Markets finally had a strong week last week. Things popped higher on Monday, as SPX closed just under 1990. Tuesday and Wednesday saw some struggles with the direction as the trading range narrowed. However, Thursday's Fed Minutes gave buyers reasons to push markets higher. Friday was a flat with small gains. SPX managed to close near 2015.

We also had a nice week with most of our trades in the "plus" column! Our calls on GLD yielded profits as high as +59%. Our stock trades on JUNO and PTCT were quite nice as well! Here are the closed trades for the week:

To subscribe or to find out more about this product, please CLICK HERE. Come see what Ecstatic Plays offers and what we are trading next!

For the week, the Dow was up +612.12 points; SPX added +63.53 points; Nasdaq gained +122.69 points. Gold advanced last week, closing above $1155/ounce. Old also jumped, with WTI trading near $50/barrel! At the time of this writing, Asian markets were mostly up. Here are how the US markets looked after Friday's close:

SPX

Nasdaq

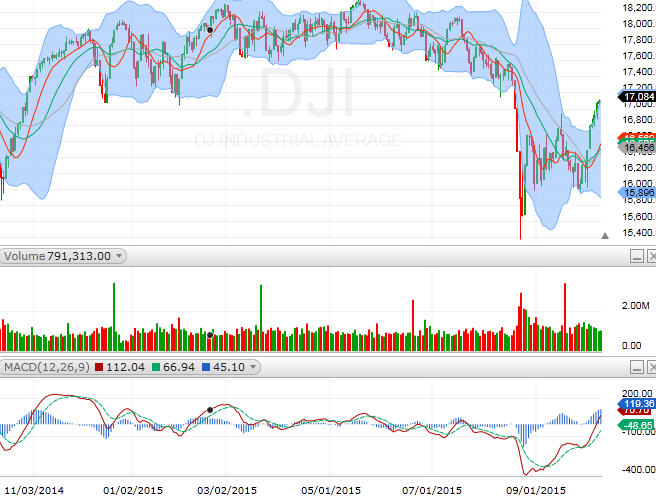

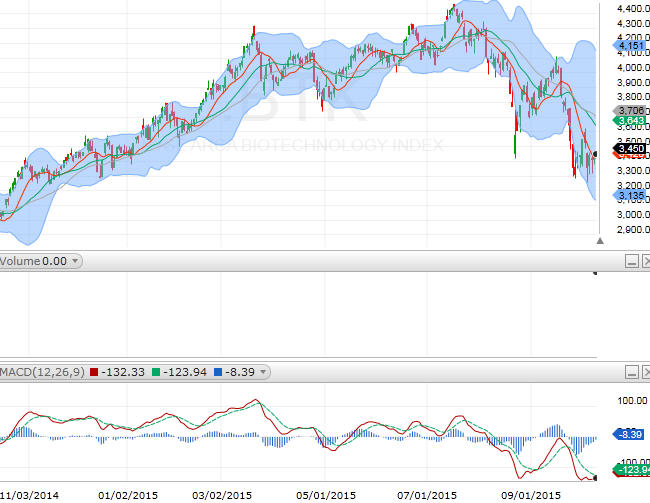

Both SPX and Nasdaq managed to stay above their respective daily MAs. The recent strength in energy stocks has helped SPX; on the other hand, the weakenss in biotechs have held back Nasdaq. What's also interesting is that after the recent pulled back, it seems that more money shifted into the blue-chip stocks, as the Dow has been very strong:

The Dow (DJI)

For the new week, earnings season is kicking in. We start off with the financials this week. Here are some notable earnings:

Monday: (AM) INFY

Tuesday: (AM) JNJ, ASML; (PM) JPM, INTC, CSX

Wednesday: (AM) BAC, DAL, WFC, BLK, PNC; (PM) NFLX, XLNX

Thursday: (AM) BX, C, GS, UNH, USB, TSM; (PM) MAT, SLB

Friday: (AM) GE, HON, KSU, STI

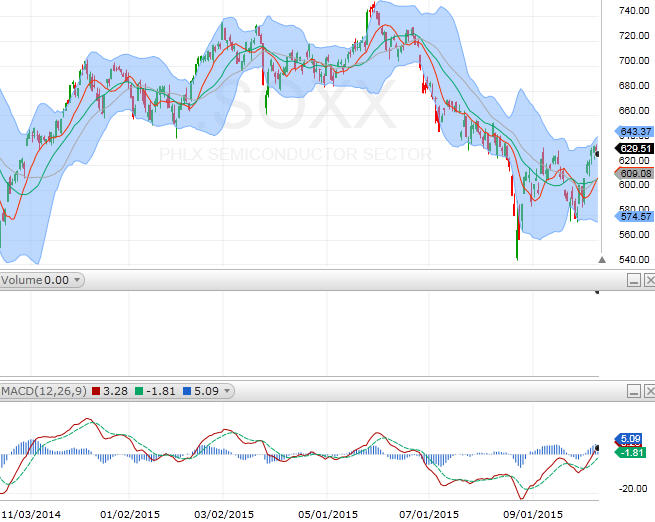

Besides the financials, we have INTC, ASML, and XLNX representing the seminconductors. It will be interesting to hear from SLB on Thursday to see how the recent low oil prices have affected the industry. KSU on Friday will allow us to get a peak from the rails. GE and HON can give us addition information on how the US economy is doing as a whole.

On the up-side, SPX's nearest resistance is at 2040. On the down-side, SPX has support at 2000 to 1990; and, then 1975.

Sector Watch

FAS (financials)

BTK (biotech)

SOXX (semiconductor)

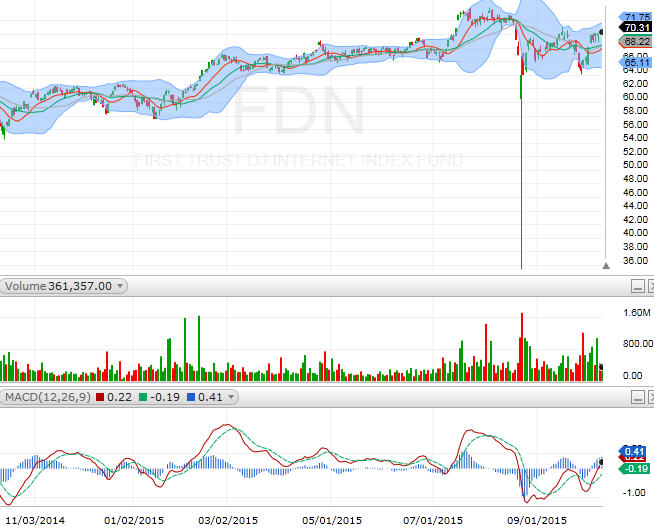

FDN (internet)

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member