Below you will find my "Morning Comment" from Monday June 3, 2019. In it, I explained why I thought the stock market was ripe for a sharp bounce. Stocks did indeed rally last week, so this call worked out quite well.....In fact, this successful call is one in a series of great calls in the last two months. I was cautious in late April...calling for a 3%-5% drop. However, I turned much more bearish after the trade negotiations broke down and so I lowered my target to a 7%-10% correction. I stayed with this call throughout May (calling the mid-May bounce just something that was working off a very-short-term oversold condition. Finally, when the market became more severely oversold (at the very end of May), I predicted a sharp short-term bounce.....These are the types of calls you can expect from BTFNow!

Morning Comment….Near term, bonds are over-bought and stocks are oversold. (From Monday June 3, 2019)

After the 6.5%-8.7% pull-back we’ve seen in the last month (depending on which major index you look at)…we still believe the stock market will see a further decline. HOWEVER, we expect the market will see a near-term bounce this week. Let’s face it, all corrections tend to see bounces along the way…to work-off a very-short-term oversold condition. We saw a small one in mid-May…and this has certainly been true during the last 3 corrections as well. The correction we saw in the 4<sup>th</sup> quarter saw 3 bounces of 4%-7%...and correction during the 1<sup>st</sup> quarter of 2018 gave us 2 bounces of 4%-7%. Finally, the early 2016 correction also contained 3 bounces of 3%-4%.

Given the short-term technical condition of both the stock market and the bond market right now, we think it is quite likely that I'll see once of these bounces this week. The daily RSI chart on the S&P has become more oversold than it was before the mid-May bounce, so it’s getting ripe for a pop. (It’s not as oversold as it was in either mid-October or late December…so this is one reason why we think I'll see lower-lows before long.) We’ve also seen a change in sentiment to a much more bearish stance in several sentiment polls like the II, AAII, DSI, etc. These numbers are not as extreme as we saw in December, but when you compare it with the calls for a “melt-up” we were hearing just over a month ago, it could/should be telling us that things are getting oversold near-term.

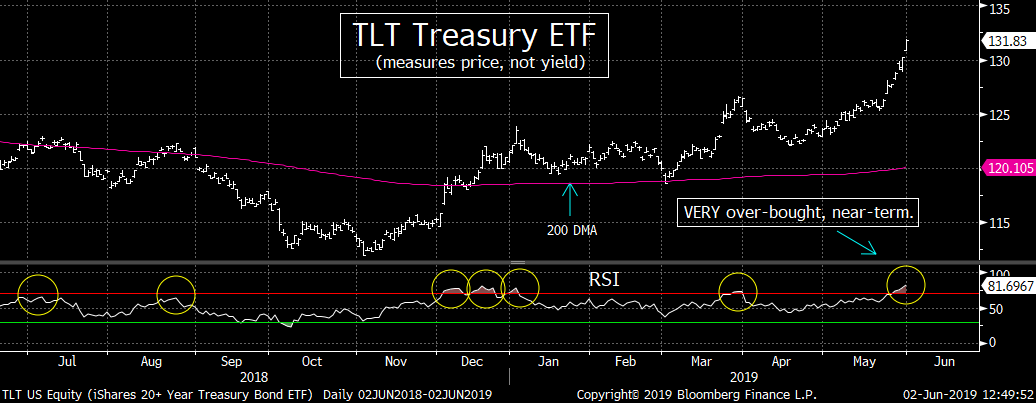

The same is true…in the other direction…for the bond market. The TLT Treasury ETF (which measures price, not yield) has become extremely over-bought on a short-term basis. The RSI chart has become VERY over-bought…with a reading above 81. As we mentioned last Thursday morning, sentiment has reached extreme levels in the bond market as well…with bullishness among futures traders above 90%. Therefore, we believe that this market is getting ready for a pull-back (which will obviously give us a pop in long-term rates). This, in turn, could/should give the stock market some relief…and allow it to rally over the very-short-term.

Of course, we called for a very similar reaction last Thursday morning…and the market still fell further. However, we think we were just a little early…and all of these readings have become even more extended over the past two trading days. That doesn’t mean that I'll definitely get a near-term bounce that begins today, but we do think I'll get some relief before the week is over.

Having said all this, we believe that a near-term bounce will only be another short-term bounce WITHIN a correction (of 10% or more). In other words, as we (correctly) predicted during the mid-May bounce, any near-term bounce will only take place to work-off these very-short-term oversold readings in our opinion. As we mentioned last week, the S&P 500…as well as several key leadership indexes (the semis, the Transports and the Russell 2000) are not oversold on an intermediate-term basis (only a near-term one). Thus any near-term bounce will probably we short-lived.

More importantly, too much has changed in the last month. The trade deal with China that was assumed to be a “done deal” has fallen apart…and negotiations have completely broken down. Also, the tensions in Iran have become more strained…concerns about a “hard Brexit” have grown…European banks have declined down to/near multi-year lows…several economic data points (especially PMIs) have shown weakness…and the Yankees took 2 out of 3 from the Red Sox.

Given that the stock market was being priced for perfection a month ago…and many of the “changes” that have taken place since then don’t look like they’ll be reversed quickly (except, maybe, for the Red Sox)…we believe any rally will fail before long and will be followed by lower-lows

Why are the “changes” of the past month so concerning? Well, not only do they create a lot of uncertainty in the market place (and markets hate uncertainty), but they all create questions about what will take place in the 2<sup>nd</sup> half of the year. Before these “changes” took place, the stock market was pricing-in a nice pick-up in both economic growth and earnings growth. However, since these “changes” have taken place, those assumptions need to be re-visited. For instance, earnings estimates for the S&P 500 were expected to go from the low single-digits in the 1<sup>st</sup> & 2<sup>nd</sup> quarters…to the 8%-9% range by the 4<sup>th</sup> quarter. With all of this new uncertainty…involving so many different issues…it’s now hard to think that I'll see this kind of powerful growth in the 3<sup>rd</sup> and 4<sup>th</sup> quarters that investors were pricing-in at the beginning of May

Therefore, we believe any bounce I'll see over the next week or two will provide an opportunity for investors should raise a bit more cash…and get a little more defensive…so that they can take advantage of a further decline as we move through the summer. However, those who have a more short-term time horizon, getting short (or staying short) down at these levels will be a risky proposition…given the technical conditions we sighted above.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22