Markets rallied last week, as oil bounced. Energy shares were strong. Financials also got a good pop. We traded well last week pushing the Ecstatic Plays portfolio to a new high! Our calls on energy and internet plays did very well. Here are the closed trades:

| D Feb 20 2015 Put 77.5 | $1.975 | $550.00 | 38.60% | 02/06/2015 |

| GS Feb 20 2015 Call 182.5 | $3.125 | $-525.00 | -14.38% | 02/06/2015 |

| QIHU Feb 20 2015 Call 60.0 | $3.90 | $150.00 | 4.00% | 02/06/2015 |

| QIHU Feb 20 2015 Call 60.0 | $3.90 | $150.00 | 4.00% | 02/06/2015 |

| TWTR Feb 20 2015 Call 47.0 | $1.94 | $-350.00 | -15.28% | 02/06/2015 |

| TWTR Feb 20 2015 Call 45.0 | $3.70 | $825.00 | 28.70% | 02/06/2015 |

| GOOG Feb 20 2015 Call 525.0 | $10.10 | $300.00 | 6.32% | 02/06/2015 |

| Z Feb 20 2015 Call 100.0 | $5.10 | $-1,375.00 | -35.03% | 02/06/2015 |

| TWTR Feb 20 2015 Call 42.0 | $4.925 | $937.50 | 61.48% | 02/06/2015 |

| FB Feb 20 2015 Call 76.0 | $1.285 | $-2,665.00 | -67.47% | 02/05/2015 |

| NFLX Feb 06 2015 Put 455.0 | $9.00 | $350.00 | 8.43% | 02/04/2015 |

| GS Feb 20 2015 Call 177.5 | $4.70 | $675.00 | 16.77% | 02/04/2015 |

| GILD Feb 20 2015 Put 100.0 | $4.65 | $-1,025.00 | -18.06% | 02/04/2015 |

| CSIQ Feb 20 2015 Call 25.0 | $2.75 | $350.00 | 9.27% | 02/03/2015 |

| LNKD Feb 06 2015 Call 225.0 | $14.05 | $1,625.00 | 30.09% | 02/03/2015 |

| LVS Feb 20 2015 Put 55.0 | $0.91 | $-2,215.00 | -70.88% | 02/03/2015 |

| SPWR Feb 20 2015 Call 24.0 | $3.225 | $981.6666 | 43.76% | 02/03/2015 |

| SPWR Feb 20 2015 Call 24.0 | $3.175 | $931.6666 | 41.53% | 02/03/2015 |

| SPWR Feb 20 2015 Call 24.0 | $3.35 | $1,106.6666 | 49.33% | 02/03/2015 |

| RIG Feb 20 2015 Call 16.0 | $1.58 | $410.00 | 35.04% | 02/02/2015 |

| FAS Feb 06 2015 Put 110.0 | $6.375 | $737.50 | 30.10% | 02/02/2015 |

For the week, the Dow was up +659.34 points; SPX added +60.48 points; Nasdaq gained +109.16 points. Oil bounced to around $52/barrel, while gold sank down to near $1235/ounce. At the time of this writing, Asian markets were mixed. Let's see where the US markets stood after Friday's close:

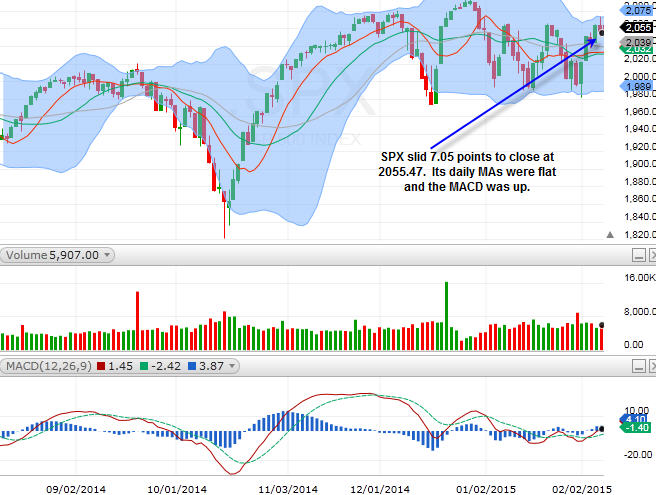

SPX

On Friday, SPX slid 7.05 points to close at 2055.47. Its daily MAs were flat and the MACD was up.

Nasdaq

Nasdaq fell 20.7 points to close at 4744.4. It closed above its daily MAs.

Both SPX and Nasdaq closed above their respective daily MAs. The indices almost broke higher on Friday, before the afternoon slip. For the new week, I think we will have to watch how oil trades. The market has had a tremendous week last week, but, it is still within the same trading range that it has been stuck in since December 2014!

