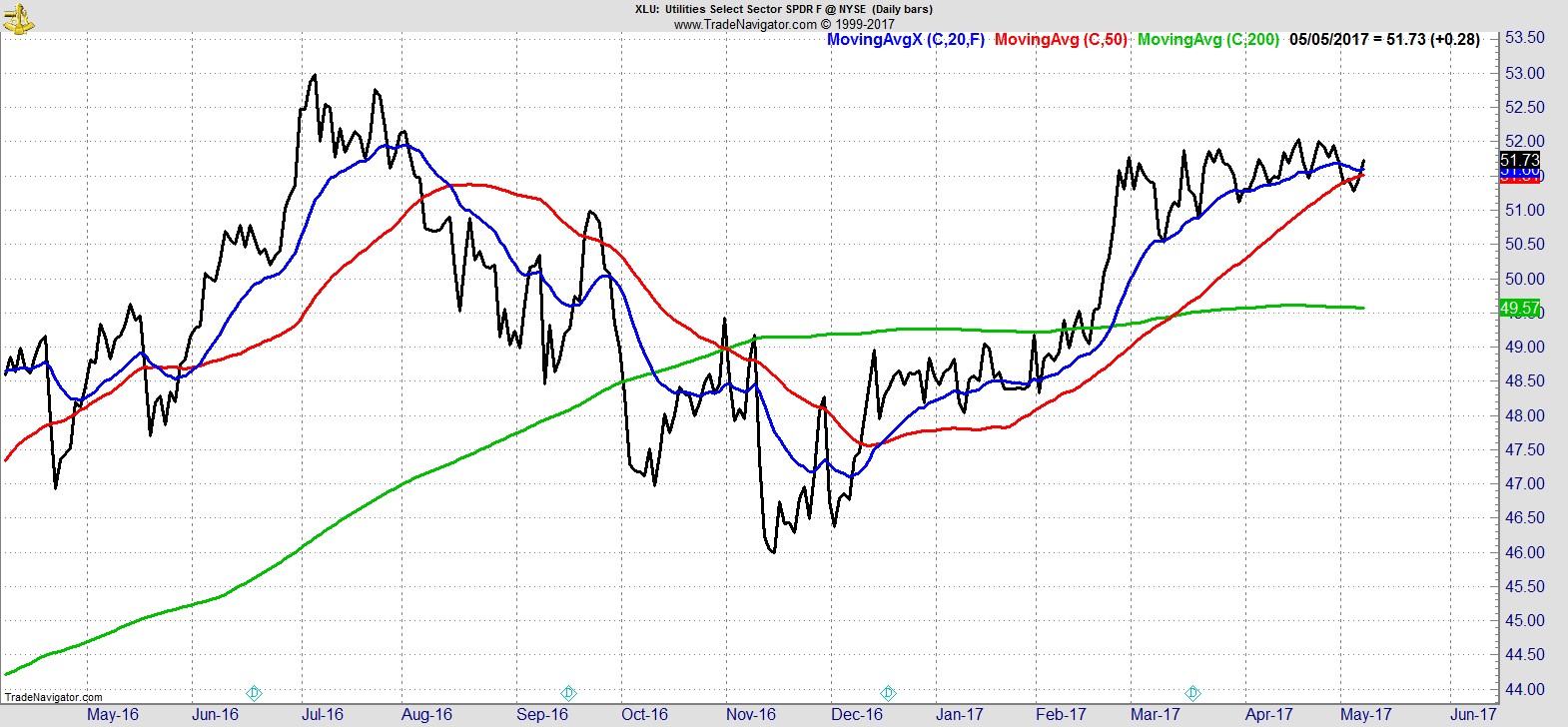

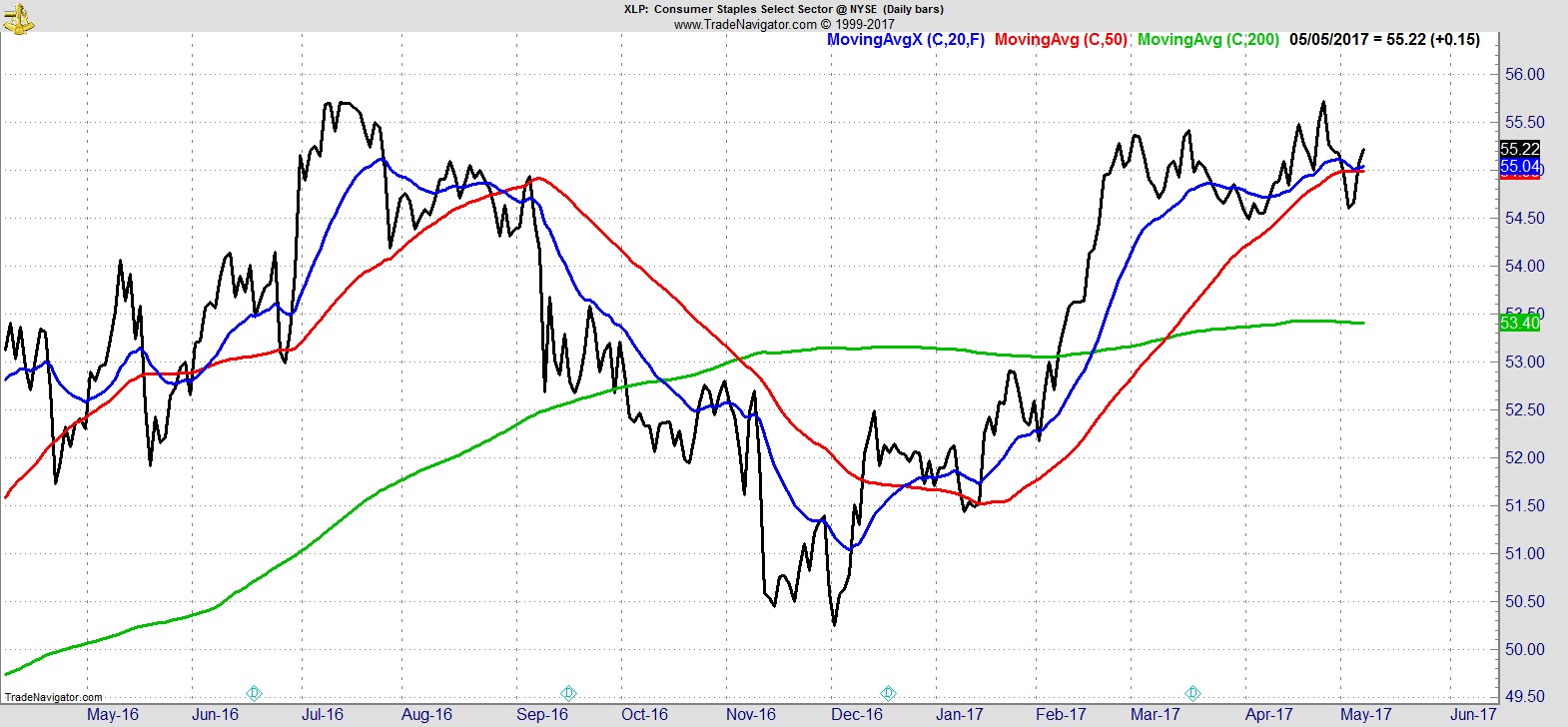

Then comes Materials, Healthcare, Utilities, and Staples. All are above their 20, 50, and 200-day MAs.

.

