Around this time each year I like to run a series of scans on all stocks to sort out the most successful companies over the past year. I have a number of favorite metrics I use to find the best stocks of the year. In this way, I know the sectors, the market caps, the stock "styles" that were most favored by investors. A little more digging around, and I can uncover the reasons why they were so favored. Such information is invaluable to making sound investing decisions in the year ahead.

For example, I like to first take a subset of stocks that are trading, on average, over 500,000 shares per day, have a market cap of at least $300 million, are priced over $10, and have returns at least 30% year to date. Once those parameters are screened for, I'm left with a universe of 441 publicly traded companies.

Of these, I like to find the "best of class" in a few key areas. For example, I'm curious to know which of those companies showed the strongest bottom line growth in earnings per share over the past year. The winners? Here are the top 3:

1. Take Two interactive (TTWO) +989%

2. Delta AirLines (DAL) +932%

3. Greenbrier Companies (GBX) +898%

Which companies had the strongest increase in institutional buying of shares (a factor that William O'Neil claims is essential to sustaining healthy growth over the long-term):

1. Kite Pharma (KITE) +90%

2. The GEO Group (GEO) +79%

3. Malinckrodt Limited Company (MNK) +50%

But by far the most important metric is price performance. Which companies, regardless of eps growth, valuation ratios, analyst upgrades, etc., made the most money for its shareholders? Here the list is surprising...and for that reason, instructive.

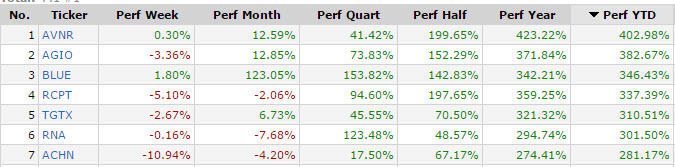

What we learn when we screen our short list for the best YTD price performance is that the top 7 stocks for 2014 were all doing drugs. I mean, they are all in the biotechnology business: testing drugs, making drugs and selling drugs. Here is the list:

Why did the biotechs do so well this year? There are several reasons. An aging population (needing more drugs), dominance in the IPO space (siphoning money away from tech start-ups), an increasingly amenable FDA (making approvals easier, thus quicker to market), an increase in analysts following these stocks (pumping the phones with "buy, buy, buy"), increased backing of the smaller makers by the giants in the industry (Pfizer, Merck, Sanofi, GSK, AstraZeneca...all stepped up to fund the party), and the list goes on.

Largely, it is just a momentum thing. Momentum draws money, and money creates momentum. If you can ride this cycle carefully, you can turn a nice profit. But be wary: you'll have to know when to get off. Last year's darlings are rarely invited to the same party twice. To wit: dominating the list of best performances in 2013 were the solar stocks. This year? Not so hot.

Thus the search is on to find the best winners for 2015.

Happy trading! Dr. Stoxx.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member