This article is sponsored by the Dr. Stoxx Options Letter.

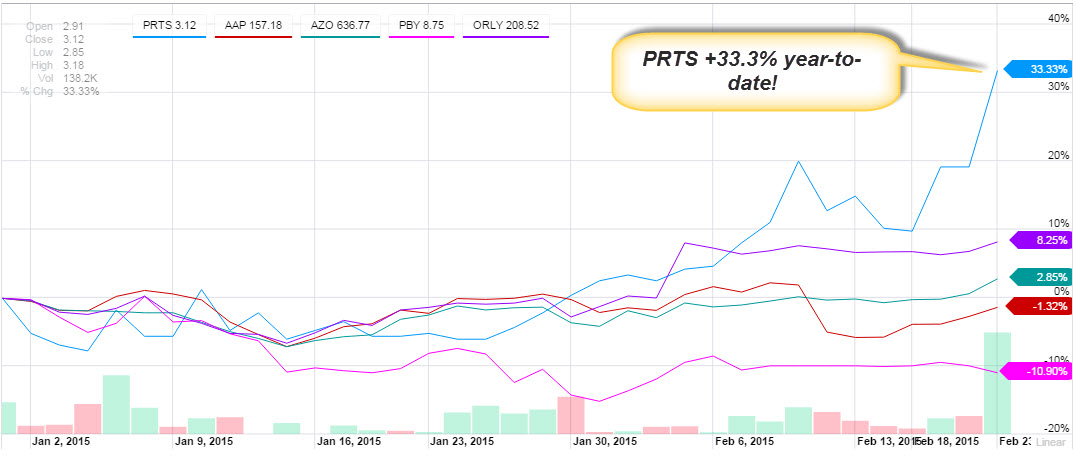

My momentum stocks scan this week turned up a smallcap company in the auto parts space. There are only five publicly traded companies listed in this industry. The other four are all household names: O’Reilly, Advance Auto Parts, AutoZone, and Pep Boys. I’m sure many of you have spent time in one or more of these stores. They can be found in just about every American town with a population over 2000. Together they account for a market cap of over $50 billion. Compare this to our little competitor: it has no stores -- all selling is done online -- and it's market cap weighs in at a very slim $94 million. Still, this little David is outpacing the big four Goliaths in all of the important categories: it has the lowest price-to-sales ratio (0.38), the strongest year on year EPS growth numbers (+59%), and as the chart below will show, it’s price performance Year-to-Date is by far the best of the group:

U.S. Auto Parts Network (Nasdaq: PRTS) is to the brick-and-mortar auto parts retailing business what Ebay is to your local flea market: it sells the same stuff, only it does it through an online portal. U.S. Auto Parts Network sells more than 550,000 car parts and car-related products through its website (usautoparts.net), all at deep discount prices. Let me give you a real-life example. Two weeks ago I was in need of a new headlight bulb for one of my cars. Although I had my local garage replace it, I went online to compare what U.S. Auto Parts was selling the same bulb for, then compared it to the price offered at our local auto parts store (I won't tell you the name, but it is the largest auto parts retailer in the country and it rhymes with "so highly"). The local store's price was $59.99, plus $15.95 if I wanted it shipped, and then another $5.70 for tax, totaling $81.64. Incidentally, this is already more than what I paid my garage to have one installed. The price at U.S. Auto Parts online store? For the same high-low beam bulb, plus the housing (which I didn’t need), the base price was only $19.32. Shipping costs were only $5.48, and there was no tax (online purchase, remember?). The total at PRTS came to less than 1/3 what the local store was ready to charge me...and I didn't have to leave the house to buy it.

This simple example explains the phenomenal growth in sales for U.S. Auto parts. From 2009 to 2011 during the post-recession recovery, U.S. Auto Parts nearly doubled its sales from $176 million to over $327 million. 2012 and 2013 were tougher years, not only for U.S. Auto Parts but for all the car parts retailers. As the economy picked up, people began turning in their older cars for newer replacements, reducing the need for parts. But the market is picking back up again. All those newer cars are now older cars, needing replacement parts (like my 2013 Jeep!).

Analysts know this about the industry. They are very familiar with the cost structure of PRTS’ online business model. They see how the company leverages razor thin margins through strategic buyouts of liquidations and through maximizing sales volume. In the last two quarters, PRTS has surprised earnings estimates to the upside -- 60% and 100% repectively. This kind of activity is essential to maintaining the stock's current price momentum going forward.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member