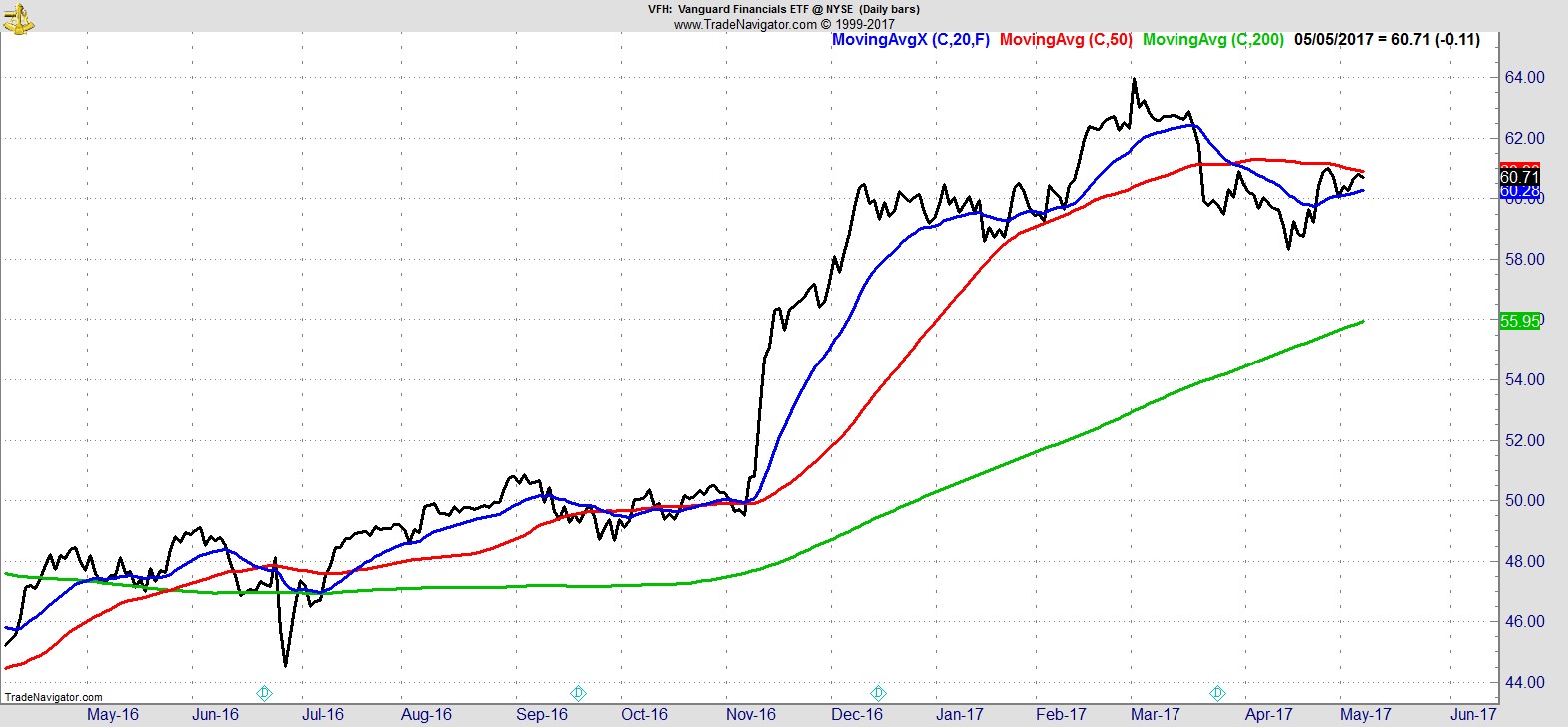

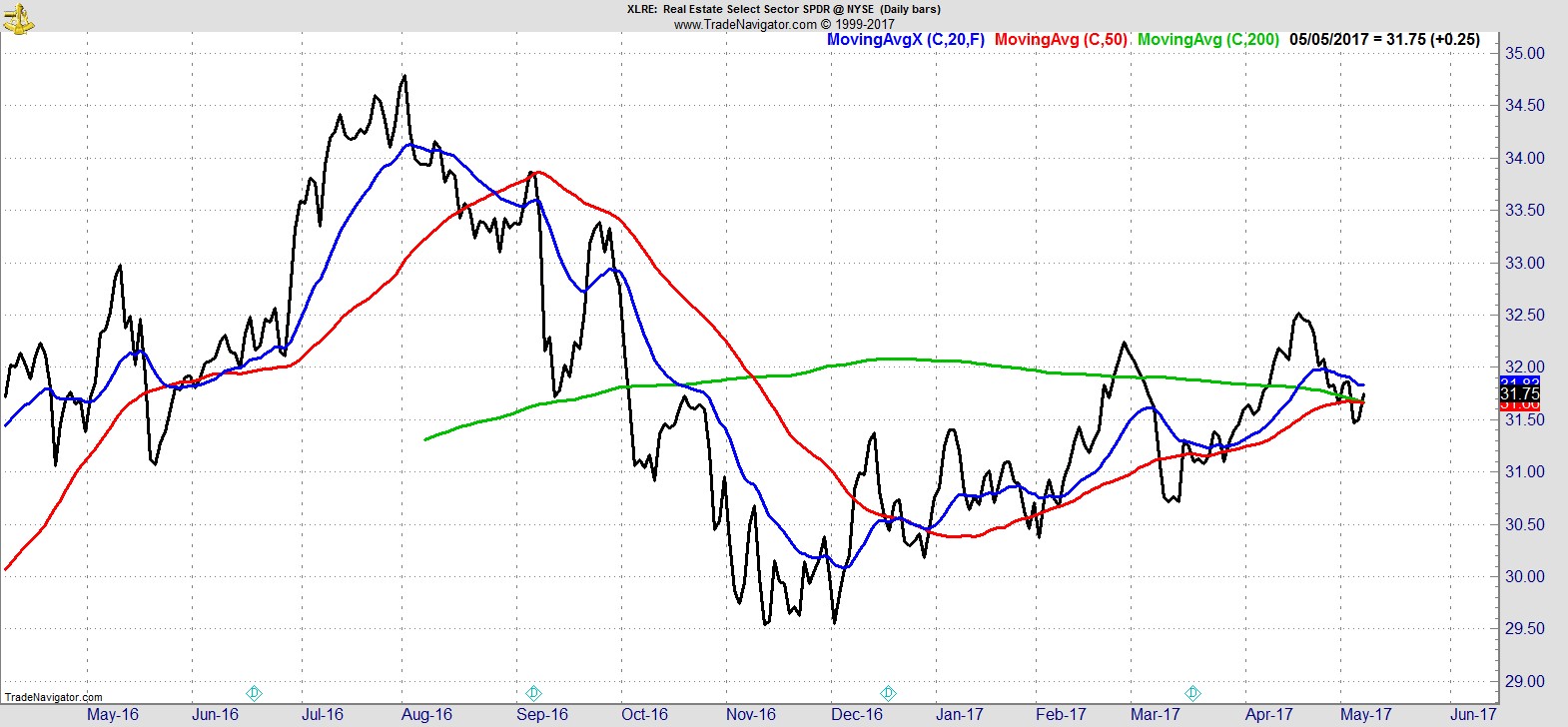

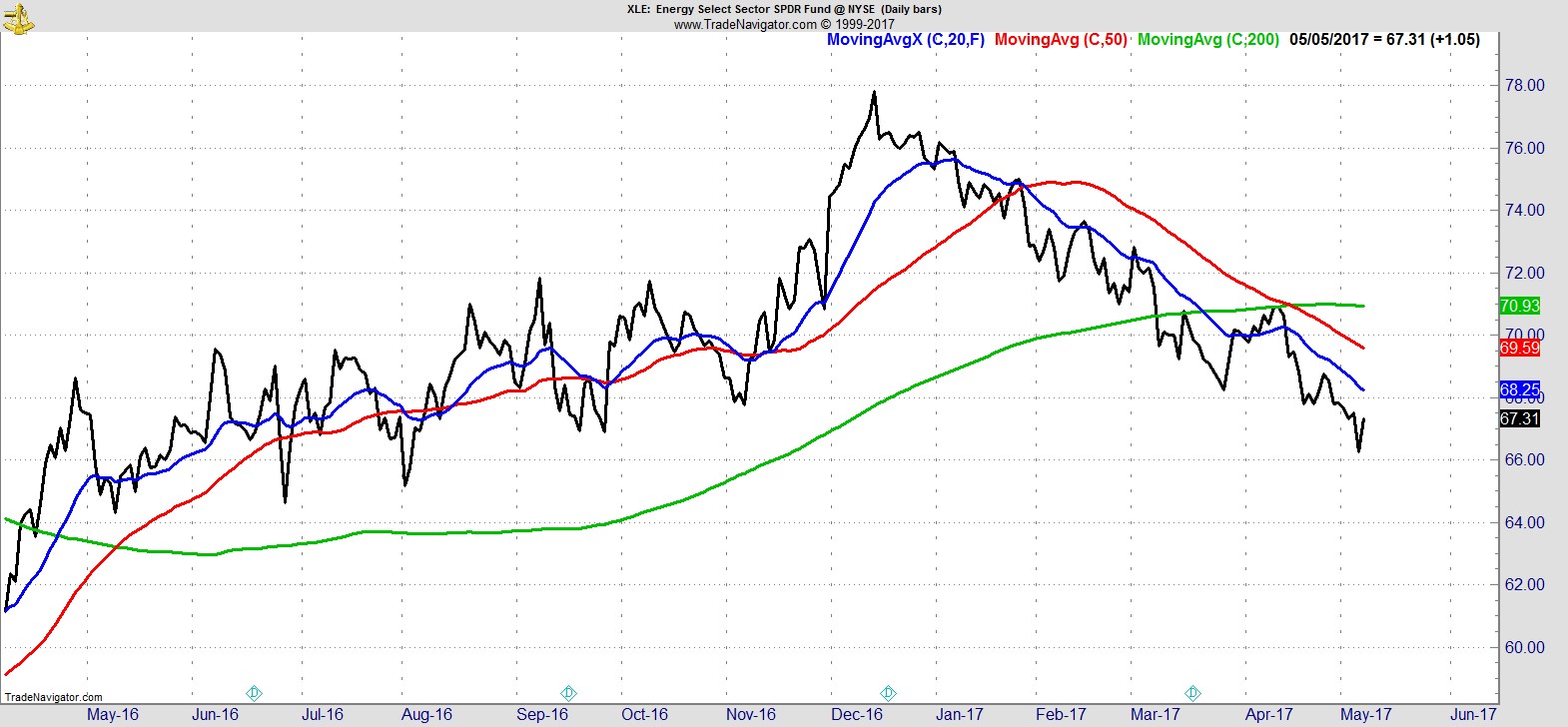

The bottom three are still Financials, which has put in a higher low but remains below its 50-day, Real Estate, which did at least manage to recover its 200-day this week, and Energy, which is below all its MAs, but did bounce off its lows Friday.

