Sponsored by the Dr. Stoxx Options Letter.

I'm a systems builder first, a trader second. My passion is to figure out what works in the market, then share that knowledge with my subscribers. For years I've been working on a variety of momentum systems. Price "momentum" is the one factor that trumps all others, technical and fundamental. Even the founding father of "efficient market theory", Eugene Fama, had to admit that "momentum" was the one positive correlation his theory could not account for.

I publish a momentum letter on another site -- 3 longs and 3 shorts each week -- which has done very well since it launched last July. But right now my focus is on a system that looks to move on short-term swing trades in the big bubble stocks -- biotechs, mostly, but also those with massive growth (like TWTR, GPOR, INFN, XON, FLWS, CSIQ, etc.). So far so good. On most of the down days this month, my stocks were showing net gains, including today. And on the up days, well, if you know what "alpha" means, you'll know that it is a good thing when I say that there was a lot of it.

I haven't yet been trading this new system in the Dr. Stoxx Options Letter since we have a lot of cash tied up right now in spreads and naked puts. But once those expire, we'll be getting positioned in a number of the most promising of these trades. Here are 3 from my current watch list that look especially good today, along with my recommended entry points:

Disclaimer: I own shares of all 3 stocks in my personal account. Subscribers to my "Trend Trade Letter" own shares of TGTX.

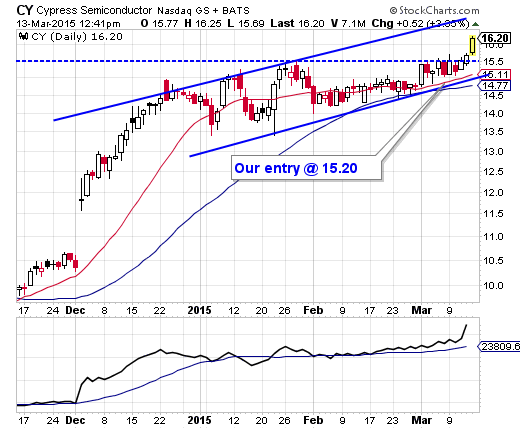

1. Cypress Semiconductor (CY)

This broad-line semiconductor company grew eps 134% this year and has projected a 26% growth next year. It trades at a 22x future earnings, and even pays a 2.8% dividend, the 5th highest in the industry. Shares were coiled up under the 15.50 area when we entered. Today they are breaking out on huge 2-day volume. Target = $19/20.

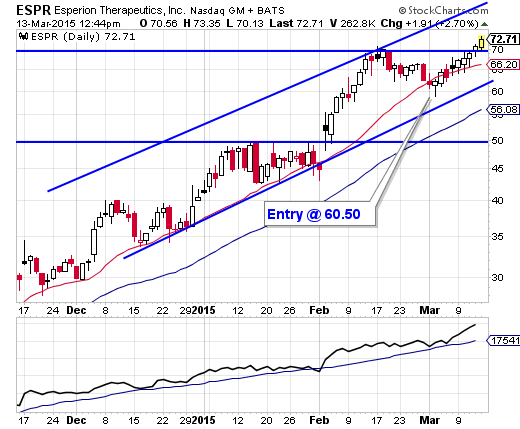

2. Esperion Therapetuics (ESPR)

This developmental biotech is working on drugs that do the same thing as statins but without the side effects (like diabetes). The FDA just approved a measure that will add many millions of people to the list of those eligible to go on statins, so the market figures this to be a blockbuster drug. Shares recently hit new alltime highs around $70, then pulled back to the 20sma where we go on board. Today they have broken cleanly above $70 to new alltime highs. Target = $84/85.

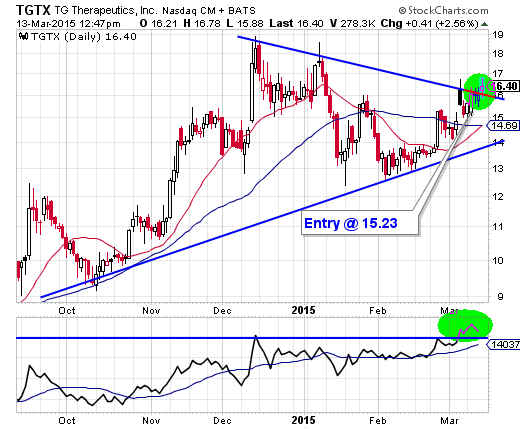

3. TG Therapeutics (TGTX)

This biotech is working on therapies to treat autoimmune diseases, the largest and fastest growing subset of disease vectors. It is also moving into the red-hot "immuno-oncology" space. Analysts love this company and keep raising price targets on the shares. There are already products in the markets and earnings are almost to net positive. The chart shows a nice uptrend with a large triangle consolidation that is breaking out today. Target = $20.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member