Last weekend, in my Market Forecast, I wrote:

"We might see some weakness in the broader market to start the week. We will have to see if sideline buyers are ready to jump in once again. SPX has support between 2120 and 2100. If SPX breaks above 2130 again, watch out bears!"

The market did indeed took a quick drop on Monday. Buyers also came in when SPX hit 2100. Tuesday, we saw a big rush of buying, partially helped by the rally in semiconductors, as M&A activities heated up in the sector. But, SPX saw some resistance above 2125. Thursday was a struggle for direction. Stocks slid again on Friday.

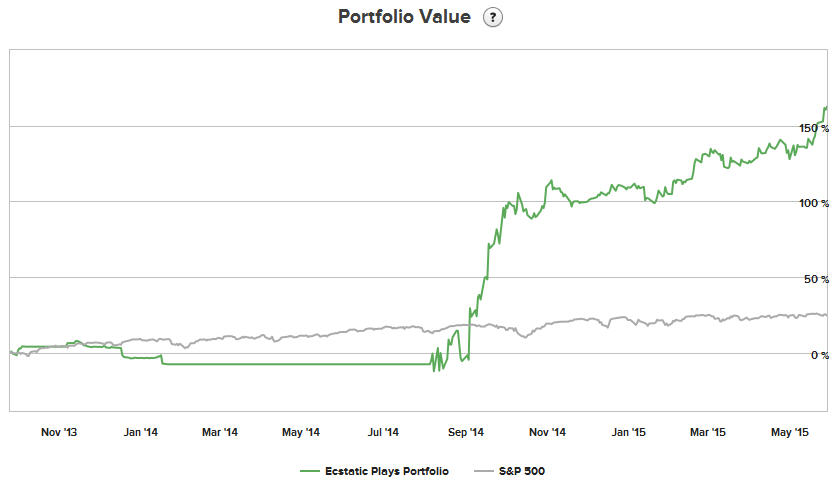

We traded really well last week, continuing to propel the value of my Ecstatic Plays higher:

This portfolio is now up +25.5% for 2015 and +184.4% over the last 365 days! (To subscribe, please click here. Please use the coupon code "Happy2015" for a 25% discount.)

We had mostly profitable trades. BRCM, CAVM, AVGO, and XLNX calls were all winners! Here are the closed trades for the week:

For the week, the Dow was down 221.34 points; SPX fell 18.67 points; Nasdaq slid 19.33 points. Gold fell again, this time closing below $1200/ounce. Oil got a big pop on Friday, ending the week above $60/barrel (WTI). At the time of this writing, Asian markets were mixed, with China (up +2.8%) and Hong Kong (up +0.7) bouncing. Let's where the US markets closed on Friday:

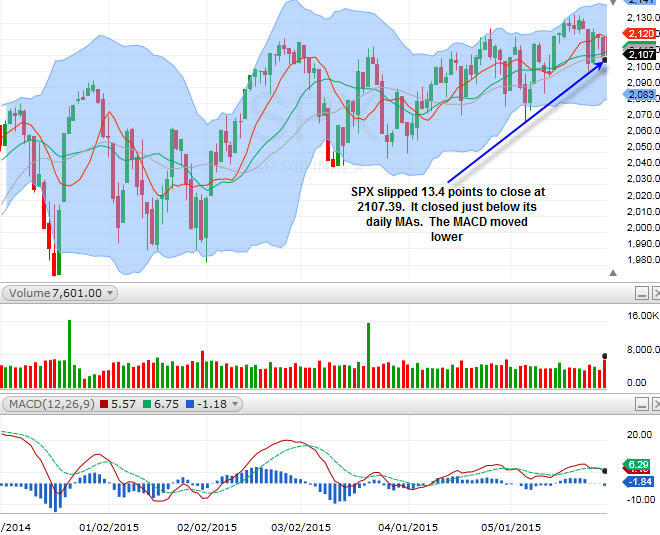

SPX

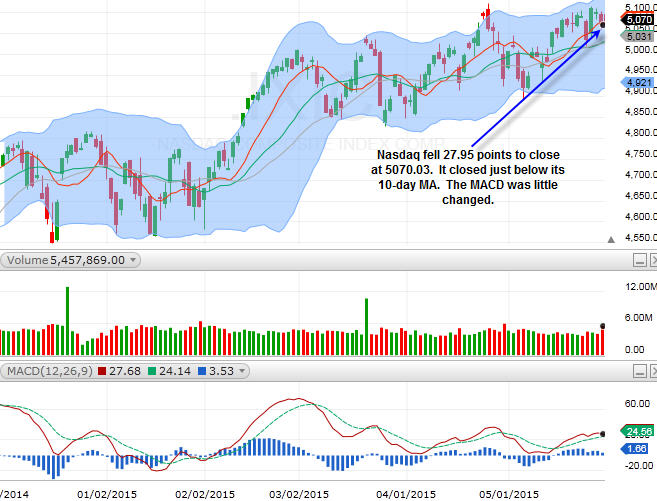

Nasdaq

SPX slipped just below its daily MAs. But, Nasdaq is much stronger, helped by the semiconductor sector. For the new week, the broader market is looking a little vulnerable here. It seems people are waiting to see how the negotiations go with Greece, EU, and other creditors. We might see a mixed market on Monday, as buyers will probably buy up more semis. The latest on INTC and ALTR is that an $17 billion deal is close to being done. Below SPX 2100, there's quite a bit of support between 2100 and 2080, as this market has been trading range-bound since mid-February, even though it did recently make a new high and pushed the range a little wider. This market won't break down unless it fell below 2080. So, there's lots of support here. M&A activities are still going, so, people may be cautious in the coming week, until they know what's going on with Greece/EU. We can see the caution in the financials. One thing that did surprise me was that oil got a big jump on Friday, but the energies did not move.

We will probably trade lightly in the coming week, until we hear more from Greece/EU.

Sector Watch

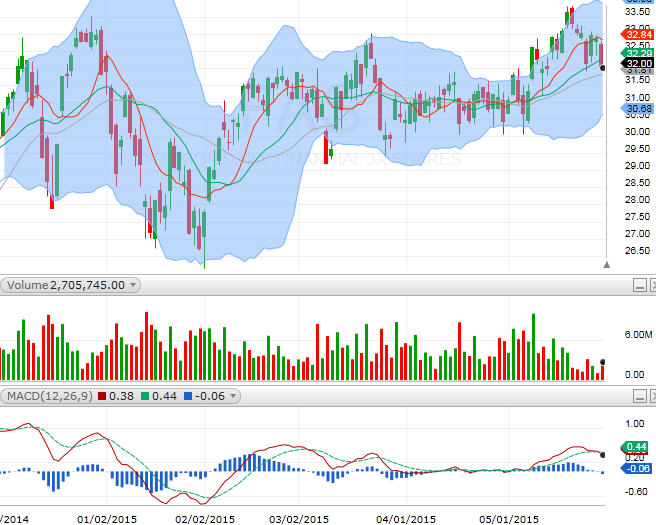

FAS (financial)

FDN (internet)

SOXX (semiconductors)

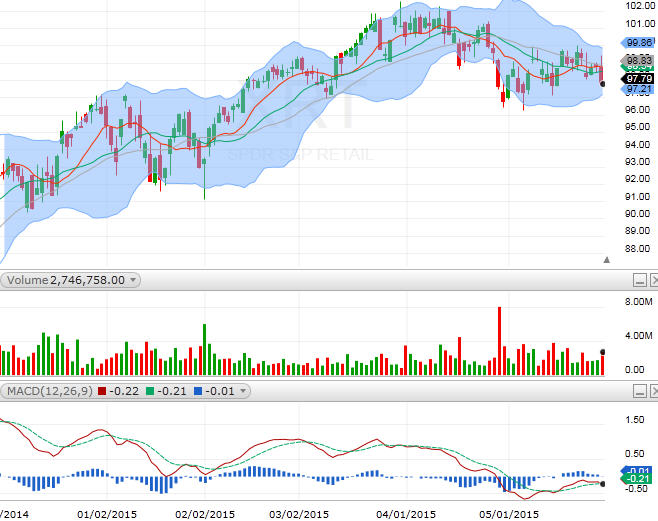

XRT (retail)

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member