.

Alpha Capture Portfolio

Our model portfolio had another good week, +1.8% vs +0.6% for the S&P. We had one exit, added to a position, and have one new entry signal this weekend. That keeps the portfolio at 12 positions, less than 2% cash, and total open risk of just under 10%.

.

Watchlist

Technology and consumer discretionary stocks have dominated our list for weeks, but there are some other areas starting to show through now suggesting breadth may be improving.

Here's a sample from the full list of 26 names:-

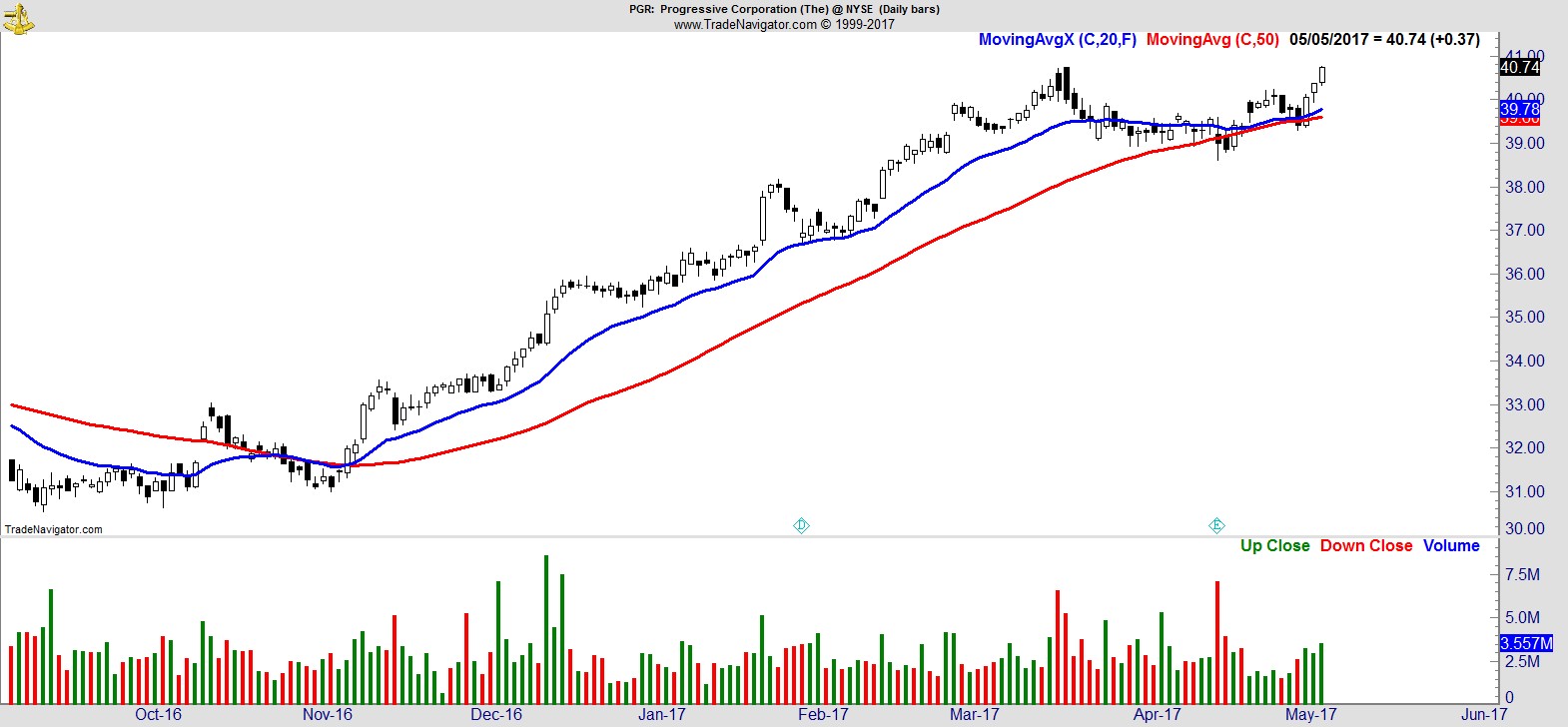

$PGR

.