Earnings are still coming in:

MON: (AM) CYOU, DO, HAS, SOHU; (PM) NTES

TUE: (AM) CDW, KO, CVS, PCG, PKX, SFUN, HOT, WYN; (PM) AKAM

WED: (AM) AOL, MOS, PEP, TWX; (PM) AEM, BIDU, CSCO, CPA, FEYE, TSLA, TSO, TRIP, WFM, Z

THUR: (AM) ACOR, AAP, APA, INCY, IOC, JK, OMG; (PM) ALNY, AIG, COHU, GRPN, HE, SFLY, TRLA, ZNGA

FRI: (AM) VFC

We will be watching SPX 2070 and 1990 as the resistance and support levels, respectively.

Sector Watch

GLD (gold)

GLD took a dive last week, closing just below its 30-day MA. This is a crucial area. Its MACD also turned bearish. It looks like gold is still range-bound.

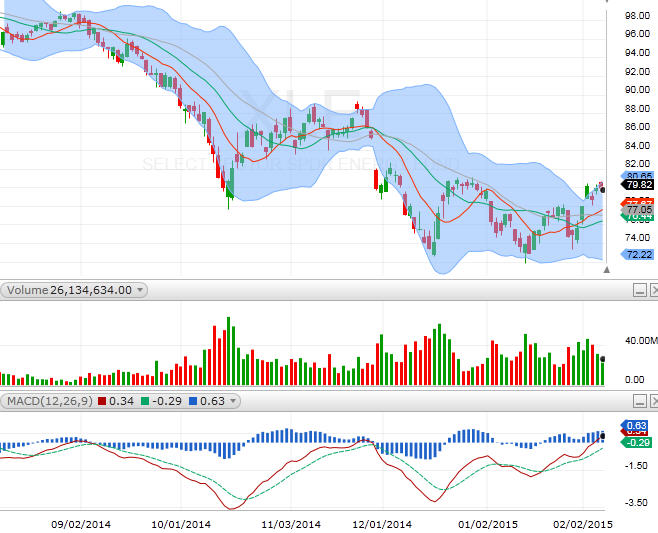

XLE (energy)

XLE got a nice pop last week with oil extending its bounce. This sector is leading the broader market right now. DO, IOC, TSO and APA are reporting in the coming week. I think we can go long on VLO and PSX before TSO's earnings. We'll talk about them during the week.

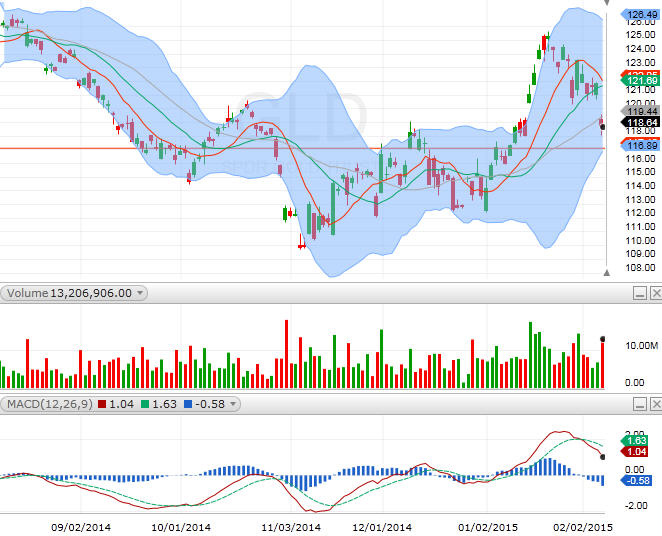

FAS (financials)

FAS also bounced nicely with the broader market last week, closing above its daily MAs. AIG is reporting on Thursday after market. Its chart is leaning bullish.

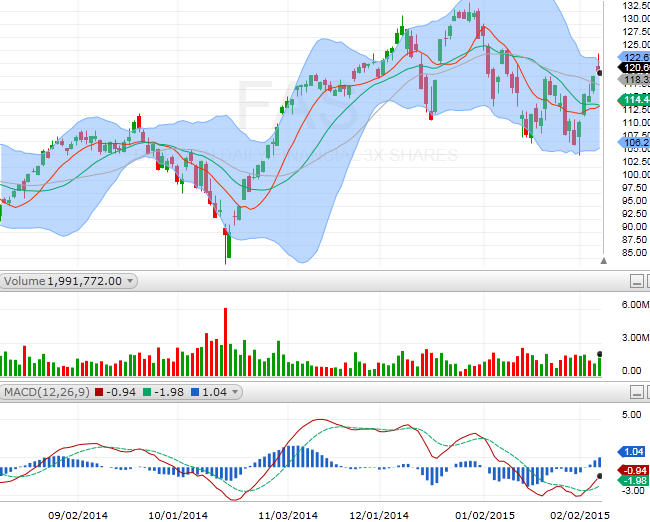

FDN (internet)

FDN is very strong. AMZN, NFLX, GOOG, LNKD, and TWTR are leading this sector. SOHU, CYOU, BIDU, GRPN, ZNGA, AOL are reporting in the coming week.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member