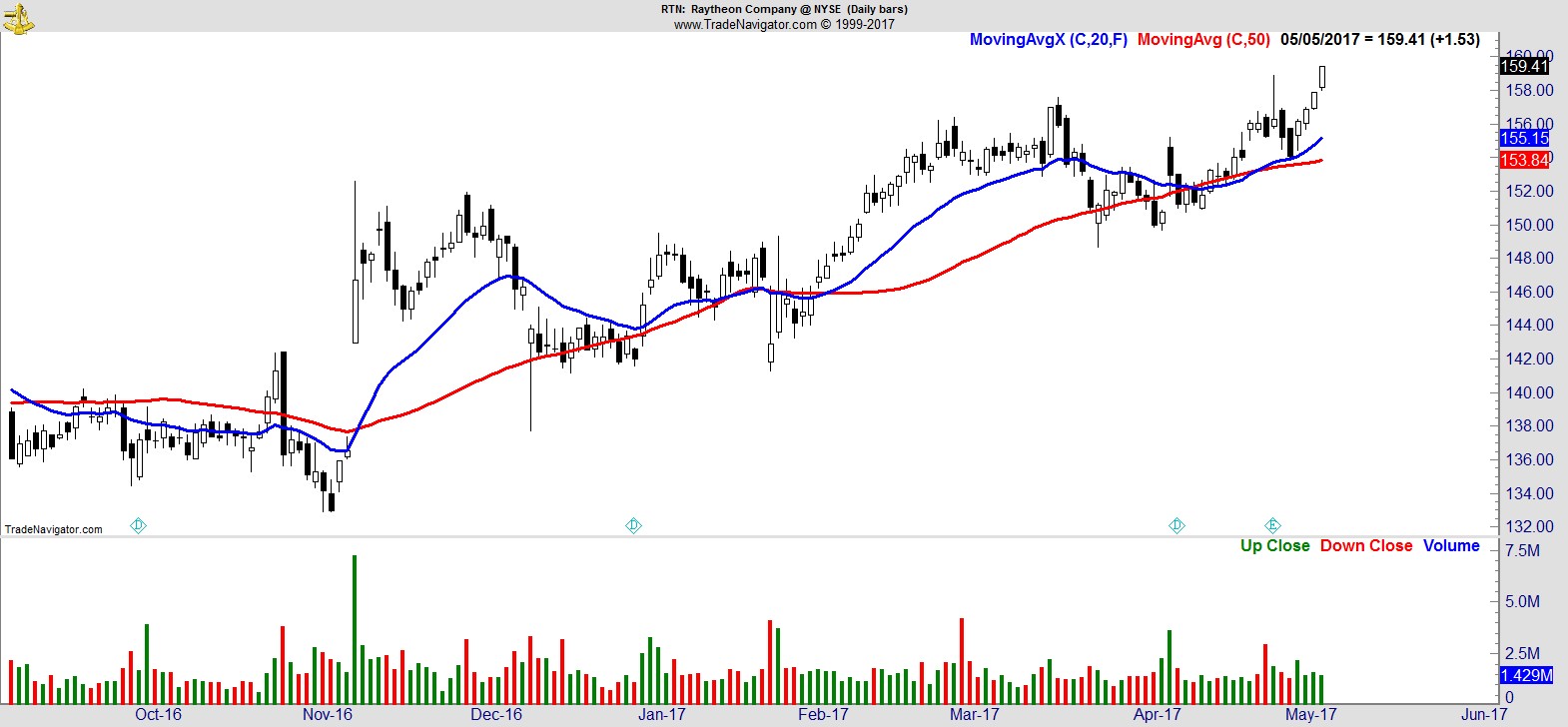

$RTN

.

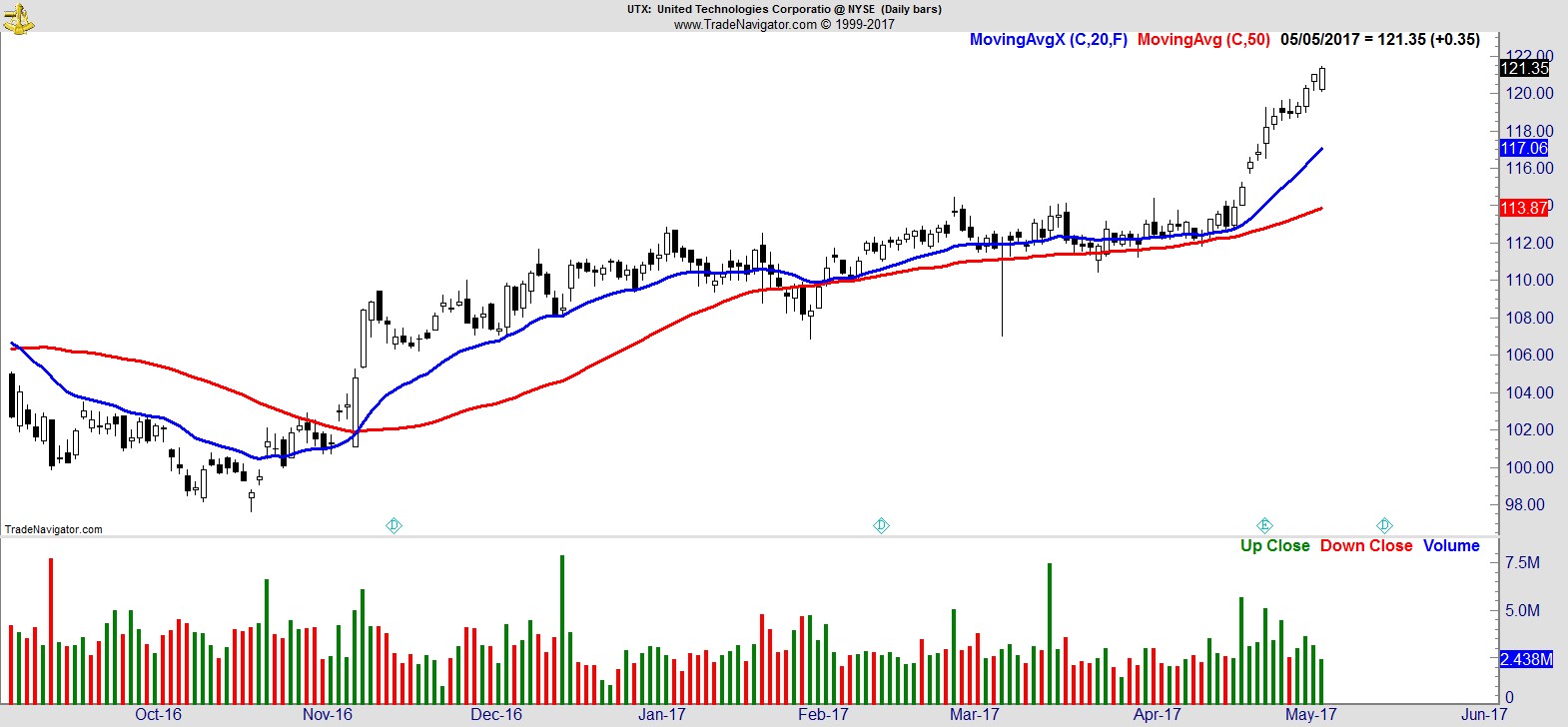

$UTX

.

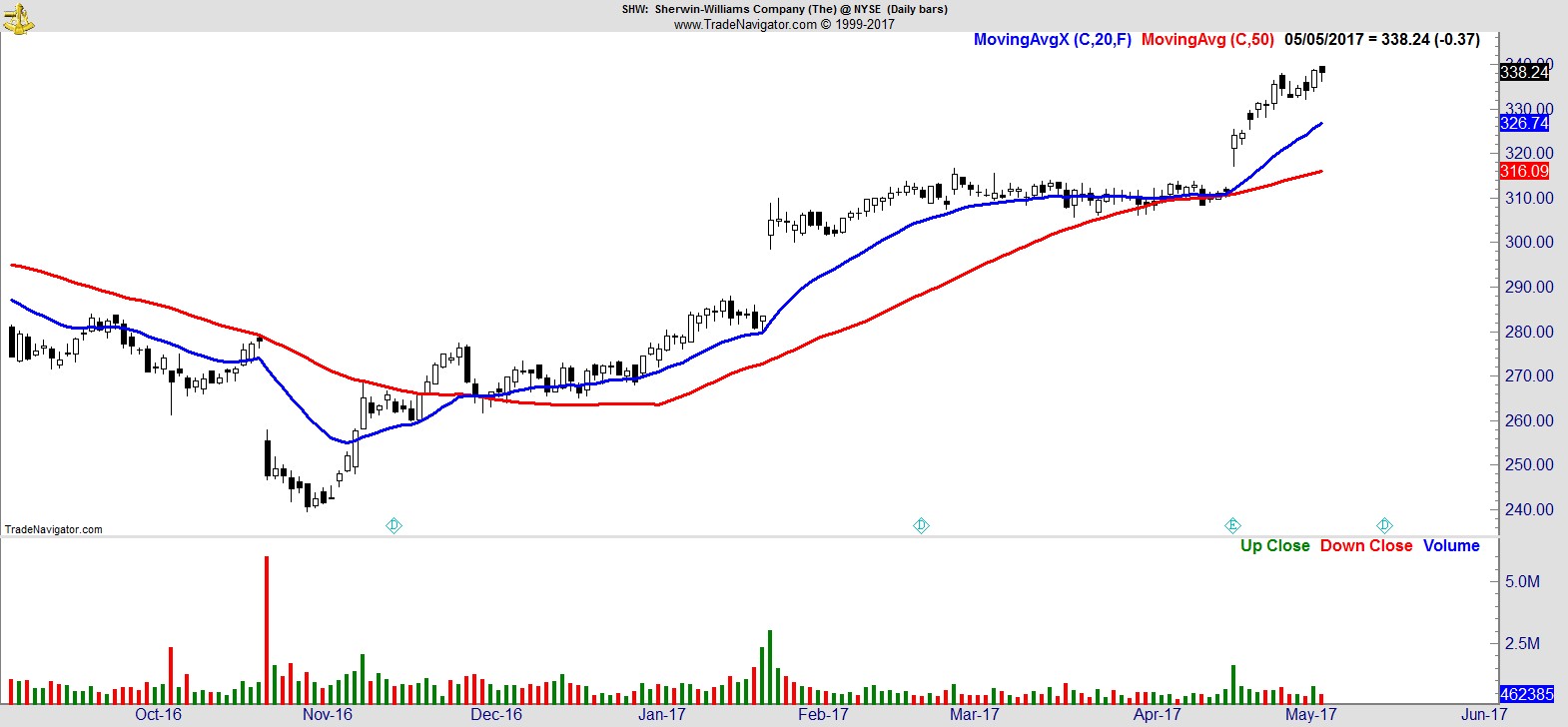

$SHW

.

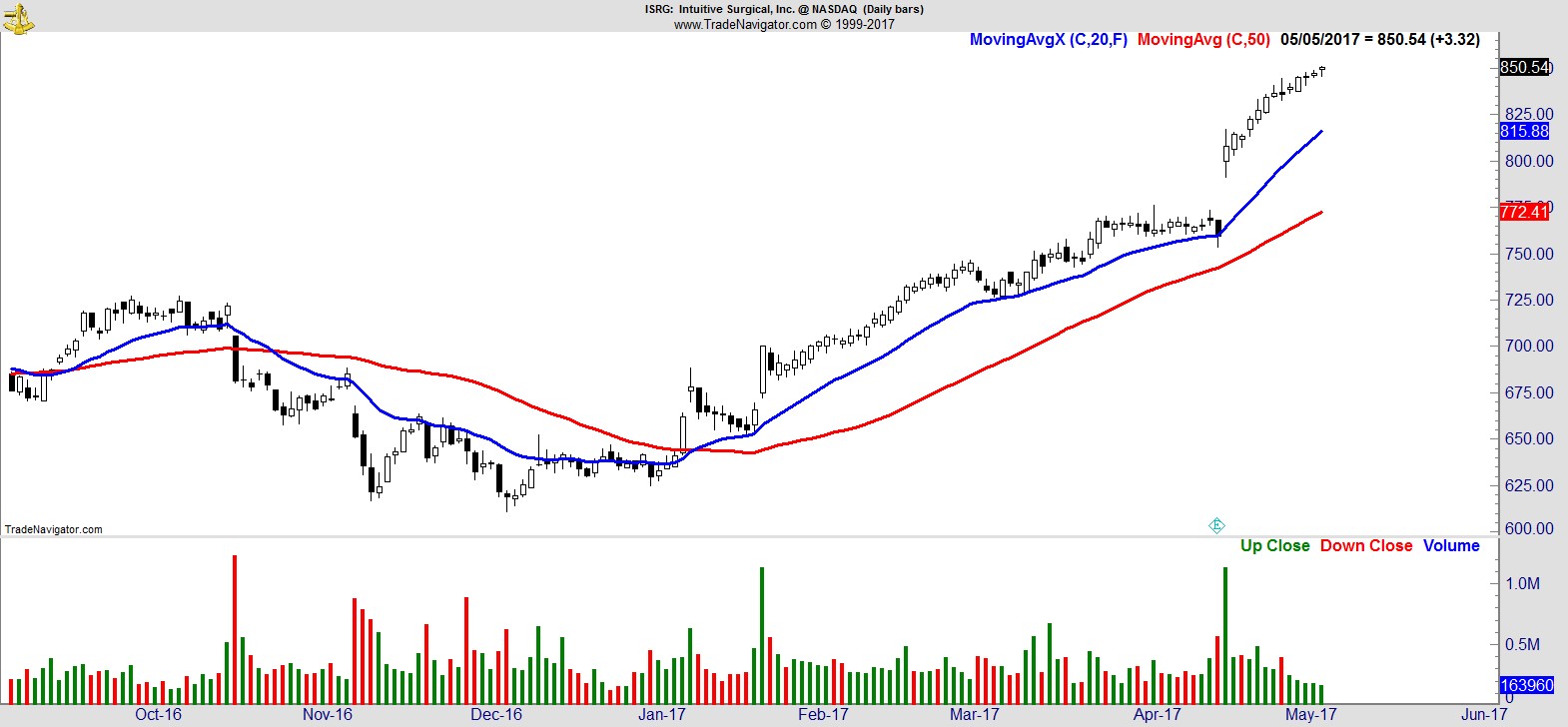

$ISRG

.

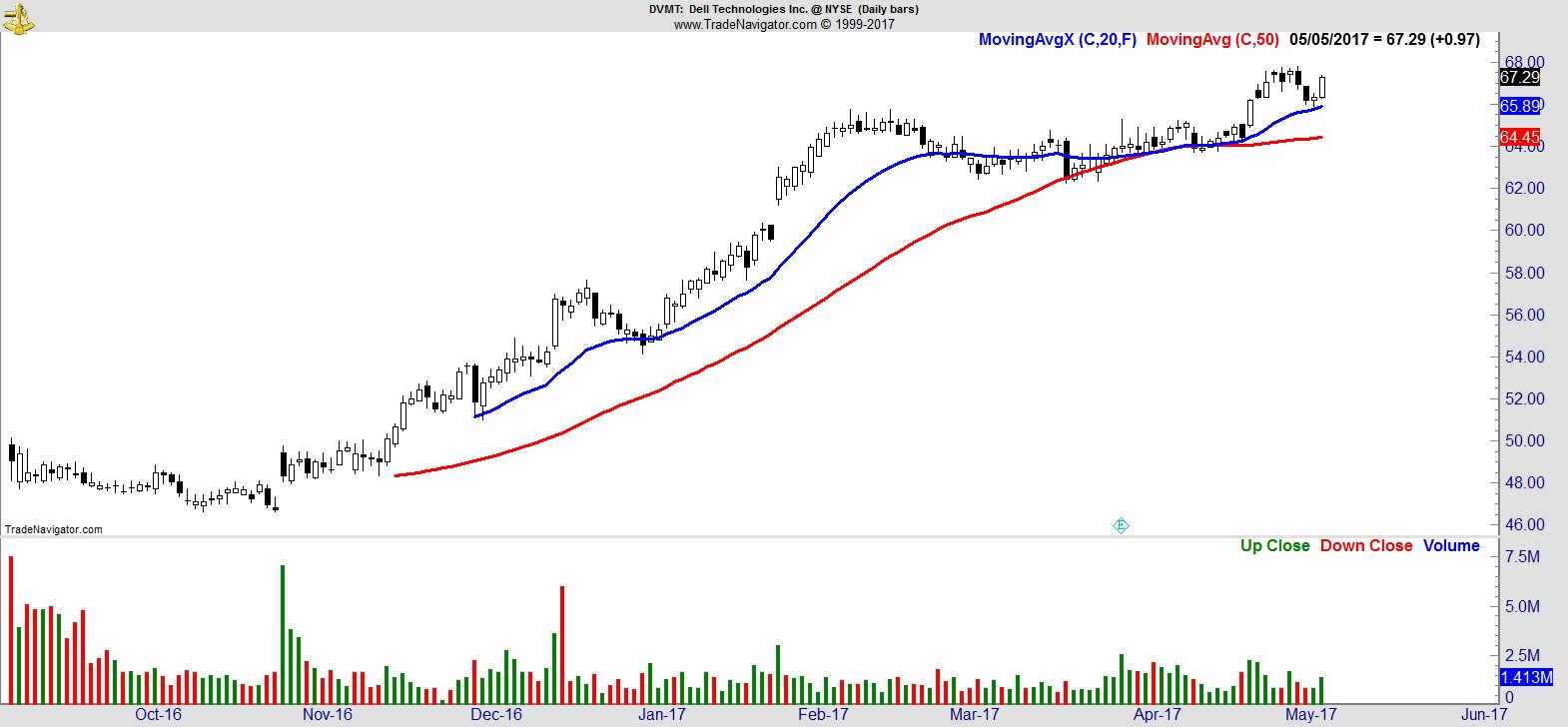

$DVMT

.

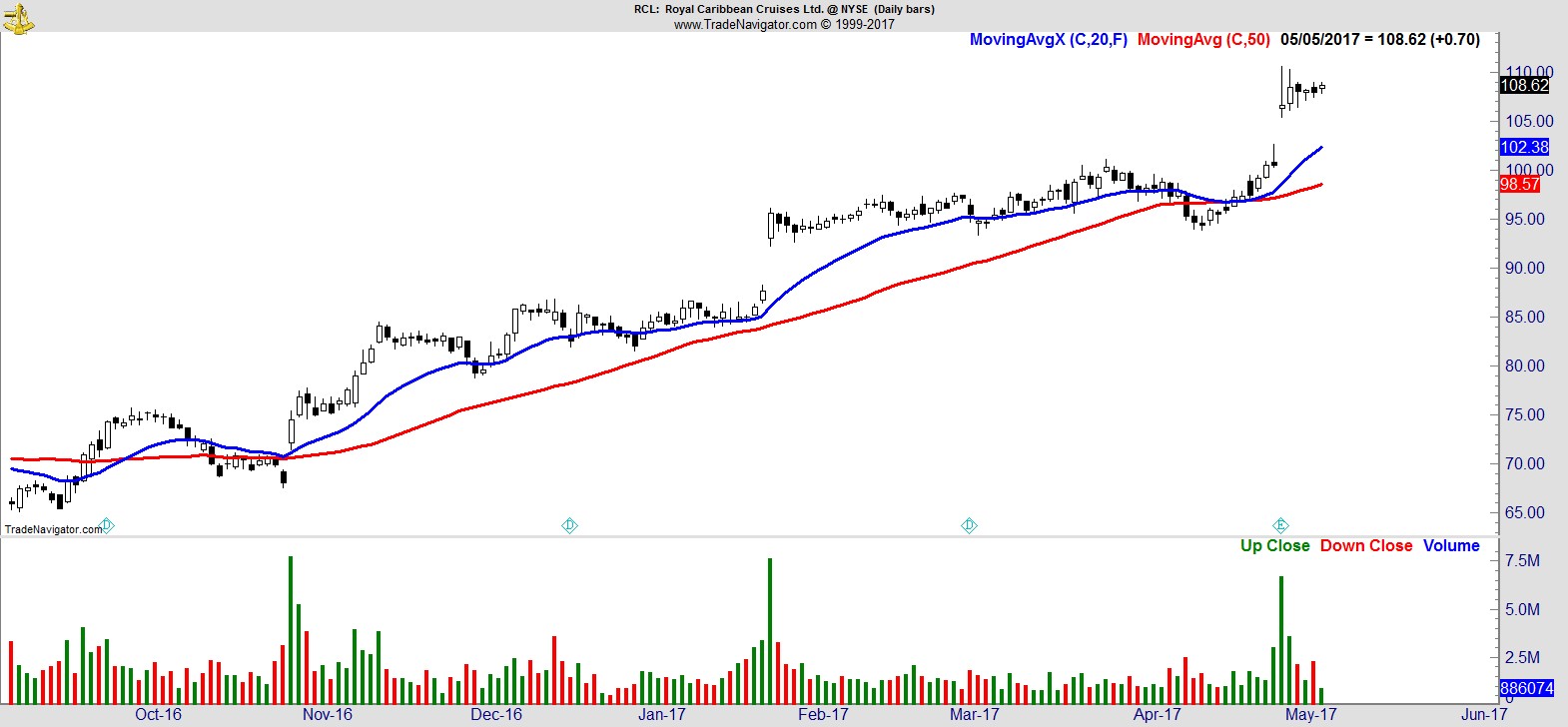

$RCL

.

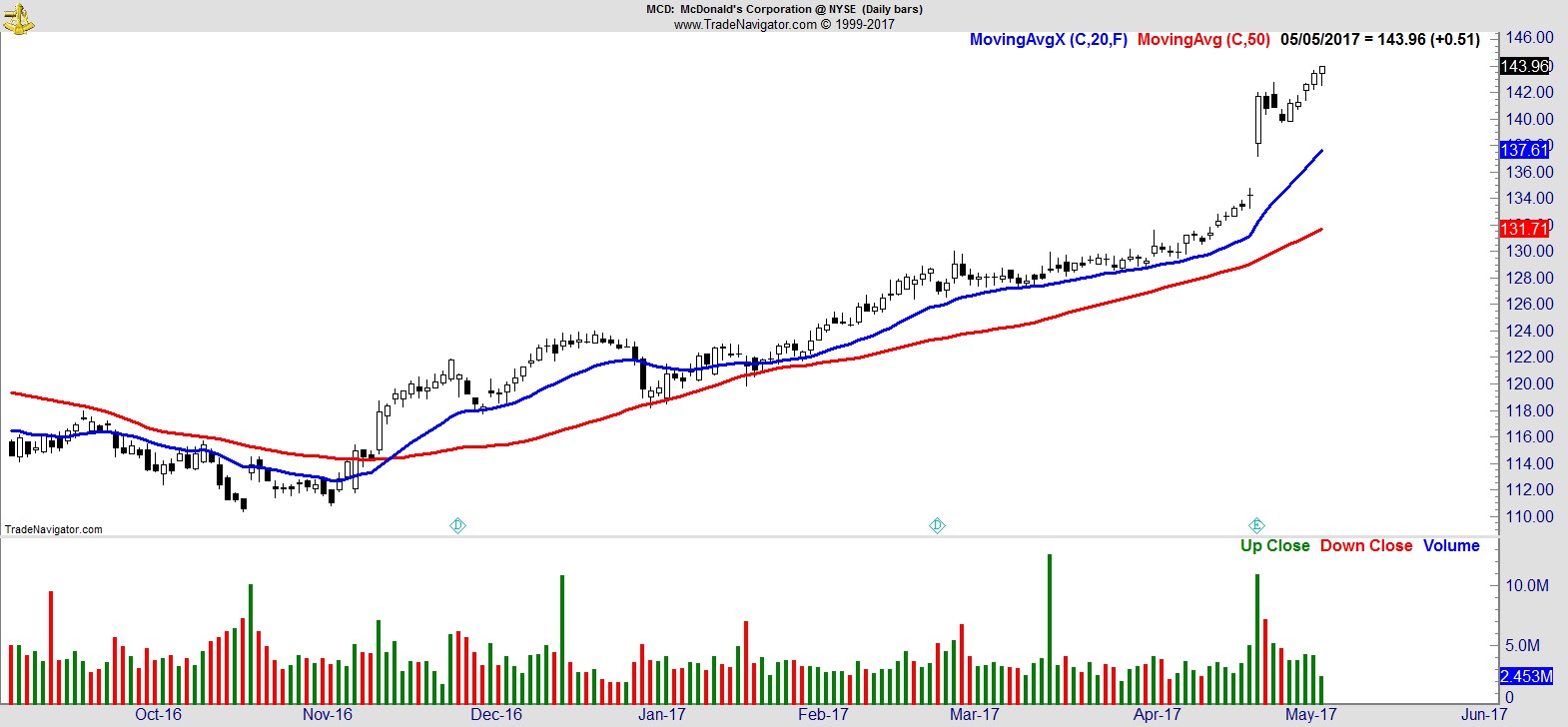

$MCD

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17